Reverse Up Concept And New Signal

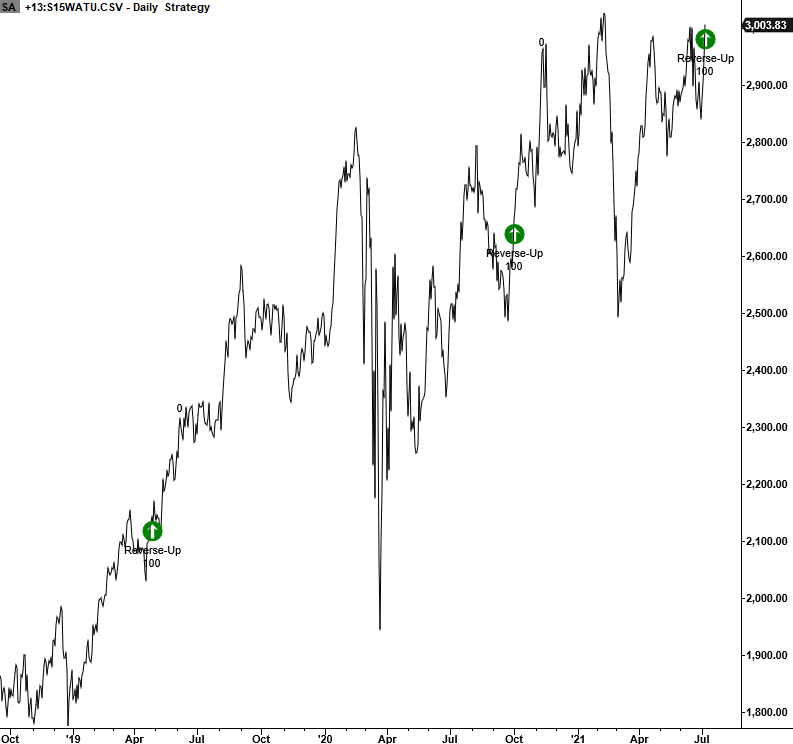

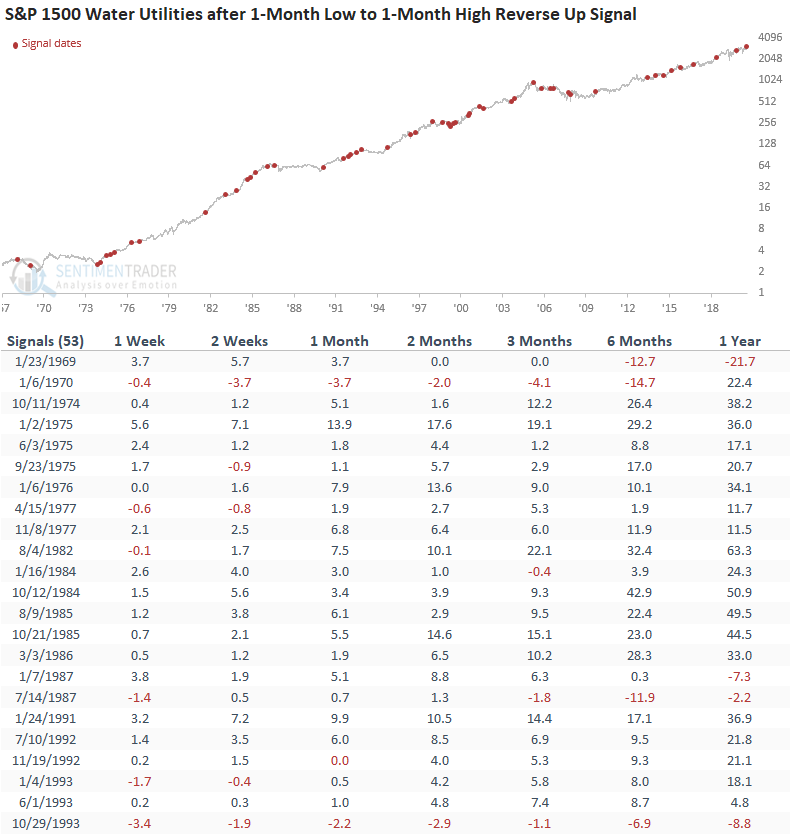

The S&P 1500 water utilities sub-industry group registered a 1-month low to 1-month high reverse-up buy signal at the close of trading on 7/7/21.

Let's review the concept and the forward return outlook for the group.

THE CONCEPT

The reverse-up signal identifies when a stock, index, or ETF registers a 1-month low and then reverses higher and registers a 1-month high in a user-defined number of days or less. The user-defined number of days is the most critical aspect of the signal. By limiting the number of days to a low level, the model identifies a momentum thrust. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

- Security XYZ closes at a 21-day low.

- If condition 1, then count the number of days since the low.

- If the number of days since the low < 10 and security XYZ closes at a 21-day high, go long.

Let's take a look at the current chart and historical signal performance.

CURRENT CHART - S&P 1500 WATER UTILITIES

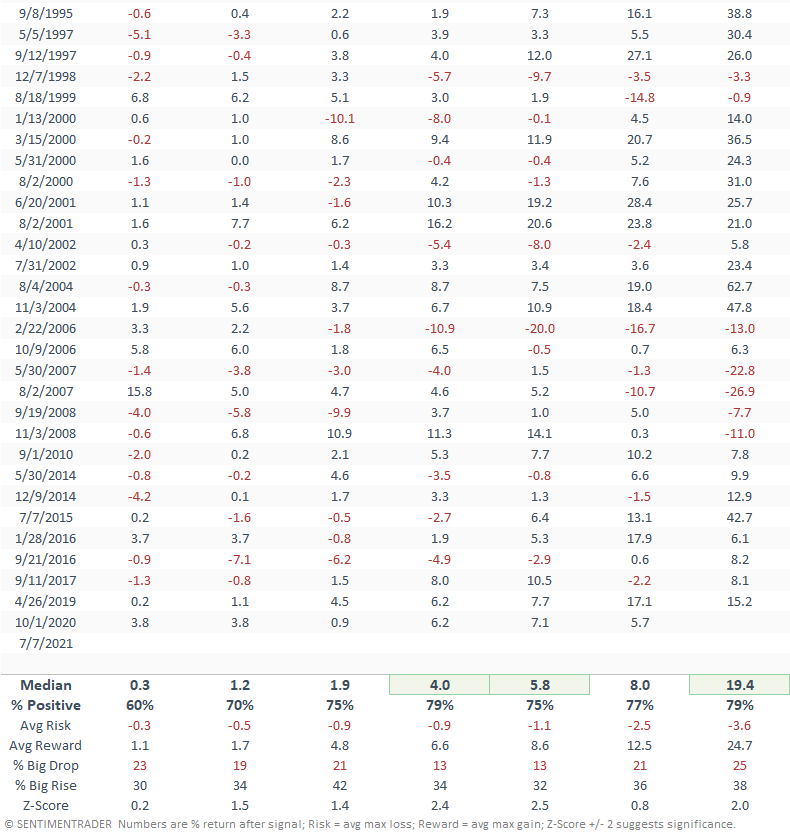

The trading statistics in the table below reflect the optimal days-in-trade holding period of 28 days. When I run optimizations for trading signals, I cap the max number of days at 42.

HOW THE SIGNALS PERFORMED

The returns look solid across all timeframes with several notable z-scores.

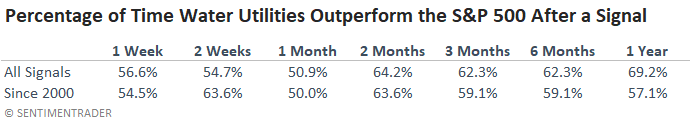

In case you were wondering how the signal performed relative to the S&P 500.

I would keep the following in mind when monitoring this algorithm. If a stock, index, or ETF is consolidating in a narrow range, the odds of a signal increase as the low and high are more easily achievable. When this occurs, the momentum thrust may be less than ideal, and the signal falters.