Speculative options activity becomes even more astounding

Over the past few weeks, we've looked at the high and increasing amount of speculative activity among options traders, particularly the smallest of them that transact 10 contracts or less.

As stocks rose 3% or more each week, it was kinda-sorta understandable. But last week, stocks suffered high volatility and a big decline on Thursday, coupled with a mostly-failed rally attempt on Friday. That did not put off speculative traders - in fact, it emboldened them.

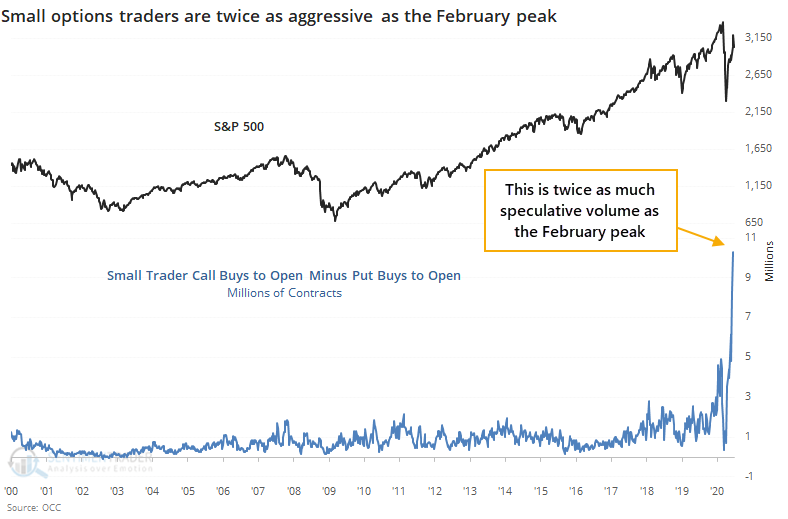

Last week, the net speculative activity (calls bought to open minus puts bought to open) of the smallest of traders was more than twice as extreme as it was at the peak in February.

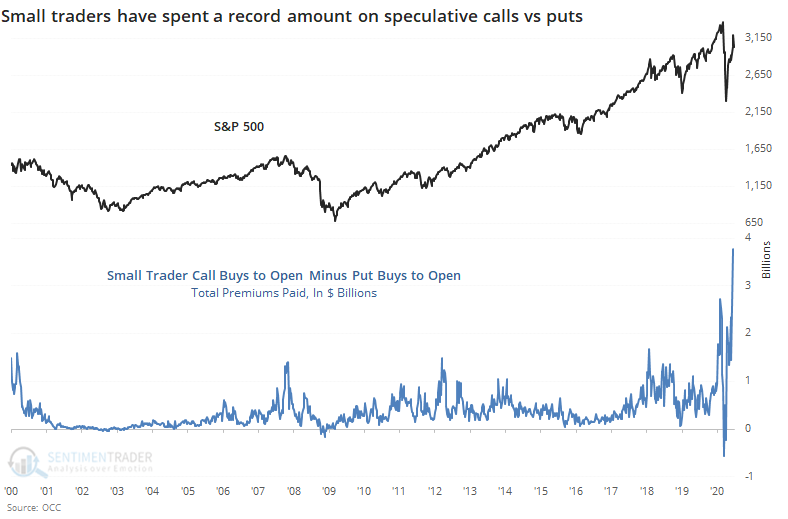

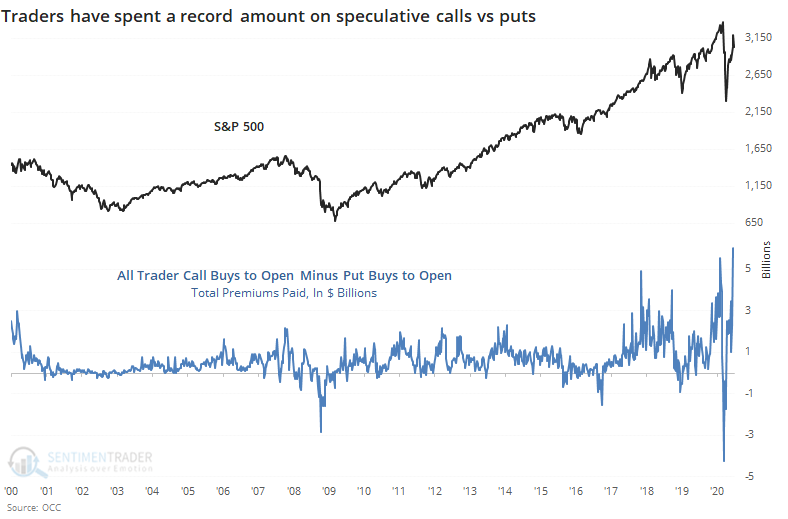

They spent nearly $4 billion more in premiums on these calls relative to the premiums they paid on puts.

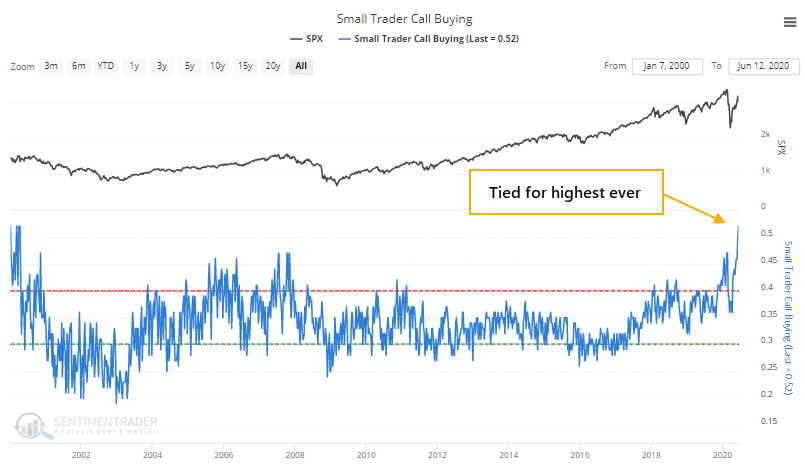

Using relative percentages, small traders spent 52% of their volume on buying call options to open. This is a record high, tied with the most extreme weeks in 2000.

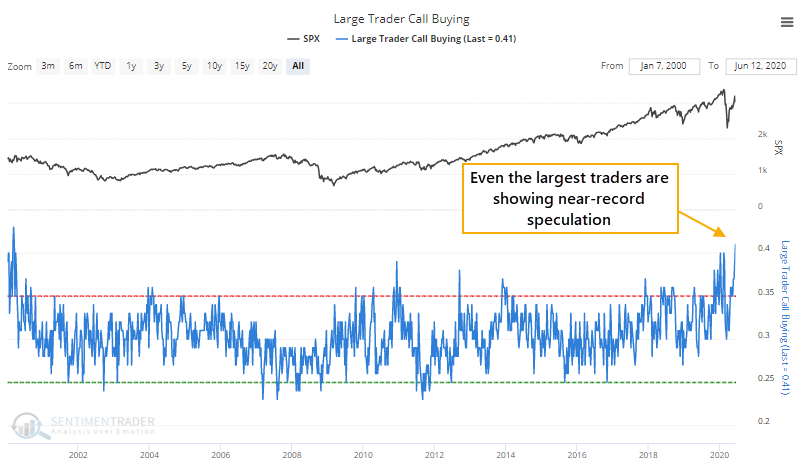

Speculation wasn't rampant only among the smallest of traders. Even the largest of them, trading 50 or more contracts at a time, focused to a near-record degree on speculative calls.

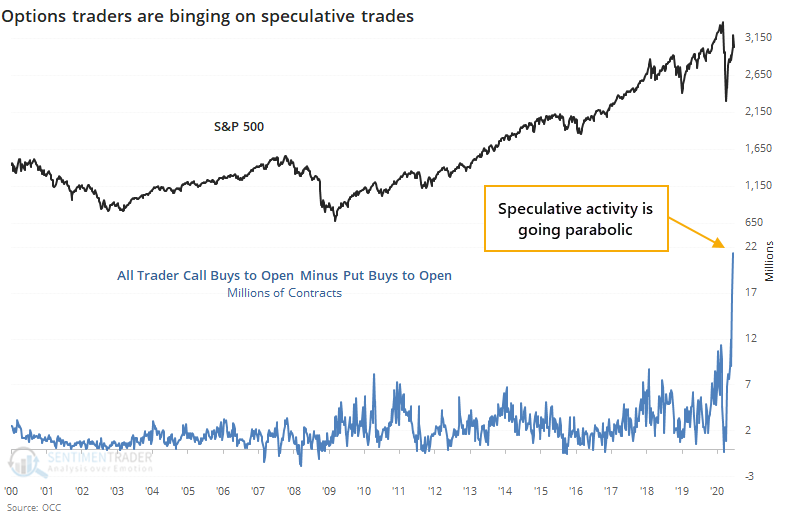

Among all traders, there were approximately 22 million more calls bought to open than puts. This is astounding.

They spent over $6 billion more on calls than puts.

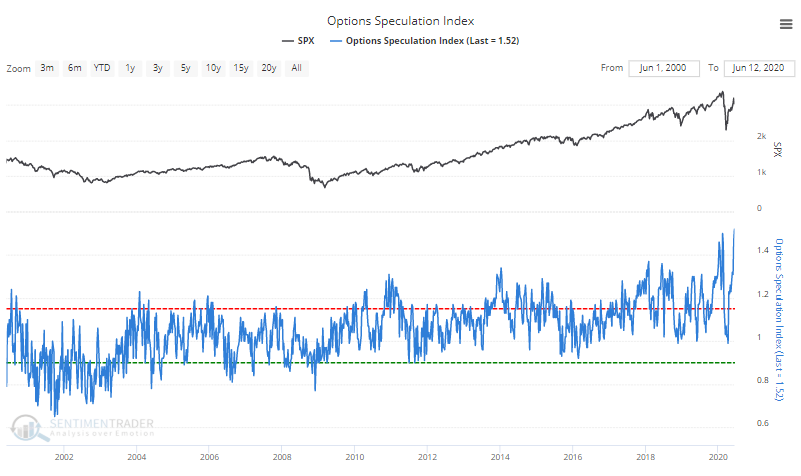

The Options Speculation Index, which is the most comprehensive look at how traders allocated their volume across speculative versus hedging activity, moved to the highest level since a few weeks in the year 2000.

Maybe the legions of new traders have spawned some kind of perverse front-running scheme among hedge funds, which are breaking their trades into tiny pieces and skewing this data. That's doubtful. More likely, it's a horde of new traders stuck at home who have seen stocks only go up for months on end. This has never ended well and remains a large risk over the short- to medium-term.