Ramp up in Chinese equities

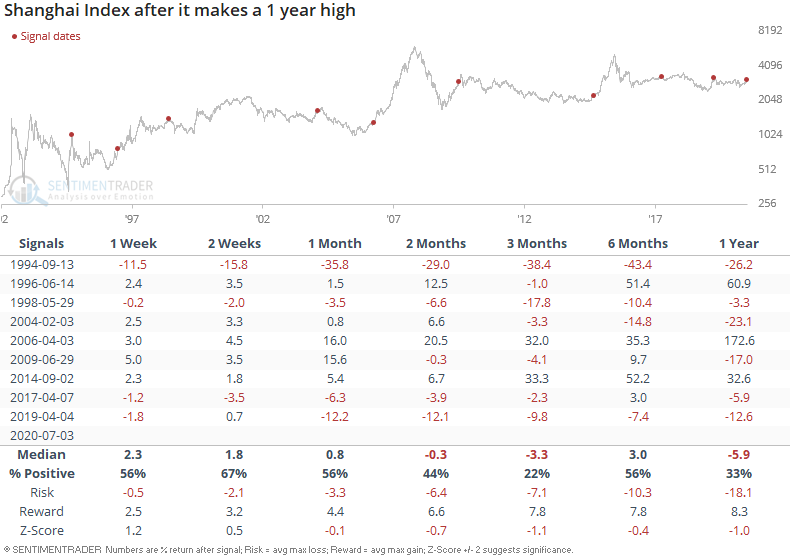

For one reason or another (politics?), Chinese equities surged over the past few days to the highest level in over a year. The Shanghai Composite Index had been trending higher over the past few weeks and jumped higher over the past few days.

Such breakouts are typically seen as a bullish sign for equities, or at least that's what standard technical analysis teaches. But this wasn't usually the case for the Shanghai Composite Index. When this Index made a 1 year high, its returns over the next 3 months were remarkably weak.

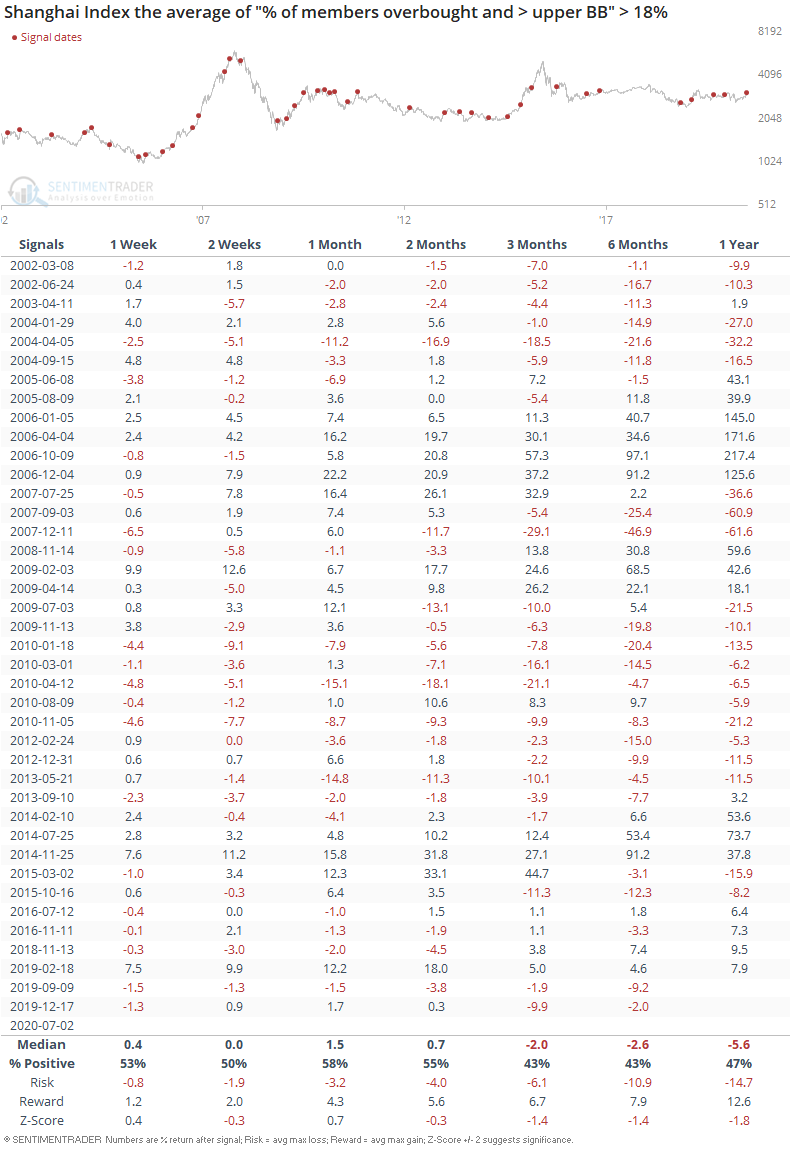

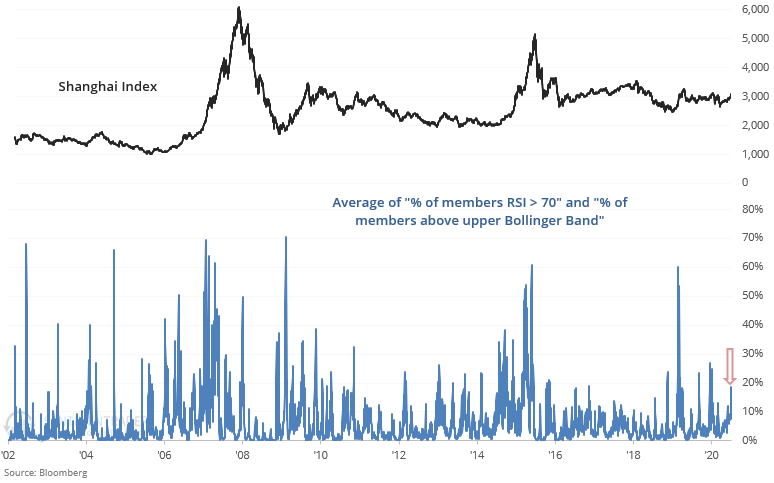

The surge in Chinese equities has lifted 2 popular breadth figures:

- % of index members that are overbought (RSI > 70)

- % of index members that are above their upper Bollinger Band

The average of these 2 breadth figures is greater than 18%, a level which we have not seen since before the global stock market crash in March.

Once again, a jump in overbought and overextended stocks wasn't a good sign for Chinese equities. While this was not a very strong bearish factor for Chinese equities, it consistently led to worse than average returns for the Shanghai Composite Index over the next 3+ months.