Small cap stocks signal risk on

Key points:

- The ratio between small and large stocks surged to the highest level relative to its recent range

- The S&P 500 rallied 79% of the time over the next 2 months after other signals

Using small-cap stocks as a way to identify risk-on cycles

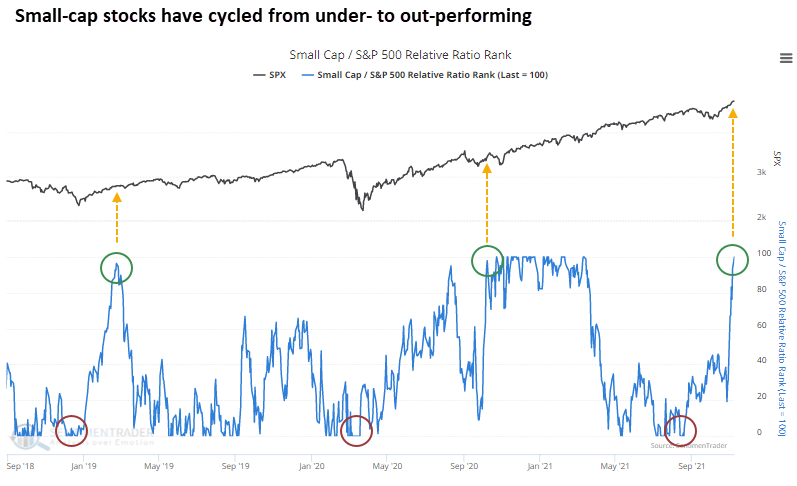

A trading model that measures when small-cap stocks reverse from underperforming to outperforming relative to large-cap stocks issued a buy signal at the close of trading on Monday.

The small-cap range rank signal triggers when the 4-month range rank for the ratio between small and large stocks reverses from less than 1% to greater than 98.75%. Typically, when small-cap stocks surge relative to large-cap stocks, economic growth accelerates, and stocks perform well.

Small-cap stocks join other risk-on relationships with recent signals

A couple of other risk-on signals triggered within the past month as well, showing a quickly increasing risk appetite among investors.

In a recent note, Jason highlighted a breakout in the Russell 2000 index. They have continued to perform relatively well, pushing the Relative Ratio Rank to 100%. The previous risk-off to risk-on signal from October 2020 led to a substantial rally for the S&P 500.

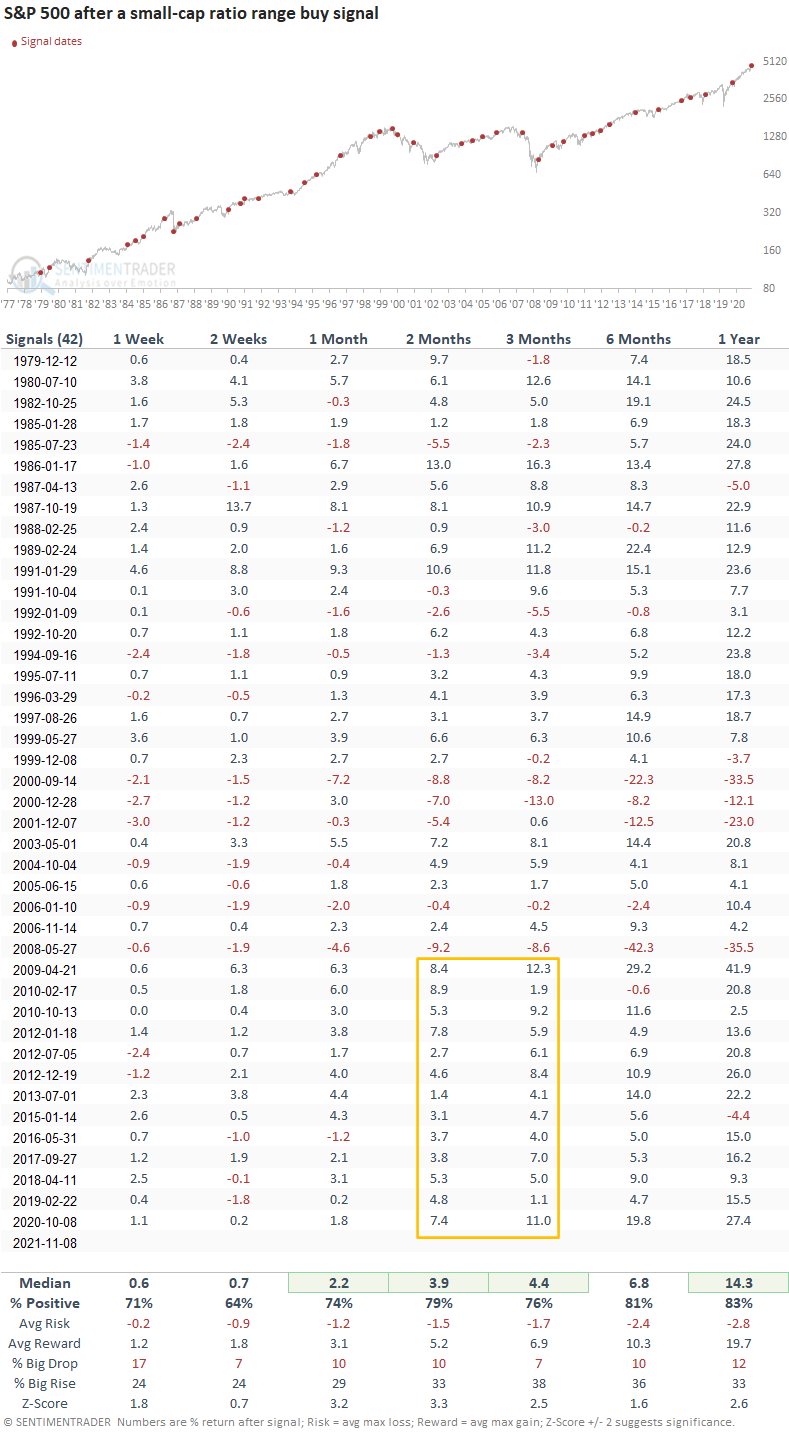

The S&P 500 rallied 79% of the time after other signals

This signal has triggered 42 other times over the past 43 years. After the others, future returns in the S&P 500 were solid across all time frames, with several solid risk/reward profiles. And, the signal has recorded 13 consecutive winning trades over the next 2 and 3 months since 2009.

Most of the unfavorable signals occurred during bear markets, which is not the case now.

What the research tells us...

When small-cap stocks surge, it suggests the economy is undergoing a resurgence in growth that provides a tailwind for the stock market. Similar setups to what we're seeing now have preceded rising prices for S&P 500 over the medium-term.