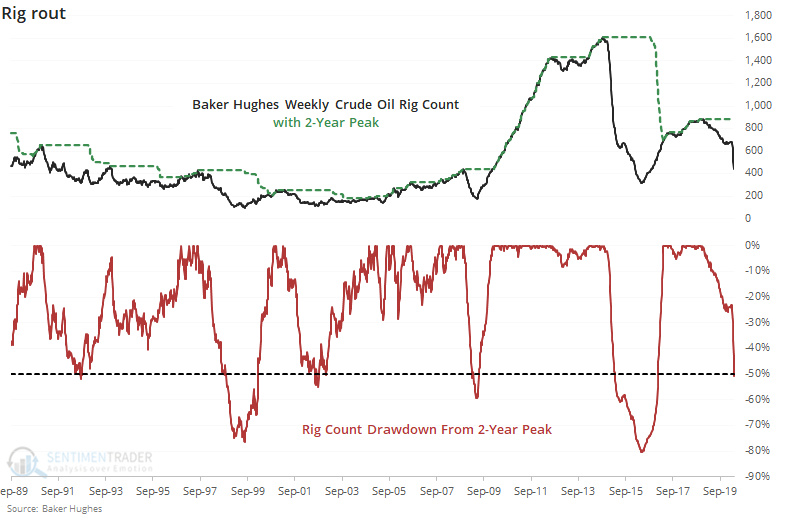

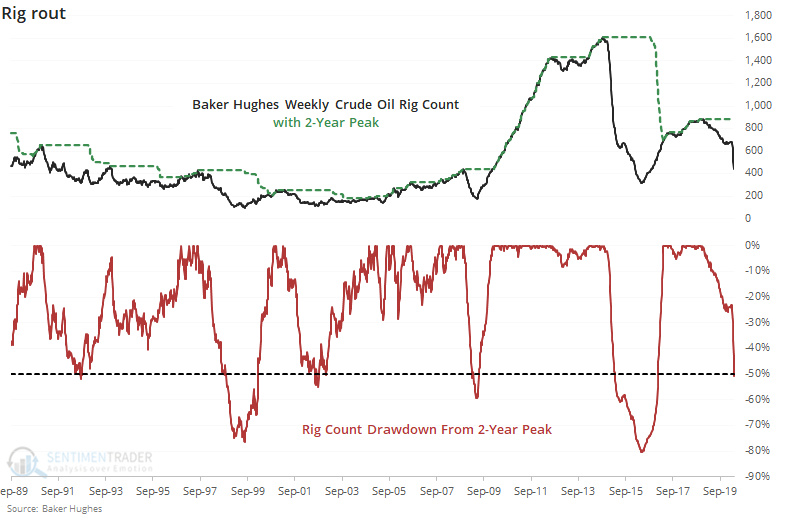

Rig rout

One of the signs that energy investors have been waiting for is a plunge in the rig count. It's finally here. The just-announced weekly Baker Hughes Crude Oil Rig Count plunged and is now 50% off its high.

From Bloomberg:

A rotary rig rotates the drill pipe from surface to drill a new well (or sidetracking an existing one) to explore for, develop and produce oil or natural gas. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies and does not include cable tool rigs, very small truck mounted rigs or rigs that can operate without a permit. Non-rotary rigs may be included in the count based on how they are employed. For example, coiled tubing and workover rigs employed in drilling new wells are included in the count. To be counted as active a rig must be on location and be drilling or 'turning to the right'. A rig is considered active from the moment the well is 'spudded' until it reaches target depth or 'TD'. Rigs that are in transit from one location to another, rigging up or being used in non-drilling activities such as workovers, completions or production testing, are NOT counted as active. Miscellaneous rig counts represent geothermal rigs.

A 50% drop in rigs equates to one of the largest pullbacks in 30 years.

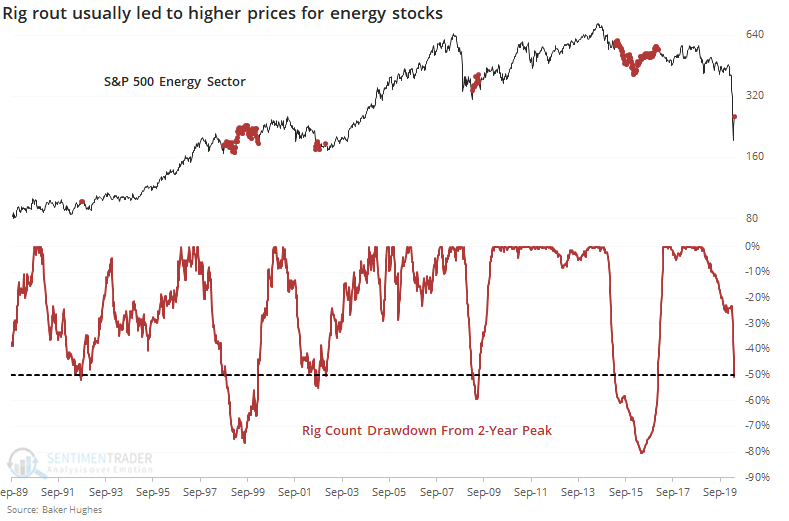

For investors, it only matters if this is a reflection of give-up among producers, which should lead to higher prices. For the most part, it did, though it triggered only about halfway through the 2015-16 decline.

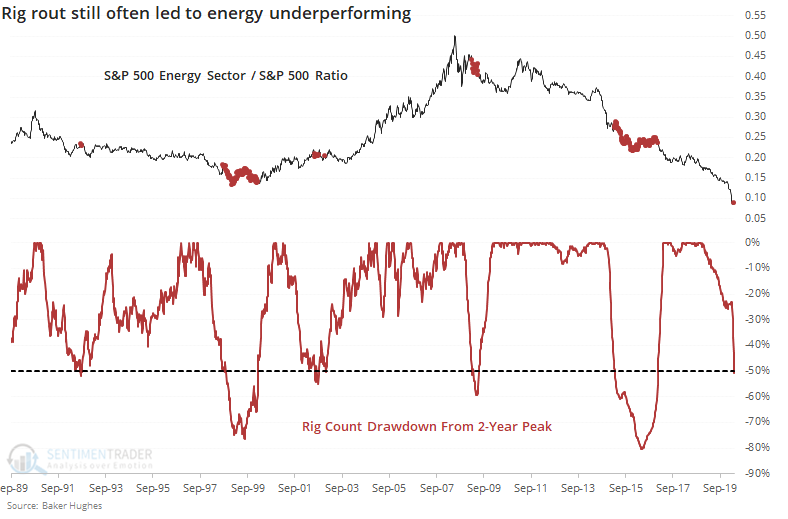

Even if energy stocks had a general tendency to rise after these drops in rig counts, they still underperformed the broader market.

There was no consistent pattern of the Energy / S&P ratio turning higher after these extremes, especially over the shorter-term of weeks to months.