Reversing The Reversal

Stocks have rallied strongly from the gap down open (which didn't quite qualify for the 0.25% gap mentioned in a Note earlier this morning), with the S&P 500 up more than 1.5%.

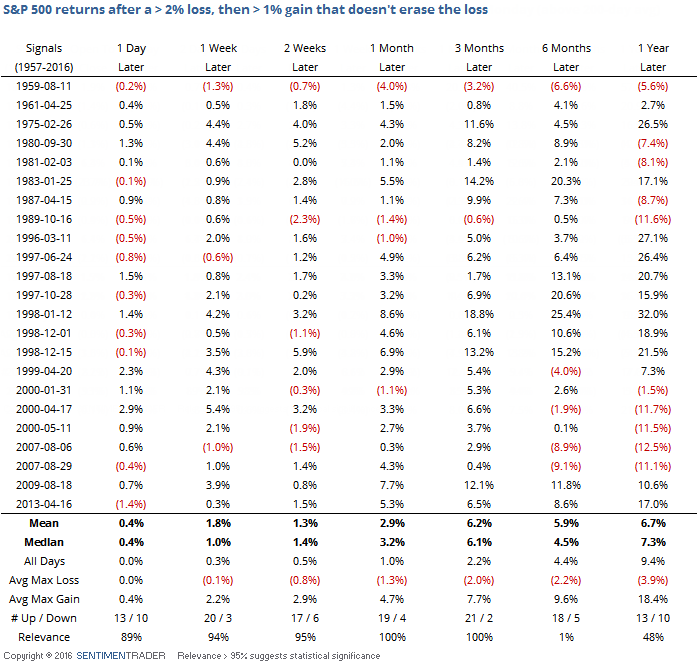

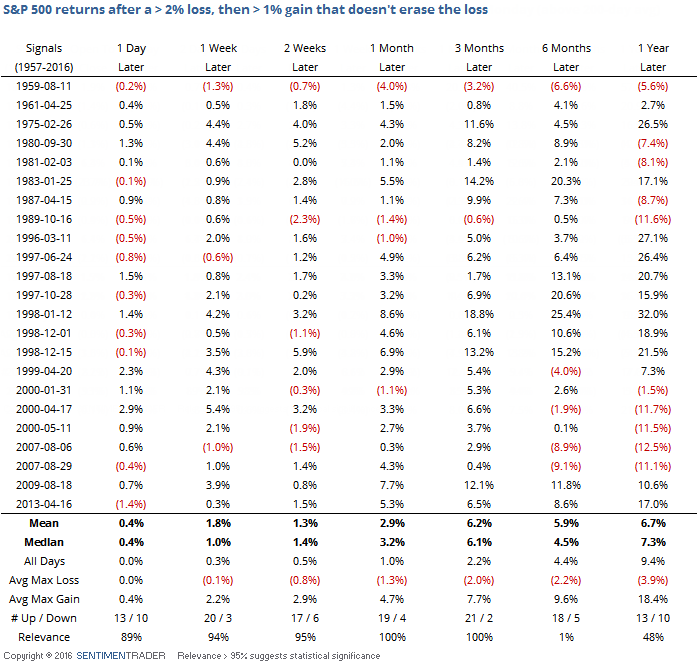

Even with the impressive gain, stocks haven't erased their losses from Friday. So let's take a look at other times the S&P lost at least 2%, then the next day it rallied at least 1% but not enough to fully claw back the loss from the prior day. We'll filter the results to only include instances when the S&P was trading above its 200-day moving average.

Often with patterns like this, we see some very short-term weakness. That wasn't the case here. Just a week later, the S&P was higher 20 out of 23 times and the positive vibe continued for up to 3 months later. Those 3-month returns were impressive, with only one meaningful loss and a risk/reward that was skewed nearly 4-to-1 to the upside. The Monday reversal diminishes some of the negatives that have been building up and leading to Friday's drop.