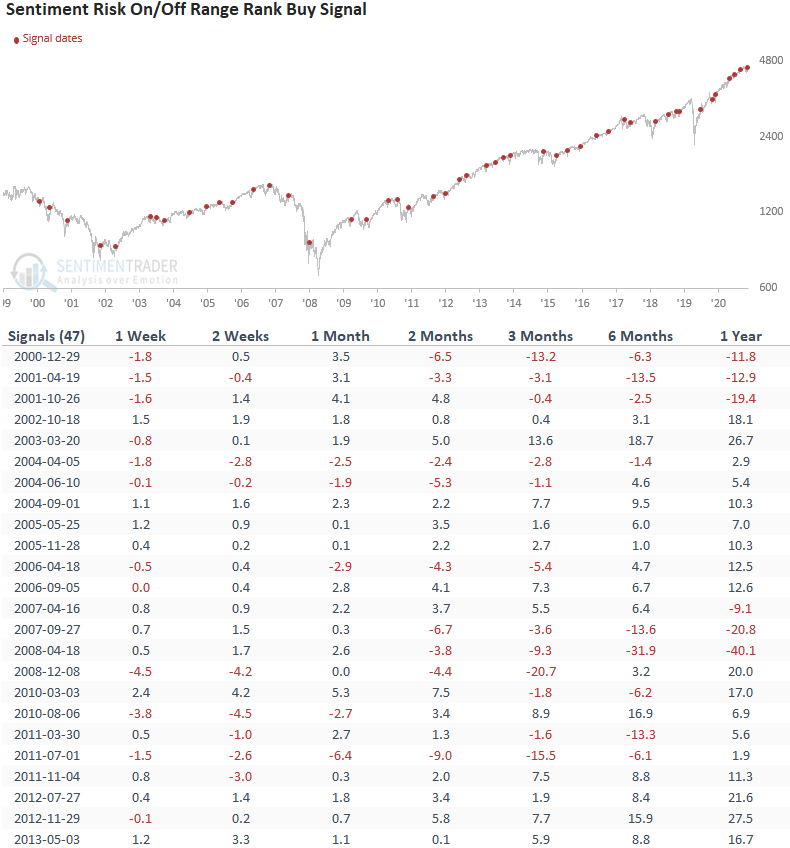

SentimenTrader.com Risk On/Off Indicator Buy Signal

The SentimenTrader.com Risk On/Off indicator registered a range rank reversal buy signal at the close of trading on 10/18/21.

Let's assess historical signal performance to see if we should be increasing equity exposure in our portfolio.

If you would like to read the original concept note, please click here.

THE CONCEPT

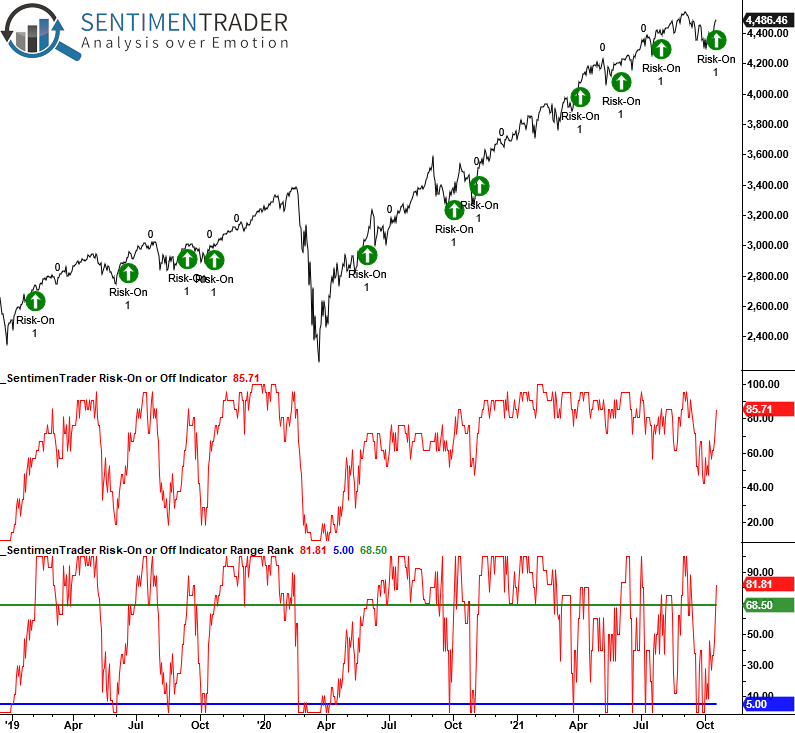

The SentimenTrader.com risk on/off indicator range rank model identifies when the indicator reverses from a bearish to bullish condition. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

- The SentimenTrader.com risk on/off indicator range rank crosses below 5%. i.e., the reset

- If Condition 1 is confirmed and The SentimenTrader.com risk on/off indicator range rank crosses above 68.5%, buy the S&P 500.

The model uses an 84-day lookback period for the range rank indicator. If you were wondering, a range rank measures the current value relative to all other values in percentage terms over the lookback period. 100% = Highest and 0% = Lowest.

CURRENT DAY CHART

Please click here for a link to the SentimenTrader.com risk on/off Indicator page on the website.

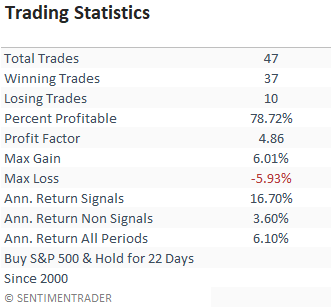

The trading statistics in the table below reflect the optimal days-in-trade holding period of 22 days. When I run optimizations for trading signals, I cap the max number of days at 42. i.e., I optimize to find the best DIT holding period between 5 and 42 days.

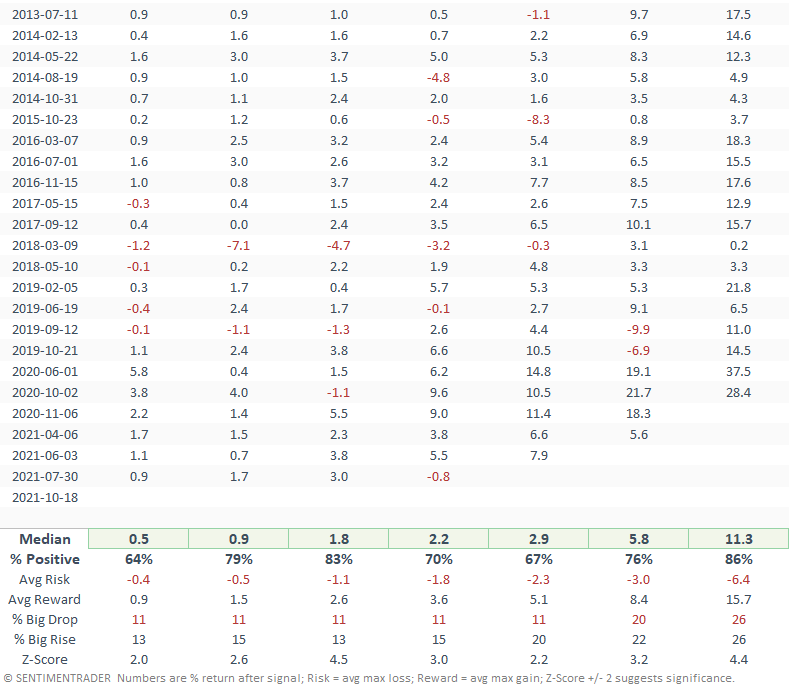

HOW THE SIGNALS PERFORMED

The performance results and risk/reward profile look excellent across all time frames. Since 2012, the 2-week timeframe has registered 24/26 winners.