S&P 500 ETF Optimism Index Surge

In the most recent market drawdown, which may not be over, the Optimism Index (Optix) for the S&P 500 ETF fell to a pessimistic level of 9.44 on 9/20/21. The Optix Index has subsequently surged to 52.77 in the previous three trading sessions.

Let's conduct a study to identify the outlook for the S&P 500 ETF when the Optix Index falls below ten and subsequently increases above fifty in three trading sessions or fewer.

I screened out repeat signals by using a 30-day filter.

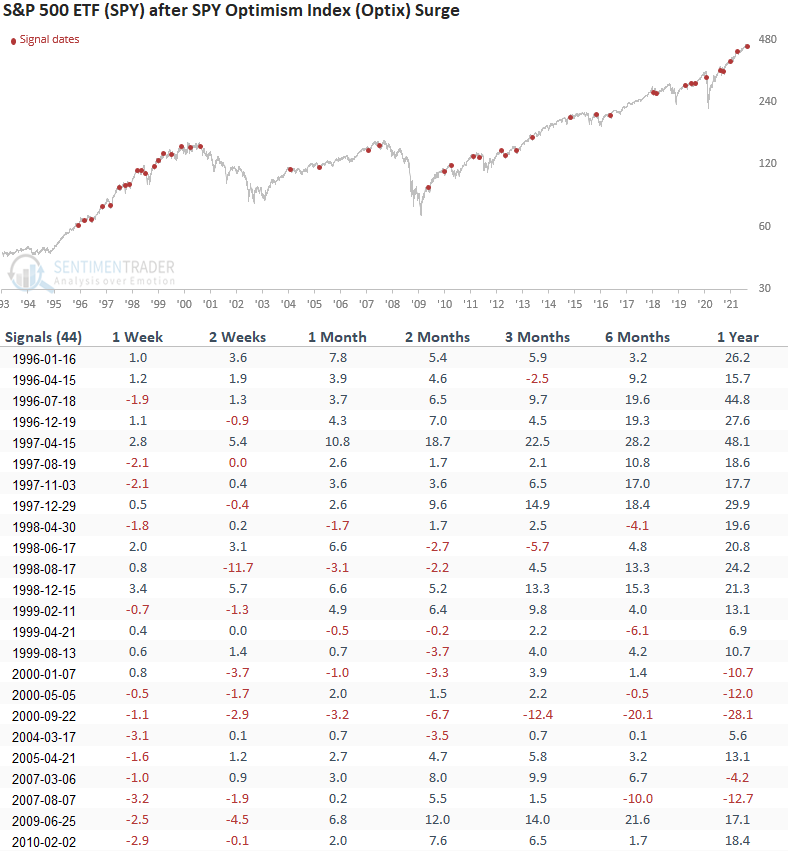

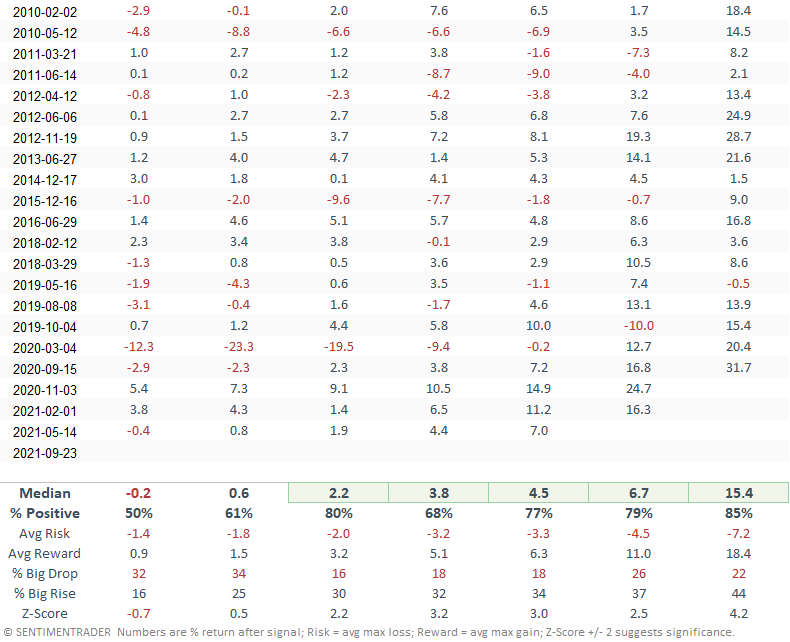

CURRENT DAY CHART

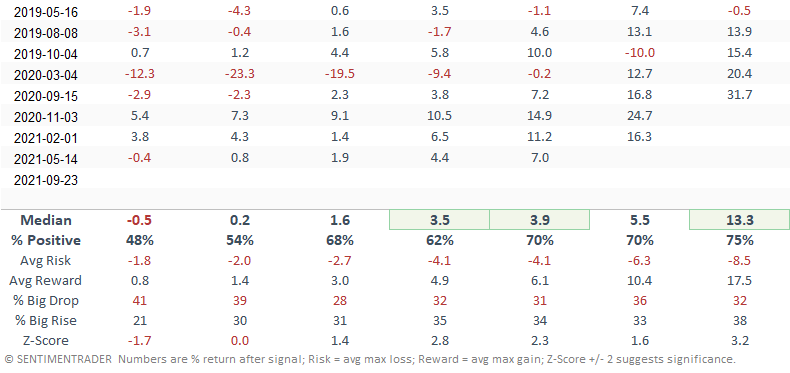

HOW THE SIGNALS PERFORMED

The results look good on an intermediate to long-term basis with several notable z-scores. As is the case with most mean reversion signals, the short-term performance can reflect choppy conditions associated with a bottoming process. And, I would also note that bear markets are unkind to short-term reversals.

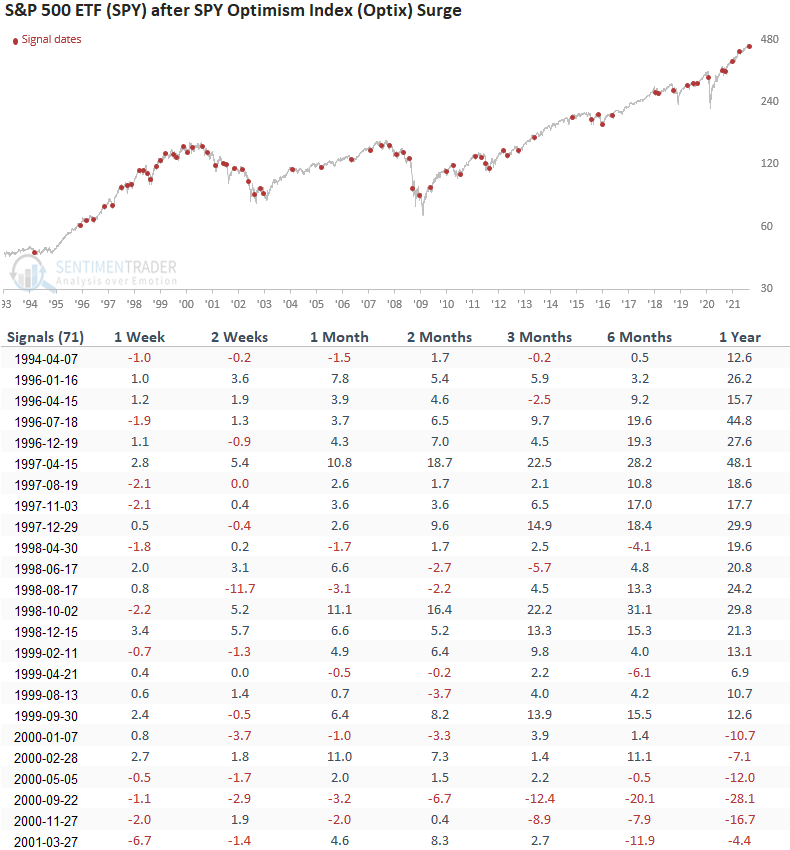

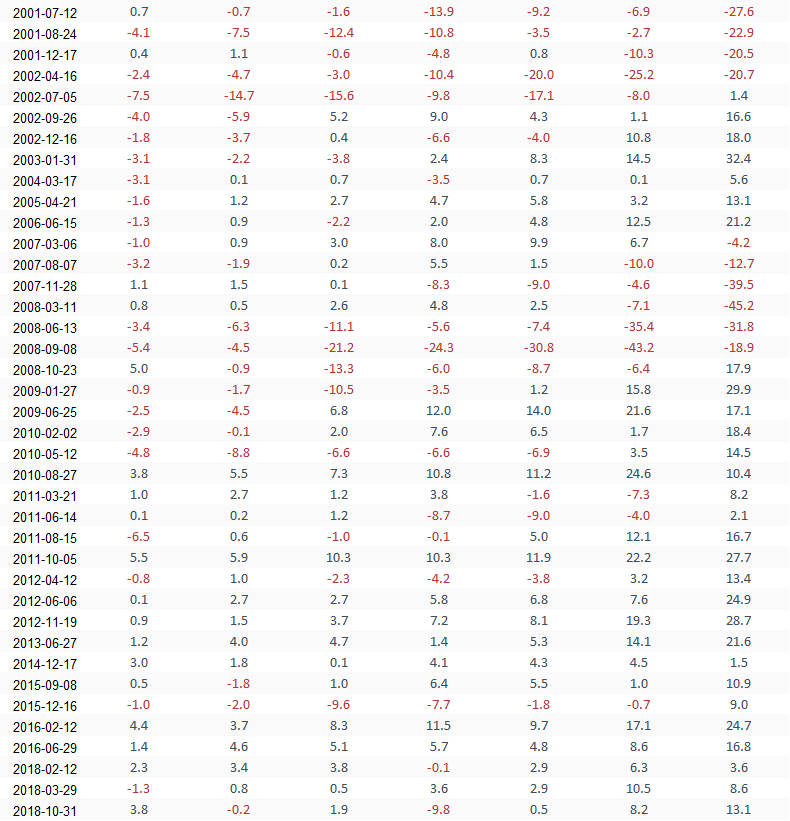

Let's add a trend filter to the study to isolate instances similar to the current one. I will keep the original study parameters but now include a condition that requires the SPY ETF to be trading above its respective 200-day moving average.

HOW THE SIGNALS PERFORMED WITH 200-DAY FILTER

Except for the first two weeks, the results look excellent, with several notable z-scores. Context is always important.