Speculators are betting on even more volatility ahead

As we head into the uncertainty of the U.S. elections, one of the worries is that we'll suffer extreme moves in the weeks ahead. Depending on the source, that volatility could be due to a contested election, a split decision, or a blue wave. There are a whole lot of biases at work with those opinions.

Whatever the outcomes, one worry is that speculators seem to be betting heavily that volatility will decline in the coming weeks. When speculators are betting heavily on something, it usually doesn't happen, which means that volatility should increase even though the VIX is already high.

The trouble with this worry is that speculators' positions in the VIX and other volatility contracts don't behave like they do in other markets. To a large degree, volatility speculators are the "smart money." We've seen that already with VIX Sentiment and it's also clear in traders' positions in VIX futures contracts.

Because commercial hedgers take the opposite sides of the trades of large and small speculators, a heavy short position by speculators means that hedgers are heavily long the VIX. In most contracts, a large net long position by hedgers would be a bullish event, but that hasn't been the case in the VIX. It's a rare case of the "smart money" not being very smart when holding an extreme position in a market.

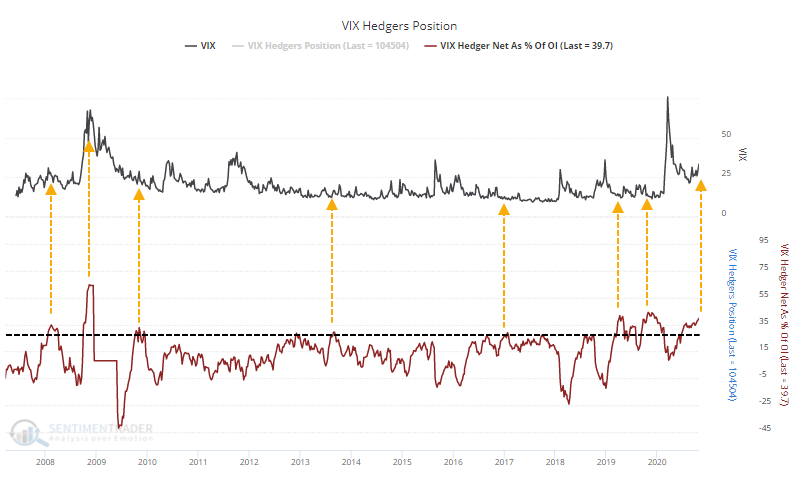

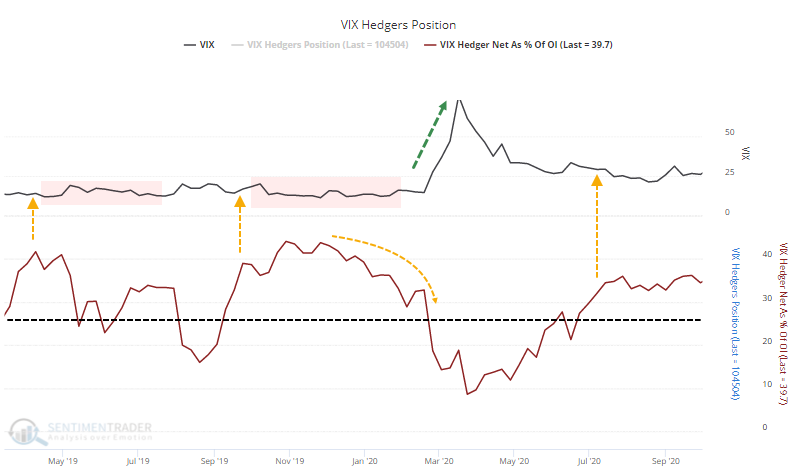

As of last Tuesday, hedgers were net long nearly 40% of the open interest in VIX contracts. That's almost a record high dating back to 2006 (there is some missing data from the CFTC in 2006 and 2009).

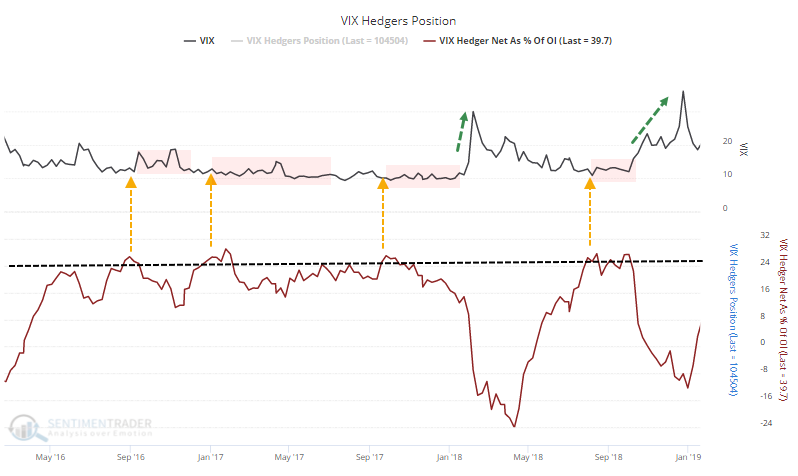

Let's zoom in on those dates when hedgers were net long more than 25% of the open interest in these contracts and see if it consistently resulted in an even higher level of volatility going forward.

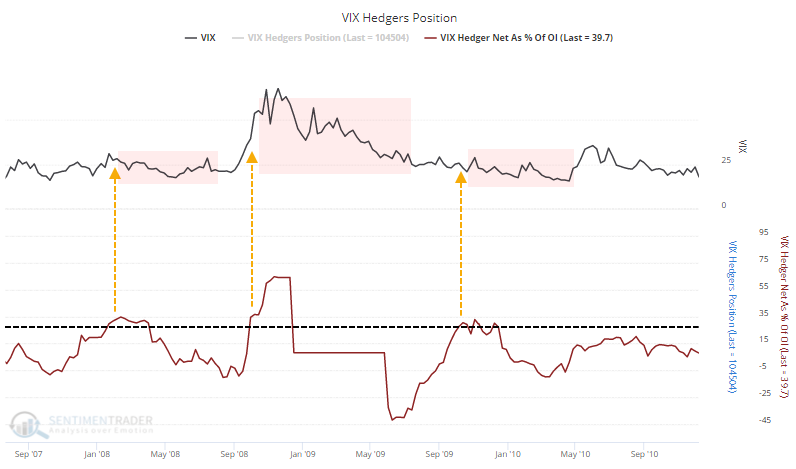

From 2007 through late 2009, hedgers got extremely long the VIX several times. Each time, the VIX declined over the next 3-6 months.

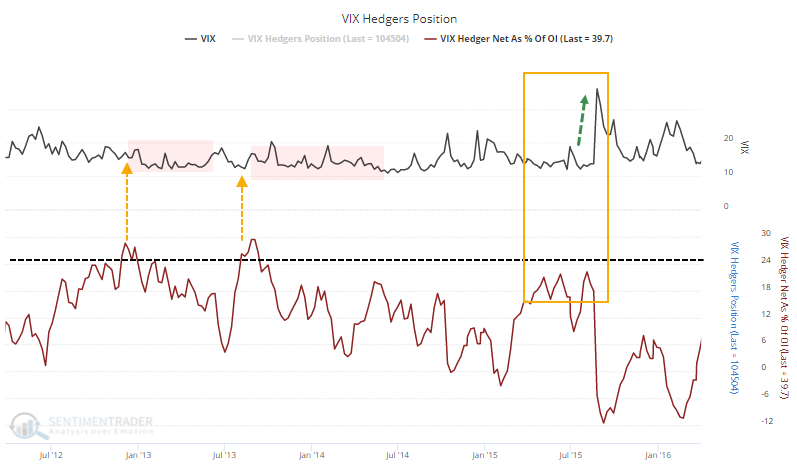

From 2012 - 2016, hedgers didn't often establish a major long position in the VIX, but when they did, volatility dropped. There were a few little spikes of a few percent in the VIX but no major events. They got kind of long from May through August of 2015, which eventually resulted in the VIX jumping from around 13 to above 35 in late August, but suggesting that hedgers were anticipating this is a big stretch.

From 2016 - 2018, there were a few instances of hedgers getting long the VIX, and mostly it ended up leading to nothing. Volatility basically flatlined in the months after these extreme positions. It eventually ended up leading to a big spike in volatility in February 2018, but that was 4 months after hedgers had established their major long position, and was already mostly unwound it by the time volatility spiked. Same goes for the increase in the VIX later that year.

In recent years, hedgers have consistently been net long the VIX, and it's mostly led to nothing. The big exception, of course, is the February - March pandemic chaos, but hedgers had been holding a large percentage of open interest for months before that and the VIX didn't spike until they had already greatly reduced their positions.

As noted on Monday, I have no idea what's going to happen with the elections or how investors will react in response. The big caveat here is that we should not assume that any of the news flow will necessarily lead to an even bigger and sustained increase in volatility, just because the "smart money" seems to be betting that way.