Starting The Year Off Wrong

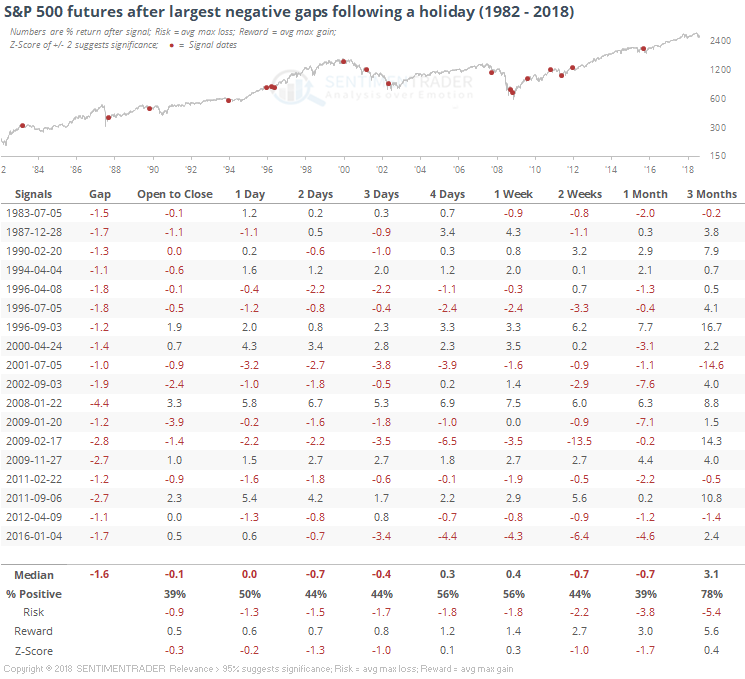

As traders return from what for most was a week away, equity futures are getting hit hard. If they stay around here, it will be the worst open following a holiday since 2016. There have been 4 others with at least a 1% opening loss since the 2009 bottom.

There hasn't been a very good record at rebounding from post-holiday weakness, though this wasn't just any holiday. We're also staring at the first session of the New Year. Perhaps starting out in a bad mood makes it more likely that traders will panic sell to avoid an immediate hit to their P&L.

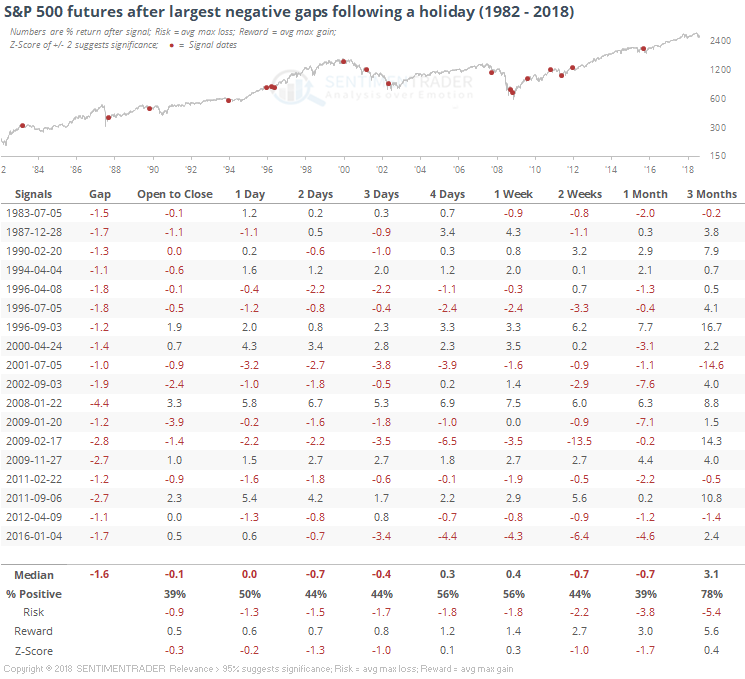

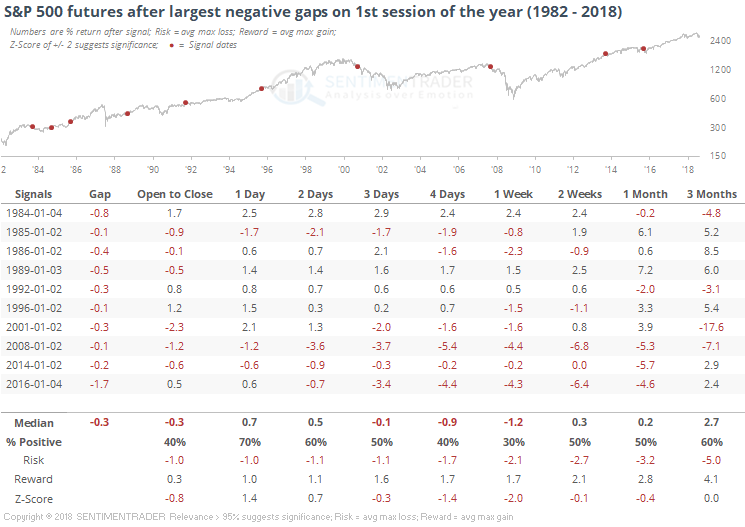

Today would mark one of the worst-ever first-day negative gaps for the S&P 500 futures. Only one other year saw the futures in the red by more than 1% at the opening print of the New Year, which was in 2016. That led to a quick rebound over the next day then some hard selling in the days ahead. Most of the other negative gaps were much more mild, mostly leading to quick rebounds, but then with a negative tint during the following week.

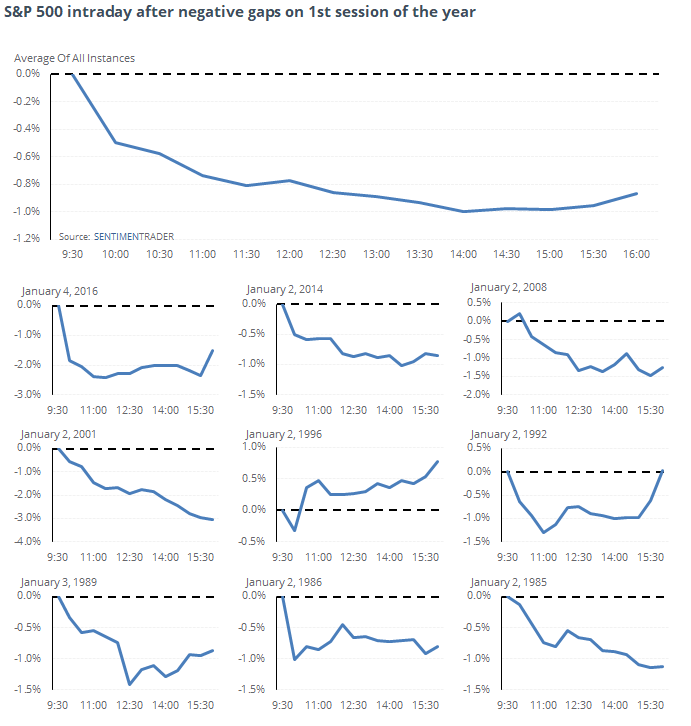

As for trading during the day itself, four of them saw most of the day's losses in the first hour or so, then flatten out or trade higher into the close while five of them saw early losses that just kept snowballing during the day.

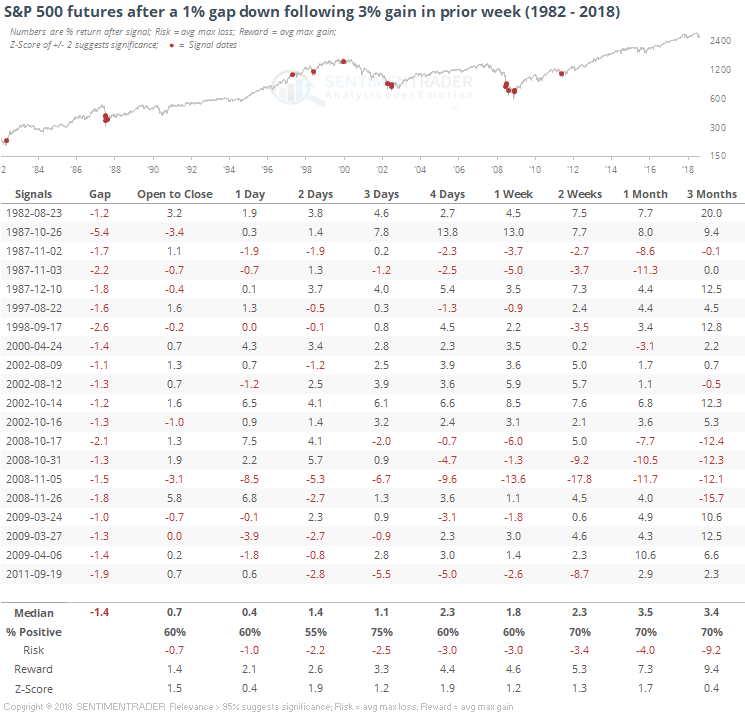

Okay, but this gap is coming after a substantial rally during the past week. The S&P rebounded more than 3% during the past week, so this morning is only retracing part of that large gain. In that context, the results become a little more positive.

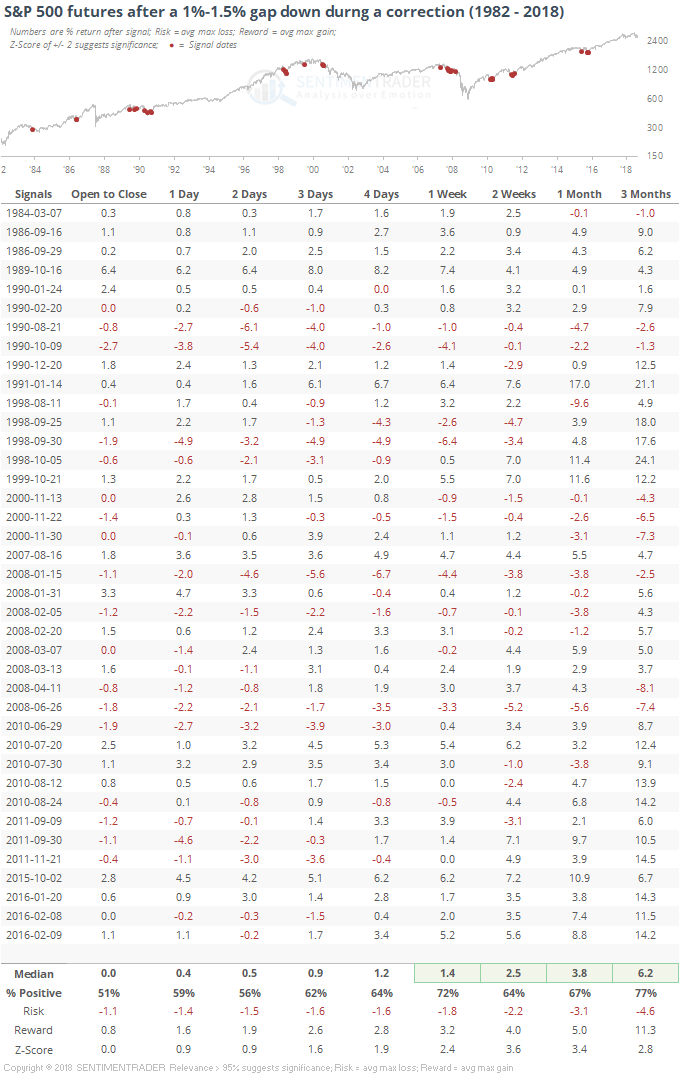

This negative open is also occurring within the context of a correction, if we want to define that as the S&P being down somewhere between 10% - 20% from its 52-week high. Large negative gap opens during corrections tend to snap back over the next 1-12 weeks.

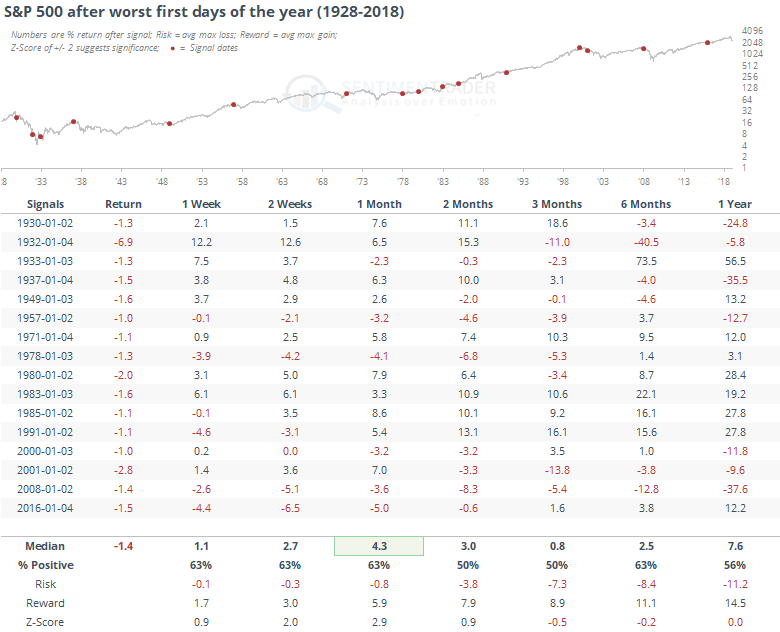

If the negativity sticks and stocks close lower today, we will certainly here about how a bad first day bodes ill for the rest of the year, trotting out 2008 as a prime example. Indeed, this would count as one of the worst first days ever, and indeed, 2008 counts among them, as does 2000. But the overall record is mixed.

Unlike some of the other gap studies we've looked at over the past year or so, this one doesn't show a strong edge either way. Seasonality here probably counts a little more than it usually does, and in that context, the implication is more negative than it would otherwise be.

Most of our medium-term (1-3 month) stuff continues to point to higher reward than risk, but on a short time frame, it's much more up for grabs, and extreme two-way moves would be common and not necessarily a bad omen during that longer time frame.