Smart Money Index Influenced By ETFs as Investor Net Worth Hits New Low

This is an abridged version of our Daily Report.

The last hour conundrum

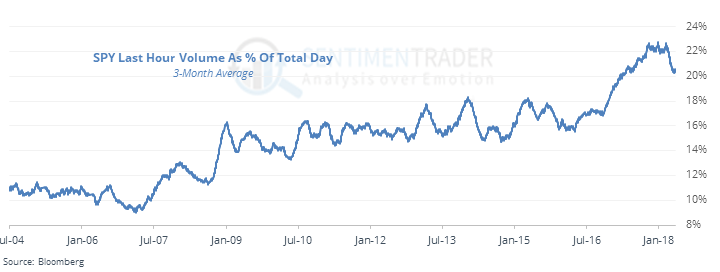

Somebody keeps selling into the close, and it’s commonly assumed that it’s large “smart money” traders. That concept worked in years past, but the proliferation of ETFs has thrown a wrench into it.

Using SPY volume, it’s clear that the last hour has become the focus, as “dumb money” shifts from a.m. to p.m.

Investors’ net worth plumbs new low

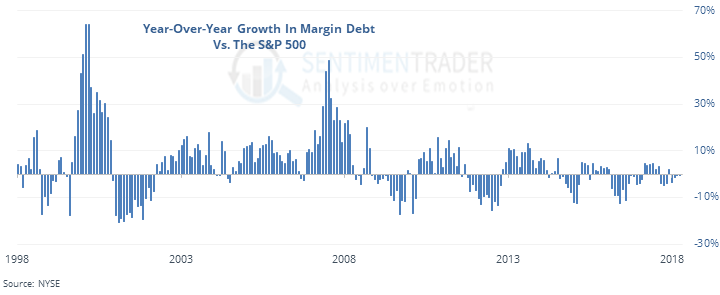

Margin debt grew in April, and cash has plunged as investors withdraw funds, leading to a new low in net worth. At the same time, an average of $440 million is riding on the average advancing stock, a heavy burden.

The lone positive is that debt isn’t outpacing the growth in stocks, unlike 2000 and 2007.

It’s tech’s time

The Nasdaq 100 fund, QQQ, opened at a 5-day low and reversed hard enough to close at a 5-day high. This is not common, with only 6 precedents.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |