Similarities between the NASDAQ now and in February

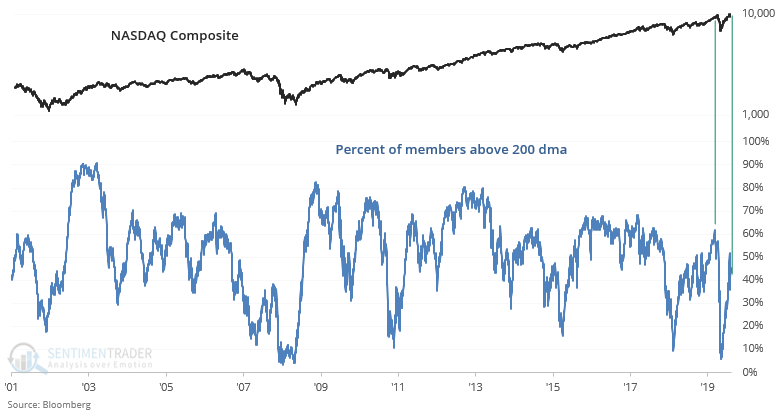

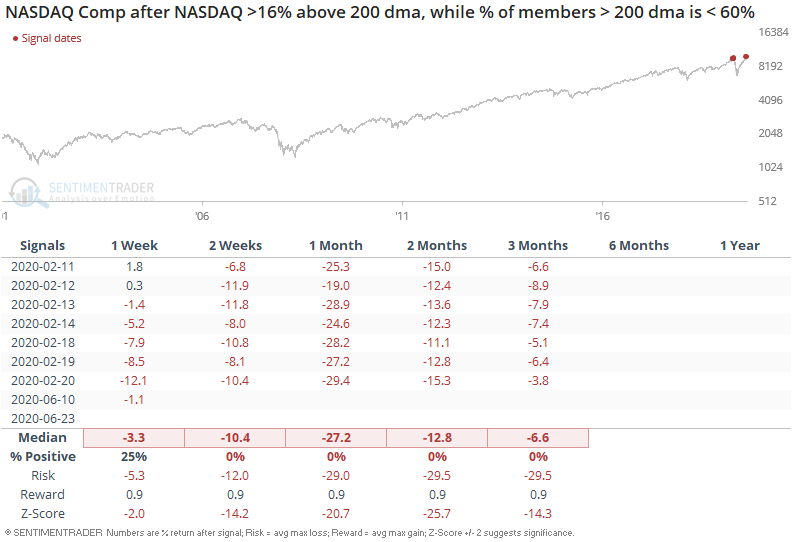

The NASDAQ's non-stop rally, particularly in tech stocks, is driving some comparisons between now and other ominous historical periods. I noted yesterday that relatively few of the S&P's members are above their 200 dma. Callie Cox was the first to mention this problem, and it's even worse for the NASDAQ than the S&P 500. The NASDAQ Composite is more than 16% above its 200 dma (i.e. a massive rally) while a mere 45% of NASDAQ members are above their 200 dma. Such weak NASDAQ breadth in the face of such a strong rally has never happened before from 2001-present:

The only somewhat comparable case was in February, just before the U.S. stock market fell off a cliff. Even comparing today vs. February is a bit of a stretch: breadth today is much worse than it was back then:

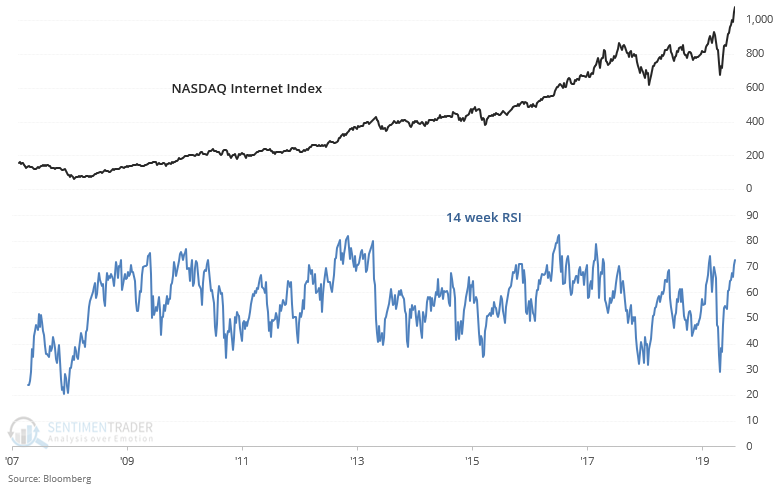

It's not hard to figure out why the NASDAQ's breadth is so weak. Internet stocks are on FIRE, while other stocks are languishing. Robinhood traders must be having a field day as the NASDAQ Internet Index SOARS. Who knew that making 10% each week in trading would be so easy (insert eye roll). Here's an excellent interview with Robinhood for those who are interested in fintech. Always remember: if a product is free, you are the product.

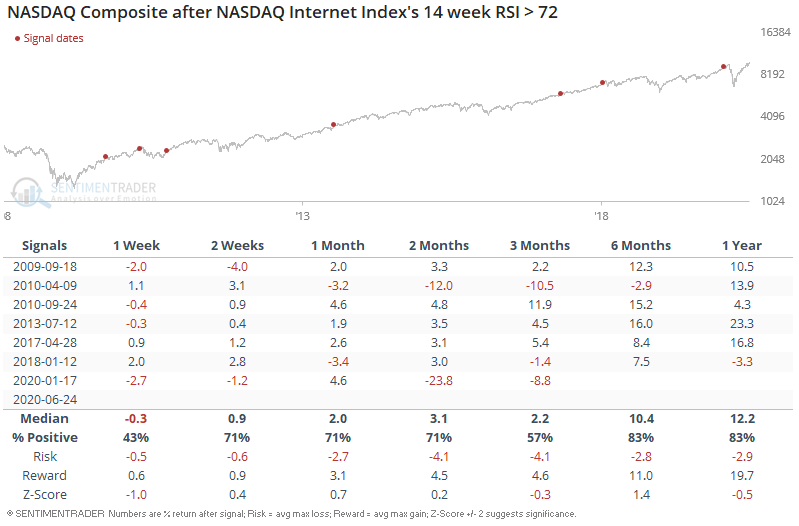

With that being said, the NASDAQ Internet Index's 14 week RSI is at the highest level since earlier this year:

Such strong momentum has been a consistent bearish factor for the NASDAQ Composite, although the past 2 cases (January 2018 and January 2020) were followed by sharp market declines:

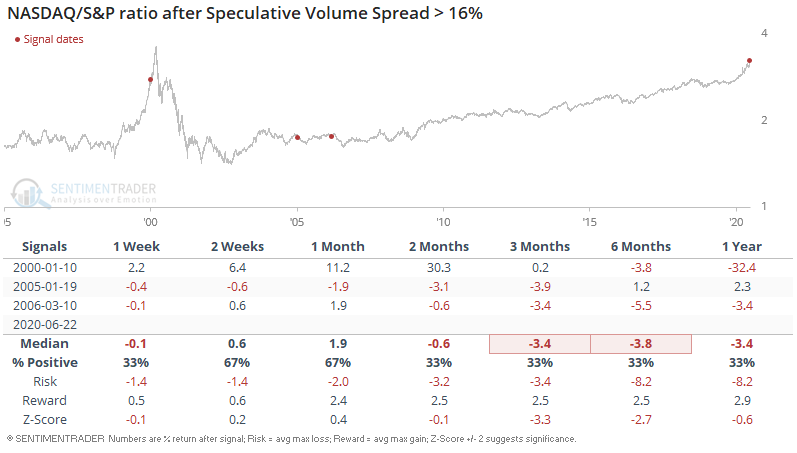

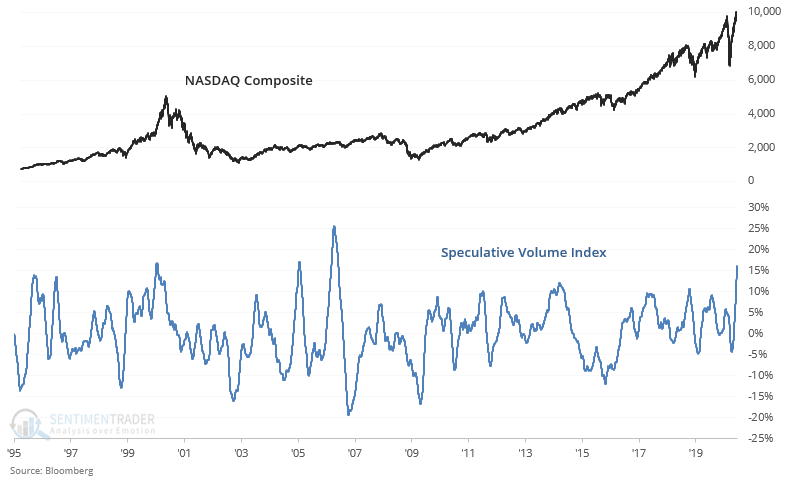

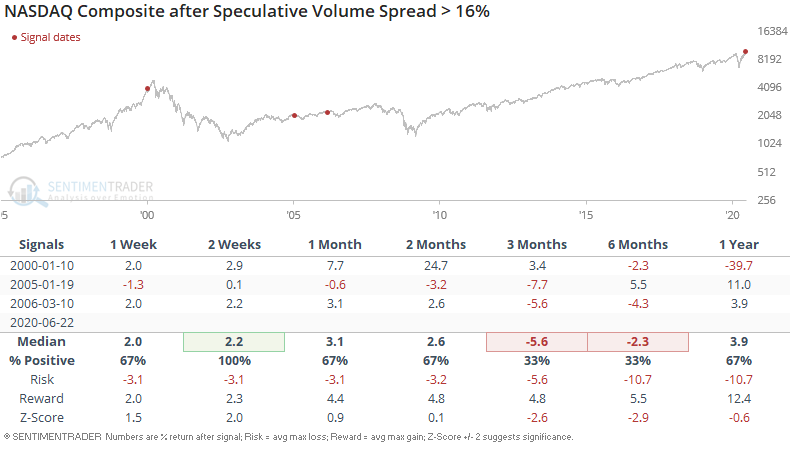

A few years ago Jason looked at a concept called the Speculative Volume Index. This indicator looks at the difference between volume on the NYSE vs. NASDAQ exchanges. The theory is that NASDAQ stocks are more speculative, so when trading activity on the NASDAQ surged relative to activity on the NYSE, it's a sign of excess speculation.

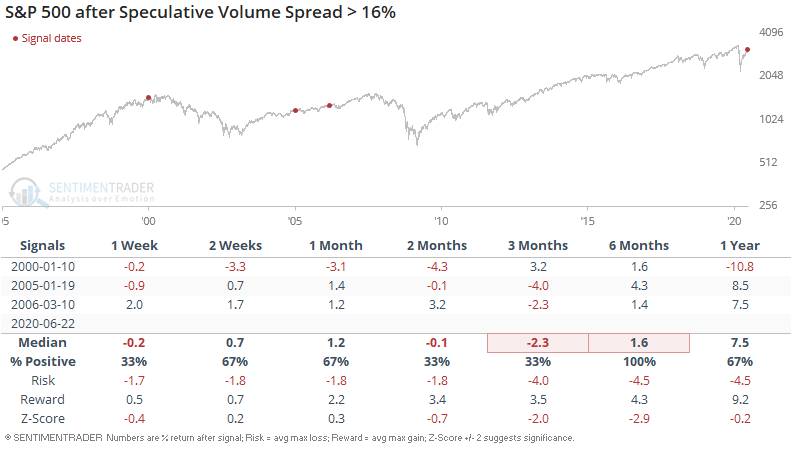

We can use this concept to compare volume for the NASDAQ vs. the S&P 500. The following compares the 50 day average of the NASDAQ/S&P Volume ratio against its 200 day average. Speculation towards tech stocks is at its highest level in over a decade:

Such an extreme level of relative speculation has only been matched by 3 other times over the past 25 years. All 3 of these cases led to a pullback in the S&P over the next 2-3 months:

And all 3 led to a pullback in the NASDAQ over the next 3-6 months:

And as one might expect, this caused the NASDAQ to underperform the S&P 500 over the next 3-6 months: