Selling in Hong Kong Nears Panic Proportions

Fear that debt troubles with China's Evergrande would spread globally was the most common excuse for Monday's slide. Using it as a reason for drops in the U.S. is questionable, but the closer you get geographically, the more sense it makes.

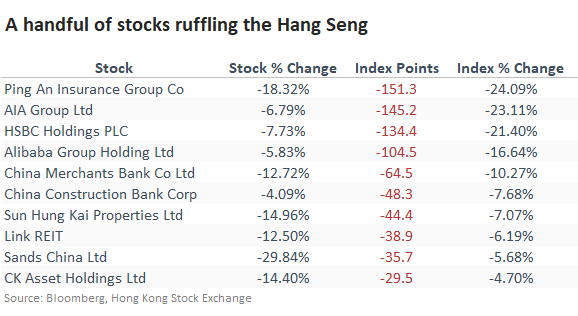

Stocks in Hong Kong certainly have been feeling that pressure, thanks in part to a plunge in property developers and related companies.

According to Bloomberg calculations, the five stocks with the most significant losses accounted for 600 of the Hang Seng's 628-point loss over the past month.

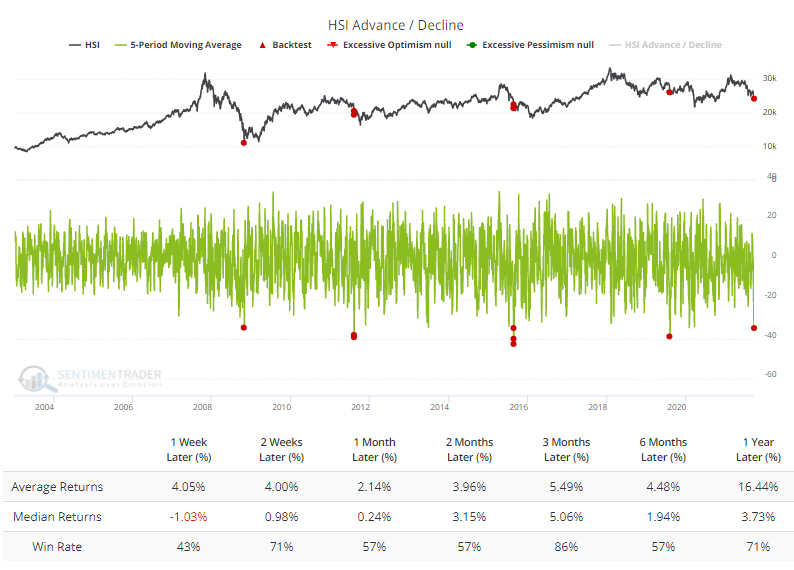

Over 5 days into Monday, an average of more than 34 stocks in the index declined versus advanced, one of the most extreme readings in nearly 20 years. The Backtest Engine shows mostly positive returns after the others. The index continued to slide for a couple more months in August 2011, then reversed those losses in the months ahead.

In prior years, we've looked at a breadth composite when a particular market looks like it's suffering panic-level selling pressure (like Mexico and South Korea in 2019). This composite includes breadth metrics that have a good record at highlighting overwhelming internal selling pressure.

When we look at that composite for the Hang Seng, we can see that it is nearing panic-level conditions that have indicated washout selling pressure over the past 20 years.

What else we're looking at

- Full returns in the Hang Seng following panic-level aggregate breadth readings

- What happens after an extended run of bullish sentiment finally ends

- Updating a seasonal tendency in gold stocks

| Stat box More than 85% of NYSE volume flowed into advancing stocks on Wednesday. That's the 15th-highest amount since 1996 on a day when the FOMC announced its decision and outlook on interest rates. |

Etcetera

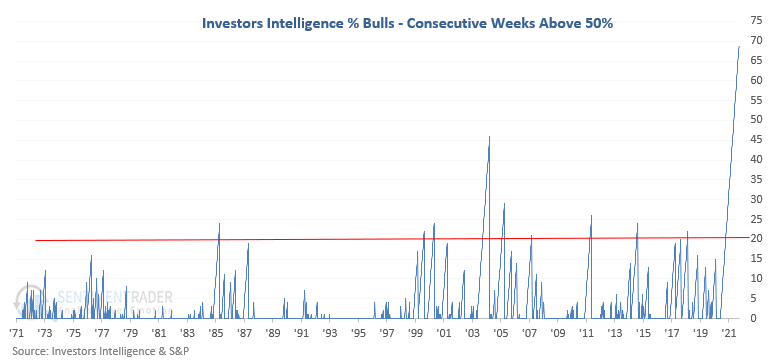

What a run. This week, fewer than 50% of newsletter writers expect stocks to rise. Finally. Dean noted that it had been 69 weeks - almost a year and a half - since the last time that Investor's Intelligence reported a non-majority of bulls.

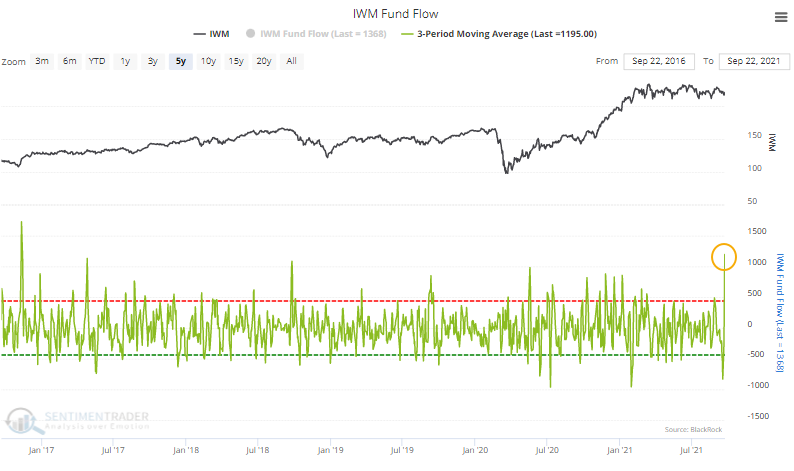

Big shift in small stocks. After days of pulling money out of the IWM small-cap ETF, traders returned in force. The fund pulled in an average of nearly $1.2 billion over the past three days, nearly the most in 5 years.

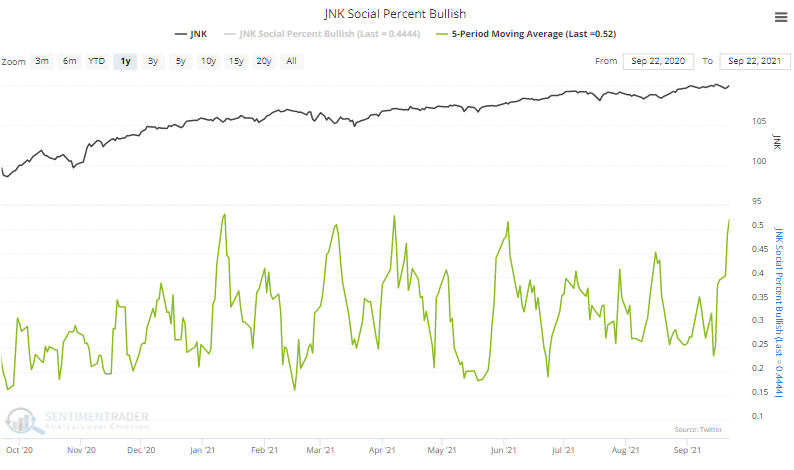

Bullish on junk. On social media, more than 50% of messages have been bullish on the JNK high-yield bond fund during the past week. That's nearing the highest percentage of the past year.