SPY Continuing To Rally On Tepid Volume

Buyers have persisted this week, despite what had been compelling studies suggesting a break. That usually tells us all we need to know, which is that "something" is overwhelming historical odds, and that in turn usually means that the path of least resistance is higher.

This is the worst kind of market for what we do, creeper-type trends that get locked into an extreme and don't let up. That makes for a very difficult decision about trying to chase a market that should be doing what it's doing, or risk being left behind even more. There's no easy solution to that.

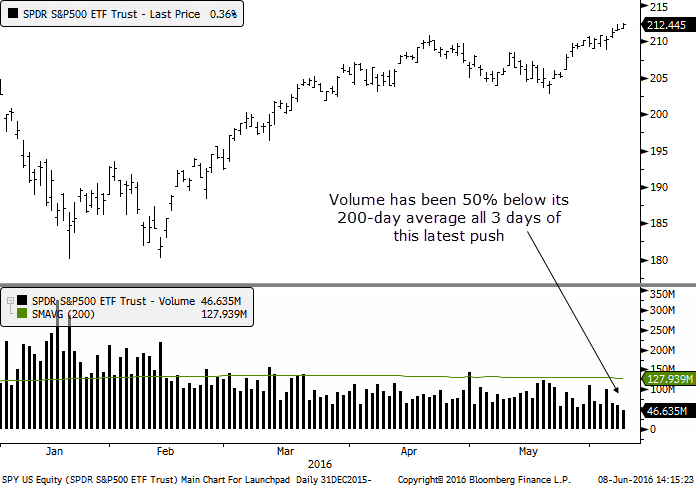

As the rally has progressed, there are additional signals that have cropped up suggesting that a break should be near. For instance, the rally of the past three days has come on very low, and receding, volume. In SPY, volume has been at least 50% below its 200-day average each of the past three days and we've never seen 3 straight 6-month highs in the fund on such low relative volume.

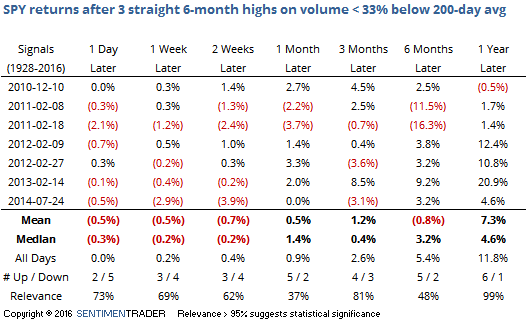

There have been a handful of times that SPY has notched such gains when volume was at least 33% below average each of the days. Here is how it did going forward:

The short-term results were muted, as we should probably expect. Similar studies turn up similar results - short-term weakness, medium-term mixed-to-strong returns.

Watching these slow-drip up days in an underinvested position is tough, but it continues to look like the short-term risk/reward isn't worth trying to chase an index that is bumping up against its all-time high and has a high potential to see a false breakout.