Selling Puts to Buy Stock "When in Doubt"

If you have traded stocks for any length of time, you have likely endured the experience whereby you know you "should" buy a particular stock, but for one of the myriad possible reasons, you just cannot and/or will not pull the trigger.

If the stock subsequently advances, you end up frustrated over a missed opportunity. And if the stock subsequently declines, you may feel momentary relief, but even then, you still know that you violated your own trading rules and skipped a trade based on some extraneous emotional tug.

Either way, the effects can last and, more dangerously, can affect your thinking as you approach new opportunities.

There are ways to avoid this type of situation. Let's consider one.

ONE APPROACH TO THE "WHEN IN DOUBT" SCENARIO

We are talking about a particular situation:

- You think you "should" buy a particular stock because you think it will advance in price soon

- However, for some reason, typically - though not always - involving fear of loss, you are hesitant to make the trade

So here is one approach to dealing with this situation:

- Sell a deep-in-the-money put

- Buy a slightly out-of-the-money put

Essentially you are entering what would be referred to in options parlance as an "in-the-money bull put spread." As always, the best way to illustrate is with an example.

AAPL EXAMPLE

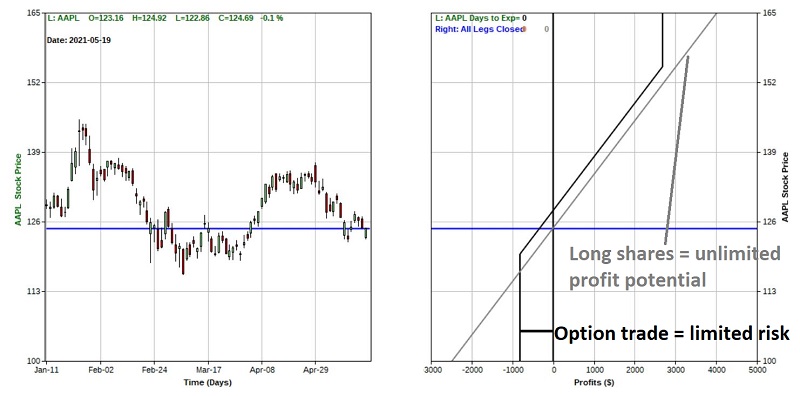

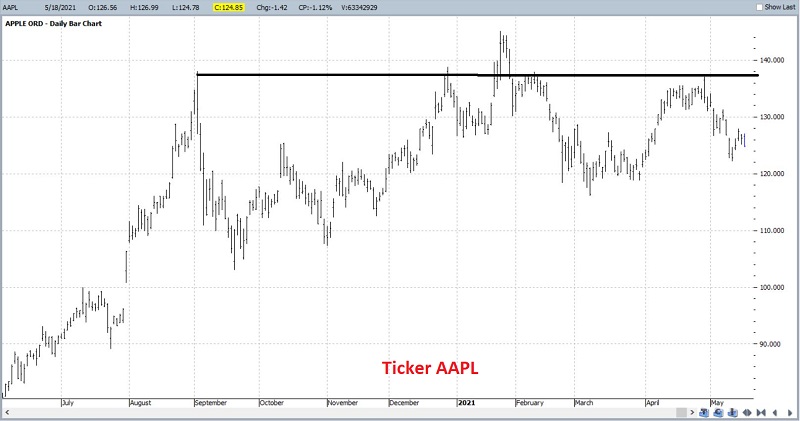

The chart below is a bar chart for Apple (AAPL) courtesy of ProfitSource by HUBB.

Let's assume that we get a "buy" signal for AAPL from our trading system. What we "should" do is buy 100 shares of AAPL at $124.85 (or $12,485 for 100 shares of stock).

As an example, let's consider the following setup:

- AAPL is above its 200-day moving average

- The 5-day average of Optix for AAPL crosses above 32

This idea is strictly an example and NOT a "recommendation." Nevertheless, to get a better sense, you can:

- Click this link to go to the Backtest Engine

- Click "Run Backtest" to run the test

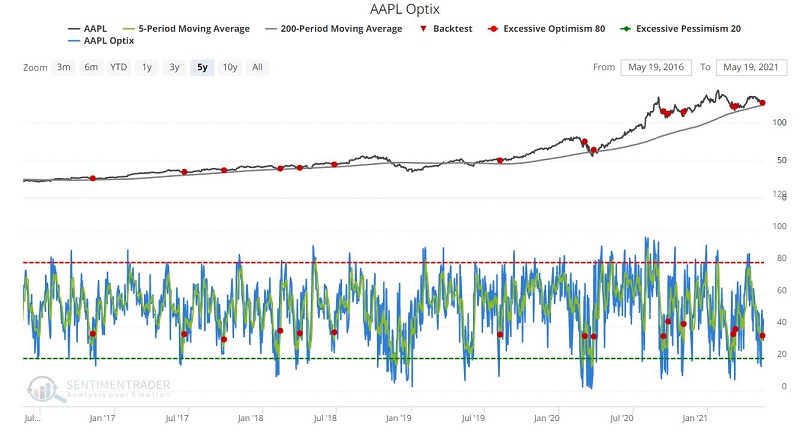

The chart below shows AAPL with the signals for the last 3 years.

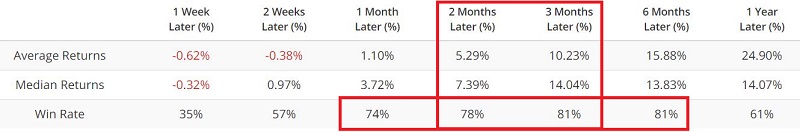

In the Backtest Engine:

- you can scroll down and click "Multi-TimeFrame Results" to view a summary table

- as you can see in the table below, AAPL has shown a tendency to rise in the 1 to 6 months after a signal

Now let's further assume that while we have a buy signal in hand, we also experience:

- Doubt that the stock will be able to break out to the upside

- Concern that the stock will either decline in the short-term or hit resistance at the recent high and then reverse lower

These doubts and concerns might keep us from buying the stock as our trading system told us to do. So, let's look at a strategy that will allow us to:

- Participate on the upside if AAPL rises in price

- Limit our downside risk if AAPL decline in price

- Most likely end up buying shares of AAPL

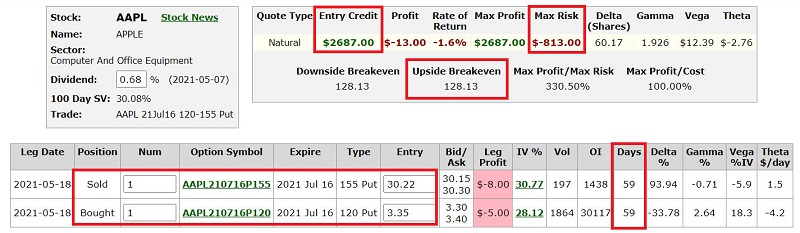

With AAPL trading at $124.85 a share, this example trade involves:

- Selling 1 July 155 put @ $30.22

- Buying 1 July 120 put @ $3.35

The particulars for this trade appear in the screenshot below.

The risk curves for this trade appear in the chart below

Things to note before option expiration:

- The options expire in 59 calendar days

- At entry, this trade takes in a credit of $2,687 (the difference between the two option prices times $100)

- The worst-case loss before option expiration is -$813 (if AAPL is at or below $120 a share)

- At any time before expiration, the short put may be exercised, requiring us to buy 100 shares of AAPL at $155 a share

- As a result, we need to have $15,500 in available funds to buy the shares

- This can include the $2,687 credit we took in when the bull put option trade was entered

- If the short put is exercised before option expiration, we can choose to continue to hold the long put as downside protection until July expiration, OR we can sell it for whatever price we can get for it (if we are primarily concerned about downside risk, we will continue to hold the put and if we are feeling more bullish about AAPL we might sell the long put

If the short put is exercised before option expiration, we will buy 100 shares of AAPL at $155 a share.

Our effective cost is $128.13 a share, calculated as follows:

- Paid $15,500 to buy 100 shares at $15.50 a share

- Received $3,022 for selling one July 155 put @ $30.22

- Paid $335 to buy one July 120 put @ $3.35

- Sum = $12,813 / 100 shares = effective cost of $128.13 a share

Things to note at option expiration:

- If AAPL rises above $155, the short option expires worthless, and we DO NOT buy any AAPL shares; however, we would generate a net profit of $2,687 from the option trades

- If AAPL is at any price below $155 a share at expiration, the short option is automatically exercised, and we will be required to buy 100 shares of AAPL at $155 a share.

- Again, part of this cost would be offset by the $2,687 credit received when the bull put option trade was entered

Note that if the short put is expired, we will pay more for the shares ($128.13) than we would have if we had bought them originally at $124.85. However, this difference ($3,28 a share or $328 for 100 shares) is the price we paid to:

- Limit our downside risk

- While waiting to see what direction AAPL stock was headed

- All the while putting ourselves in a position to acquire shares of AAPL stock ultimately

COMPARED TO BUYING SHARES INITIALLY

To fully appreciate the relative pros and cons of this options-based approach, let's compare the reward/risk tradeoff for this trade to that of buying 100 shares of AAPL at $124.85 as we originally intended to do. The chart below overlays the risk curves for the option trade with the risk curve for buying 100 shares of AAPL at $124.85.

The primary differences are:

- The stock trade has unlimited profit potential above $155 a share and unlimited risk to the downside

- The option trade has limited risk below $120 a share and limited profit potential above $155 a share.

Which is the better approach? That is in the eye - and mind - of the beholder/trader when a trade is called for.