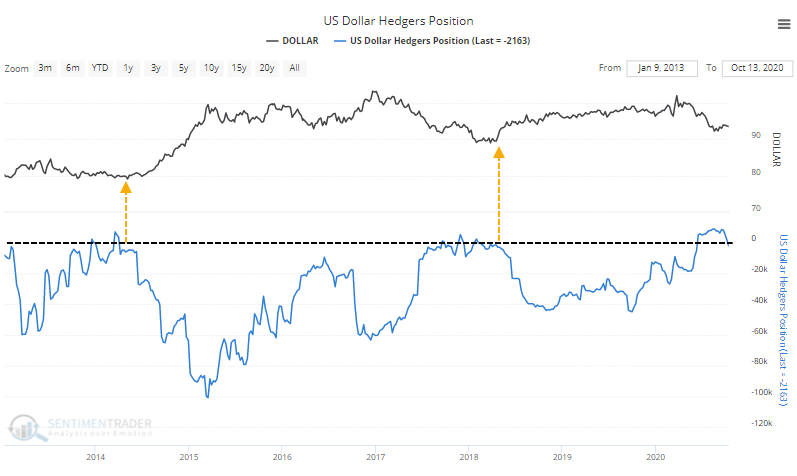

Smart money turns negative on the buck

The smart money has gone net short stocks for the first time in months. They've also started to short the U.S. dollar.

The last two times they flirted with longs in the dollar and then flipped to short, the buck proceeded to rally strongly. Commercial hedgers have underlying exposure to the contracts they're trading, so while it always seems like they're fighting the primary trend, they're not. They're just constantly adjusting their exposure and should never truly be net short any market.

Those last two instances are a bit different from what we've seen in recent months because hedgers only flirted with being net long, and not for any more than a few weeks at a time. This time, they were net long for several months.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- What happened to the dollar, gold, and stocks when hedgers turned negative on the dollar

- The Barron's Big Money poll shows the most optimism in 2 years

- What happens when building permits jump

- Sentiment on natural gas, copper, and cotton has become extreme

| Stat Box The Nasdaq Composite just ended a 5-day losing streak, its longest since August 2019. A month after it ended other streaks of at least 5 down days since 1971, it was higher a month later 54% of the time, averaging +1.1%, slightly below random. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

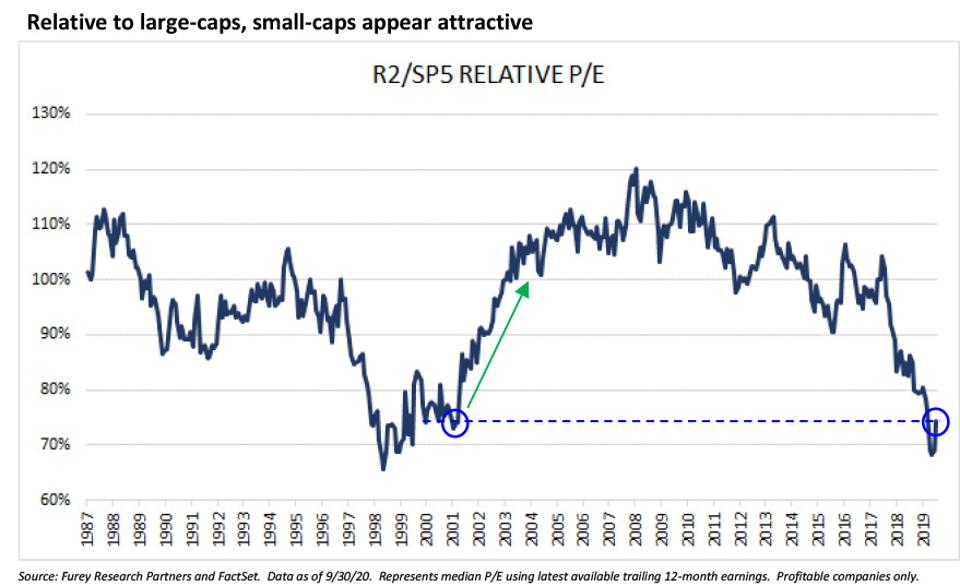

1. Scared investors have pushed small-cap valuations to a relative extreme - Capital Spectator

2. Open interest in put options on the ~20-year Treasury fund, TLT, has skyrocketed - Financial Times

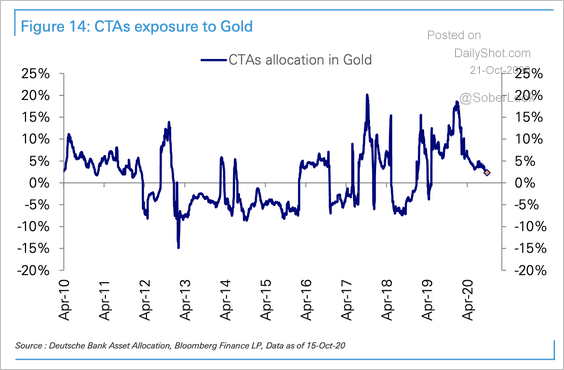

3. Trend-following hedge funds have reduced their gold exposure - Deutsche Bank via Daily Shot