Record breadth readings

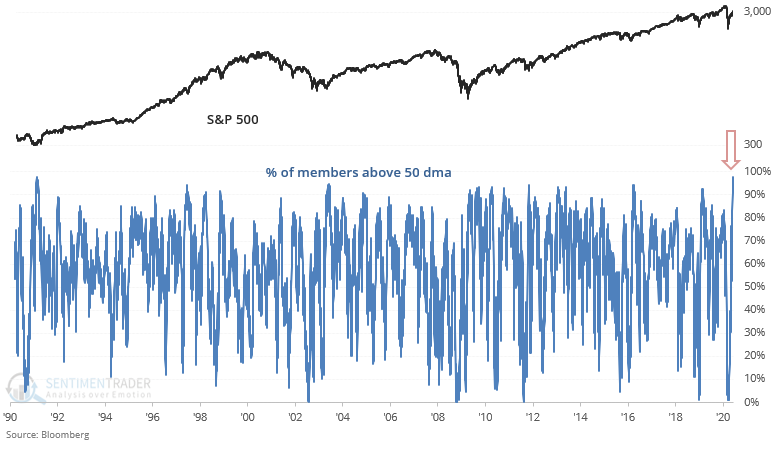

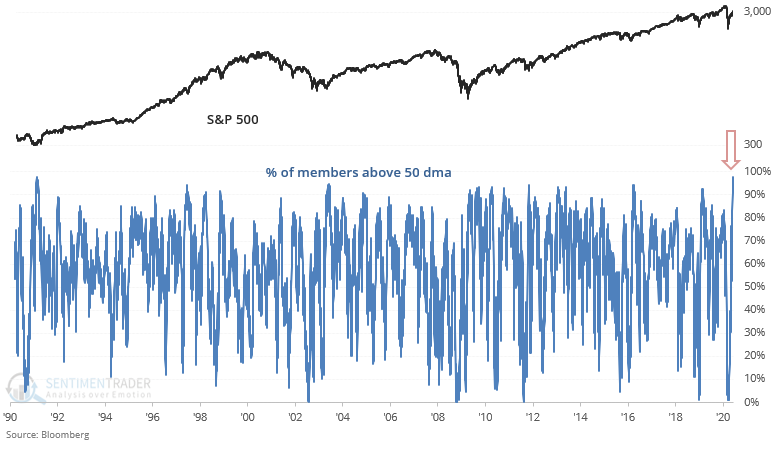

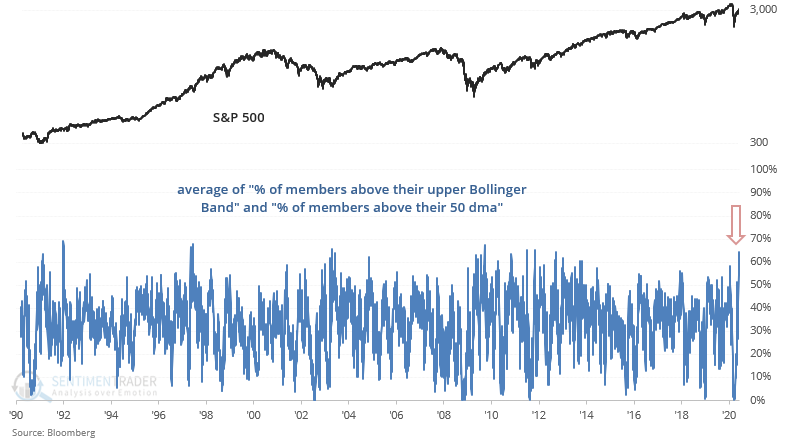

Various indices around the world are approaching record breadth readings. For example, 97% of the S&P 500's members are above their 50 dma. This has only been matched by 2 other days from 1990-present:

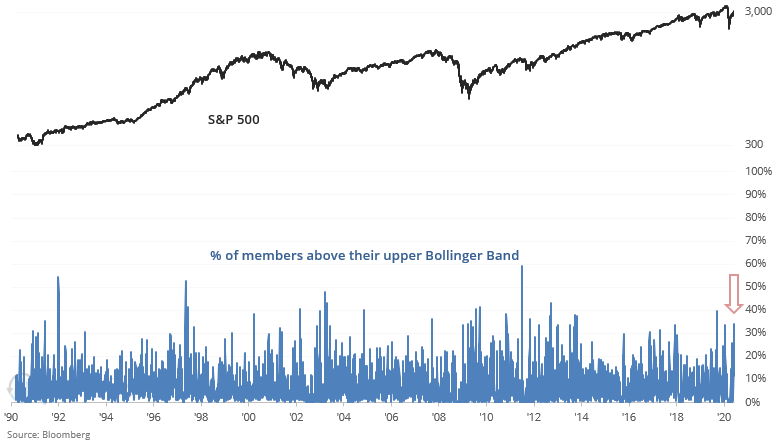

Recently, 34% of the S&P's members were above their upper Bollinger Bands:

As a result, the average of these 2 breadth readings is at its highest level in years:

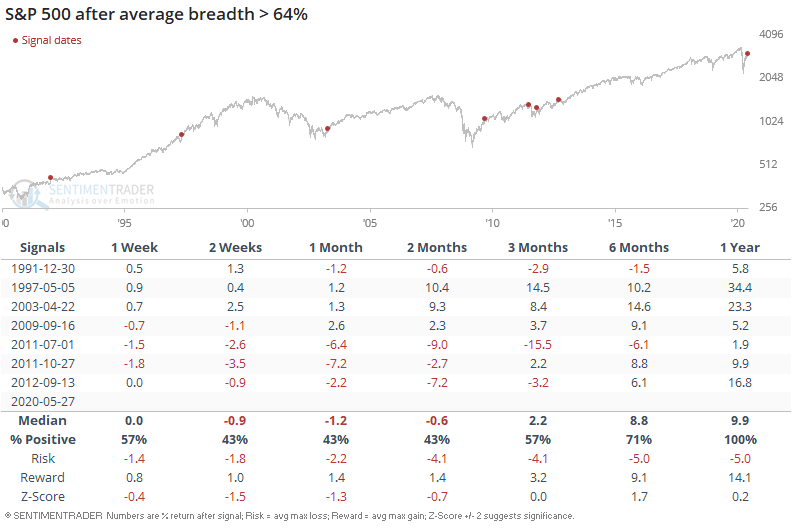

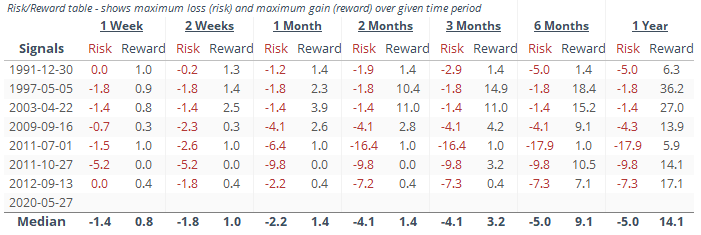

When average breadth was this high, the S&P's returns over the next 1-3 months were more bearish than random:

This has been particularly true over the past 10 years, when the 3 historical cases led to sizable pullbacks of 7-16% over the next 2 months:

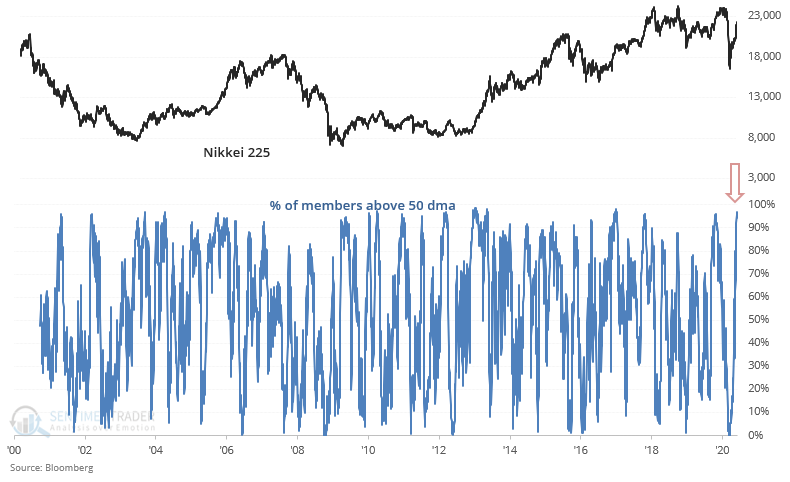

Overseas, 95% of the Nikkei 225's members are above their 50 dma:

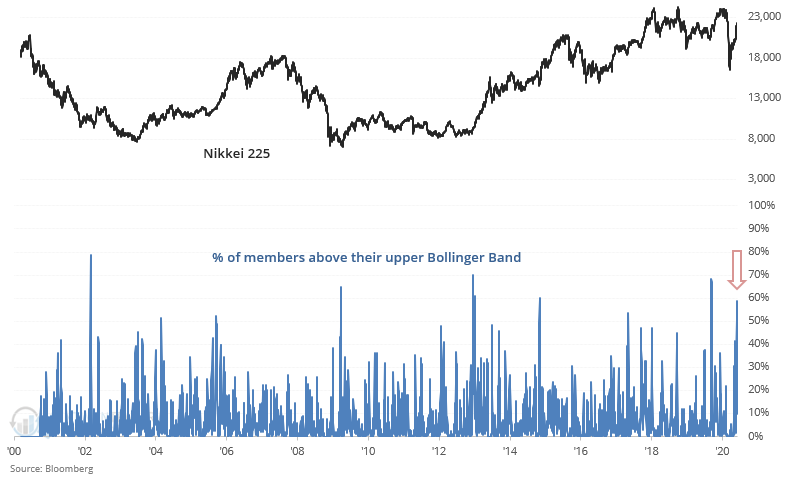

And recently 58% of the Nikkei's members were above their upper Bollinger Bands:

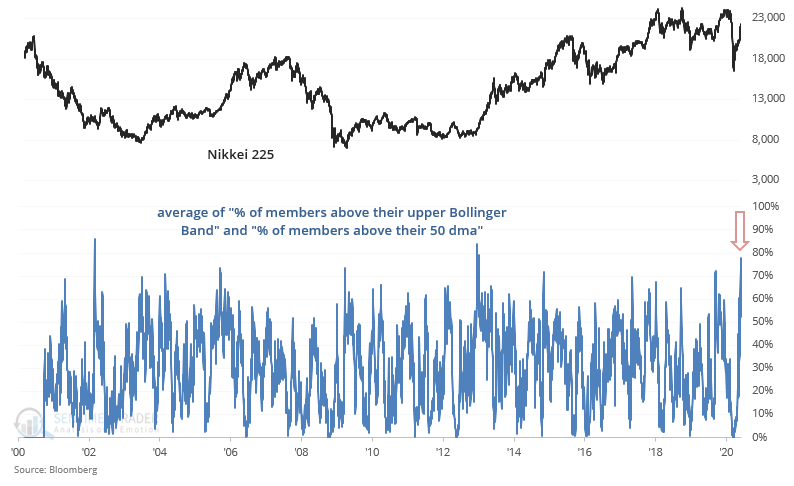

As a result, the average of these 2 breadth readings is at its highest level in years:

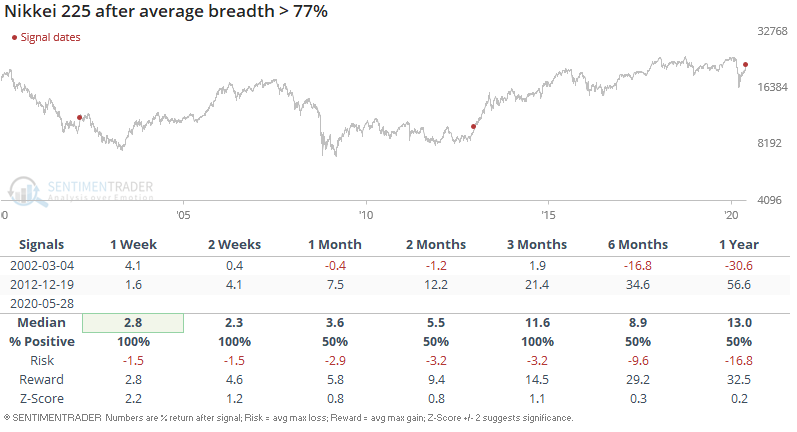

There are only 2 other cases with such extreme readings. One led to another leg down in the Nikkei's bear market, whereas the 2nd historical case did not lead to a pullback at all:

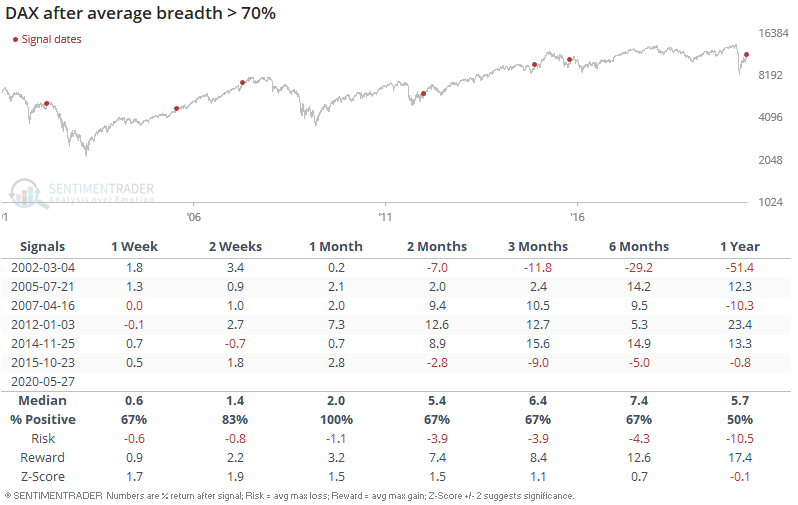

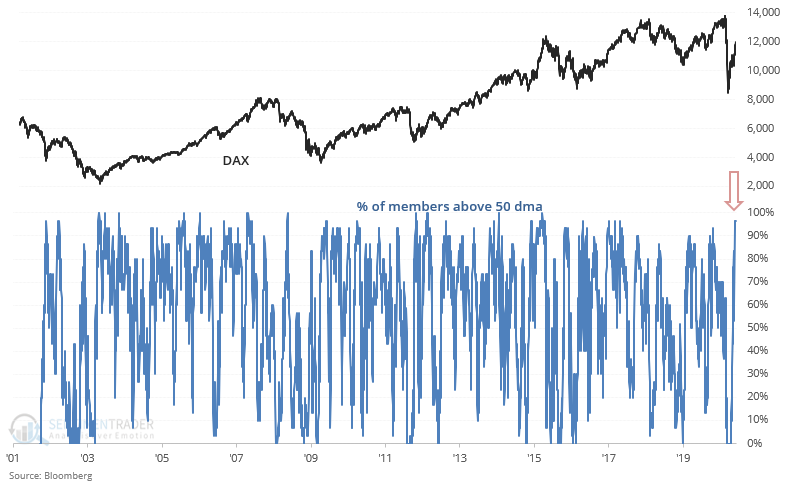

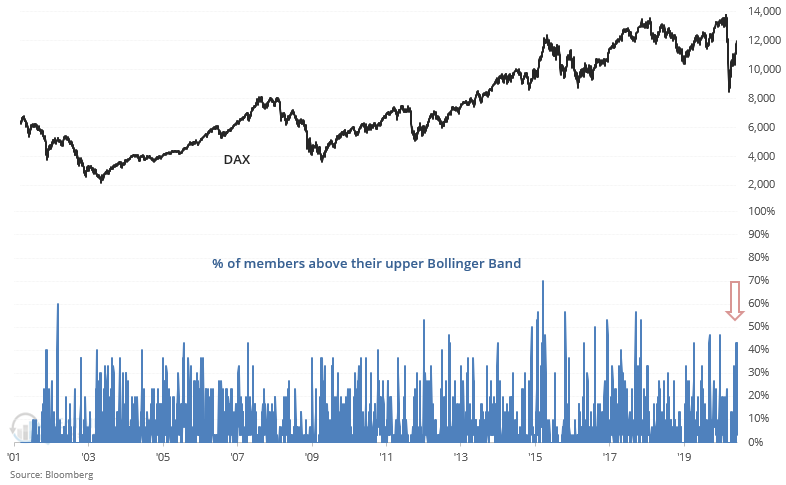

In Europe, 96% of the DAX's members are above their 50 dma:

And 43% of the DAX's members were above their upper Bollinger Bands:

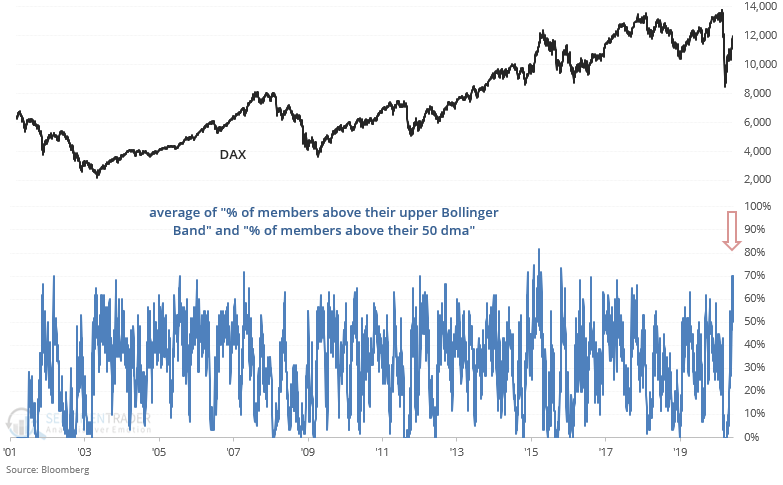

As a result, the average of these 2 breadth readings is at its highest level in nearly half a decade:

When average breadth became this extreme, it wasn't a consistently bearish factor for the DAX on any time frame: