South African Fund Giving Buyers A Discount

Looking through a list of ETFs trading at premiums or discounts to net asset value, the only fund really sticking out today is EZA, the iShares MSCI South Africa ETF.

The fund has a large allocation to banks, and they've been getting slammed in recent days as the South African finance minister was fired and replaced by a relative unknown.

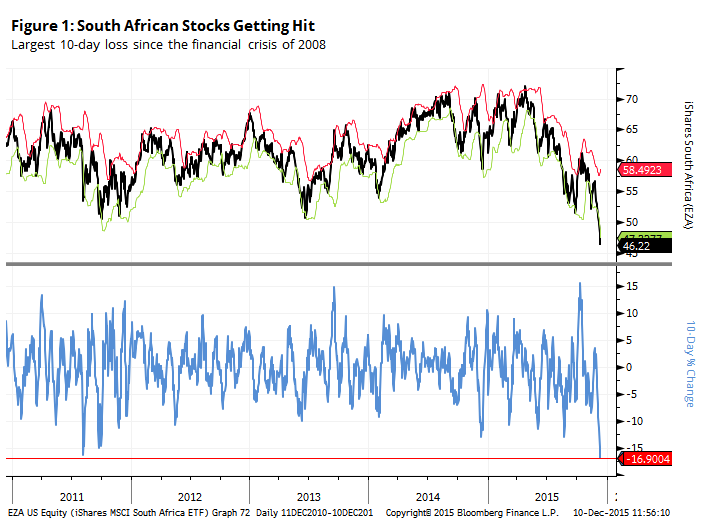

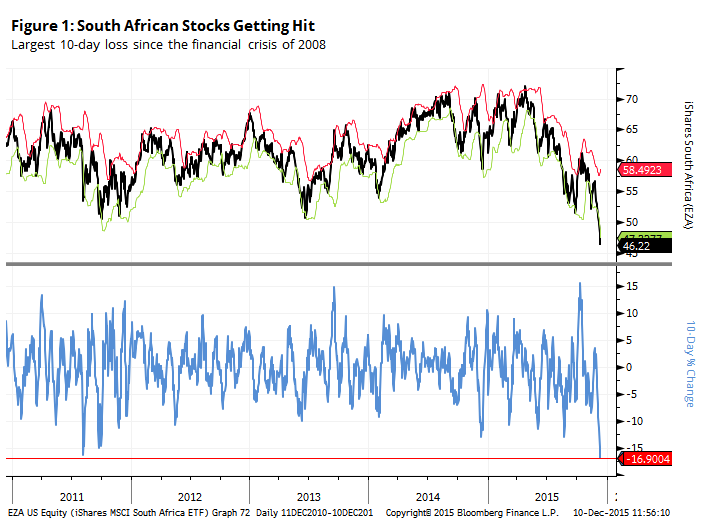

That has pushed the fund to its largest 10-day loss since the financial crisis of 2008, and the third-largest drop since its inception in 2003.

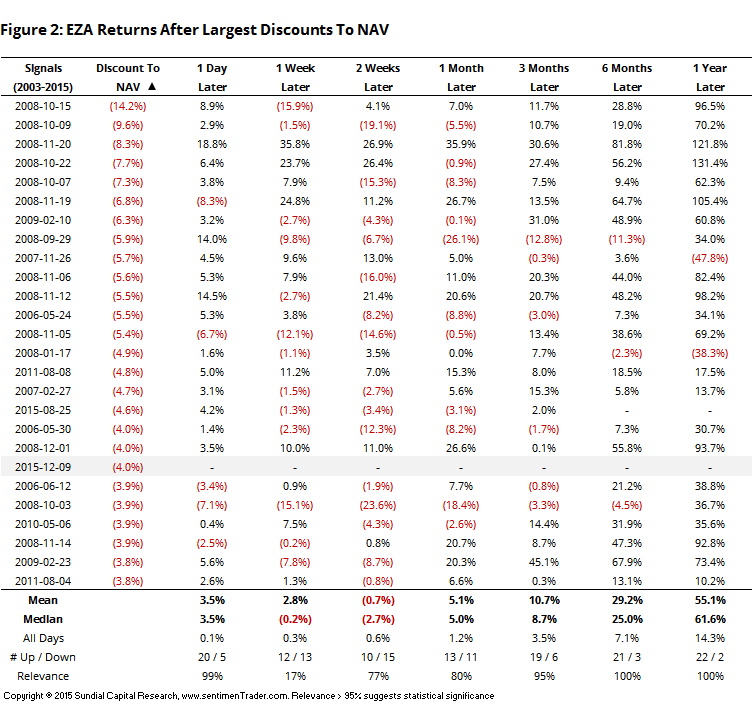

As a result, the fund is being driven to a 4% discount to its underlying holdings. Figure 2 shows the fund's return after traders drove it to the largest discounts to NAV.

It had a strong tendency to bounce back in the very short-term and again in the longer-term. After the initial bounce to relieve the discount, though, it tended to struggle.

Something to keep in mind for those looking for a very short-term mean-reversion trade, or as the beginnings of a potential longer-term investment.