Sentiment problems

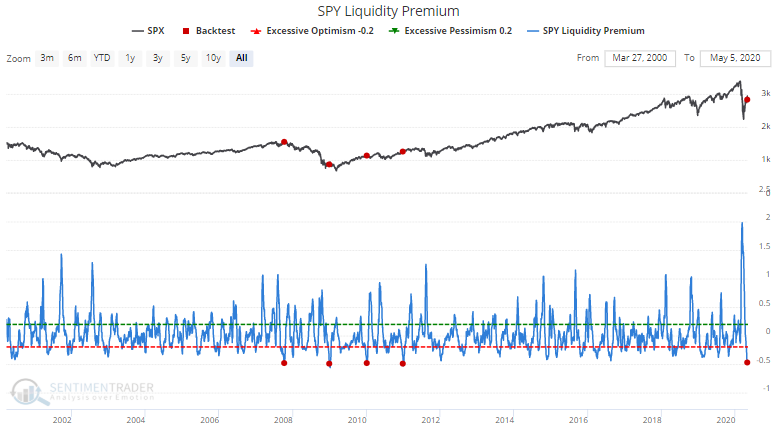

Investors and traders continue to hope that picking individual stocks will lead to above-average returns. Our SPY Liquidity Premium, which looks at volume in SPY vs. its underlying stocks, is at the lowest level in almost a decade. This is not surprising given how well some select sectors (e.g. tech and health care) have done during the pandemic-driven recession.

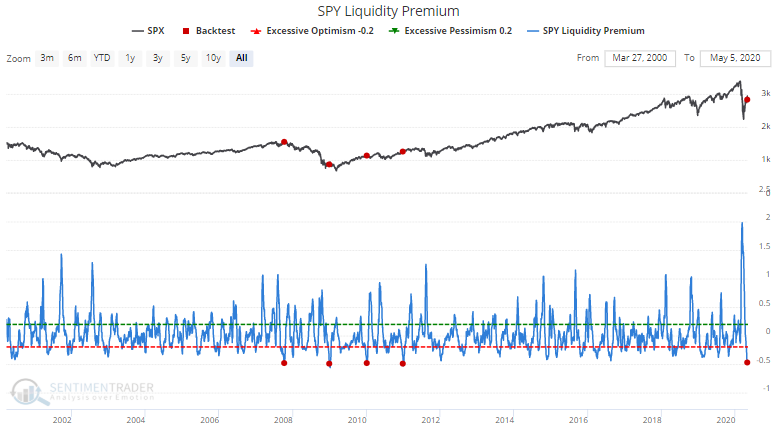

When our SPY Liquidity Premium was at -0.47 in the past, 3 out of the 4 historical cases led to short term losses for U.S. equities. The only bullish case came at the end of 2010, but even then stocks struggled greatly in 2011:

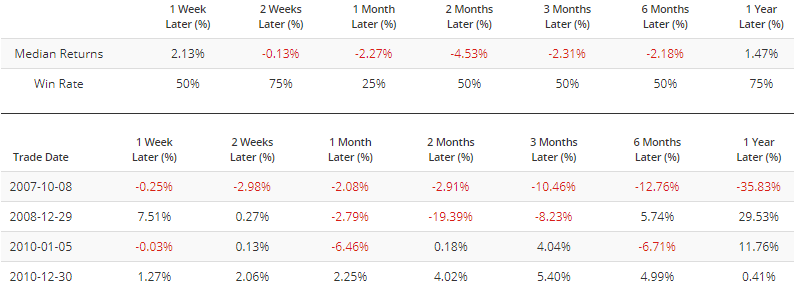

Meanwhile, sentiment is picking up but isn't at true extremes yet. Our CNN Fear Greed Proxy's 5 day average is at 73. Stating the obvious, in a bear market this was bearish and in a bull market this wasn't bearish. (This kind of thinking isn't very useful, because only in 20/20 hindsight do you know if it's still a bear market or bull market).

All we can know in real-time is indisputable facts, e.g. whether or not this occurred when the S&P was in a long term downtrend (under its 200 dma).

When this happened in the past while the S&P was under its 200 dma, the S&P's returns over the next 2-3 months were mixed because once again, this was bearish during a bear market:

So while it's hard to say if the short-medium term is bearish now, we do know that short term risk is higher than average.