Small-Cap Stocks Haven't Run Like This Since 1995

With a flood of money combining with preternaturally calm conditions in the broader market, equity investors can't help themselves. Once again, buying interest was enough to push the S&P 500 to a record monthly close in May.

For the most widely-benchmarked index in the world, this was its 4th consecutive month with an all-time high. After the 18 other times it managed a feat like this since 1928, risk outweighed reward over the next six months only twice.

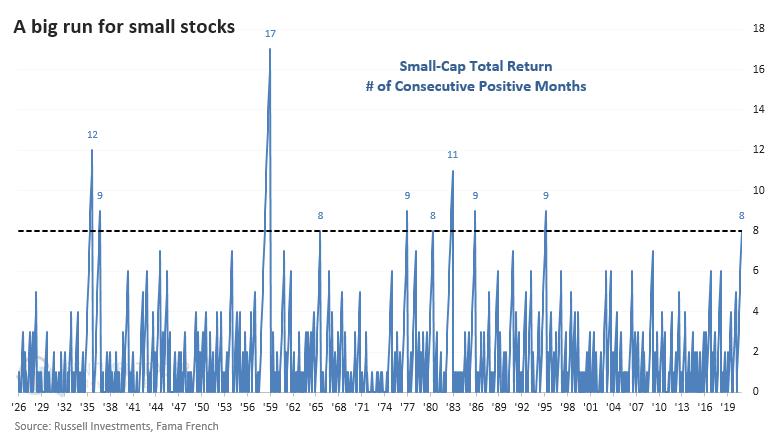

While they've settled back recently, part of the momentum has been due to a tremendous run in Small-Cap stocks, which just ended their 8th straight month with a positive total return, tied for the 5th-longest streak since 1926.

After other 8-month winning streaks, Small-Caps have tended to keep going, but there were some rough patches. A few times, they lost more than 10% over the next six months, though there was only one (very) large loss a year later.

Looking at the other end of the spectrum, the Dow Jones Industrial Average just celebrated its 125th anniversary by recording its 6th-largest gain over a 14-month stretch.

We've seen time and time again since last April that momentum does not die easily.

| Stat Box Over the past 3 months, individual investors in the AAII sentiment survey have allocated an average of more than 70% of their portfolios to stocks. According to our Backtest Engine, there have been 36 months since 1987 when the average has been this high. Over the next 3 years, the S&P 500 averaged a return of -5.5%. |

What else we're looking at

- Full returns in the S&P 500 after streaks with record monthly closes

- What happens in small-cap stocks after rallying for 8 straight months

- Since 1896, a look at the Dow's future returns following jumps of 50%

- Why the dollar is about to enter an unfavorable period

- An update on industry, sector, and country absolute and relative trends