Pure panic

The biggest risk since the end of February has been that the spread of the virus, and the fear surrounding it, was a true Black Swan for which there were no historical precedents.

We've spent a lot of time since then going over how investors have responded after similar bouts of selling pressure, price crashes, and pessimism, and so far none of those precedents have closely tracked what's happening now.

It's getting worse, with the futures on the verge of triggering the circuit breakers yet again. This didn't happen in 1997, the only other time that the breakers had been triggered.

In the 25 years I've been closely involved with markets, there is only one time that even remotely compares to the sentiment we're seeing now, and that's in the aftermath of 9/11. It is nothing like 2008, other than some passing resemblance to the level of selling pressure and overnight trading activity. When it comes to existential crises in specific industries, jingoism, extrapolations, self-reflection, price gouging - only the fears of terrorism following the 2001 tragedy compares to what we're seeing today.

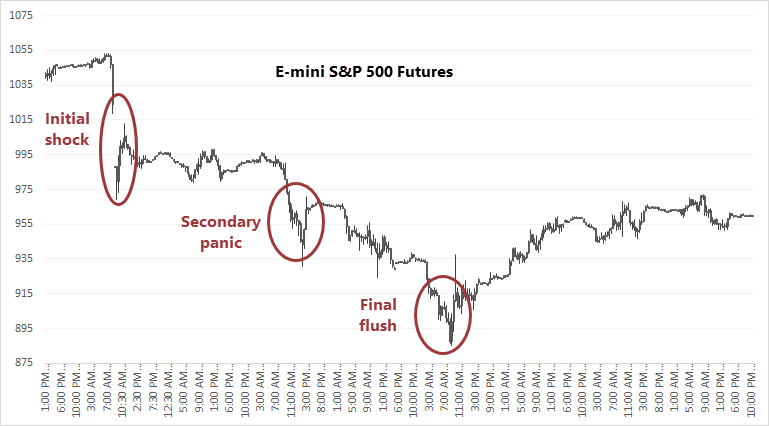

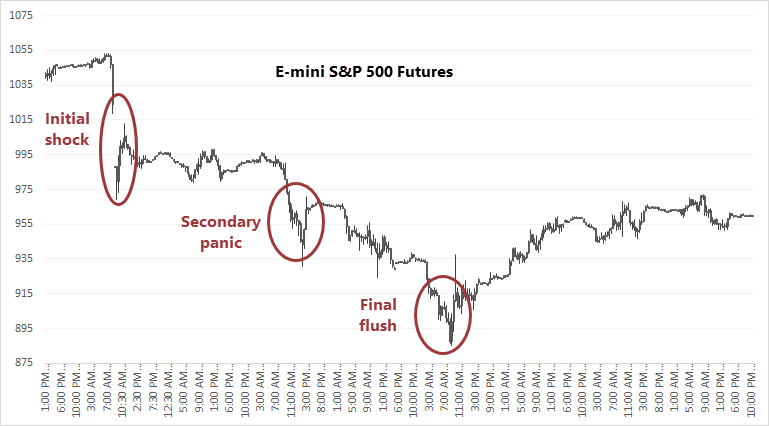

Here is how the futures market traded after markets reopened.

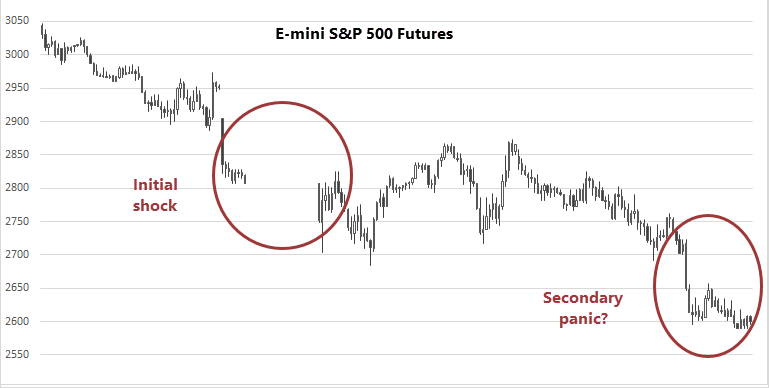

If there is any comparison, then we're in the 2nd phase of recognition now.

Headlines and market commentary around that time are very similar.

- Job cuts, profit warnings, and international instability all rose in the days since hijacked plans crashed into targets in New York and Washington...

- It wasn't supposed to be this way. Monday began with calls for a patriotic rally. It also started with the year's eighth interest rate cut by the Federal Reserve.

- Trading volume set records. In their warnings, some companies blamed the effect of the attacks, which shuttered some businesses and could slow spending by recession-wary consumers and executives.

- "Investors are very concerned about the short-term prospects for the economy, and that's why they are selling stocks,"...

- Nearly half of all Americans believe the terrorist attacks will push the U.S. into recession, according to a survey released Friday by the Conference Board. Slightly more than 30 percent said they or a member of their household would postpone or cancel plans to travel by airplane because of the tragedy. Still, many analysts are optimistic, encouraged by the Federal Reserve's aggressive rate cuts and the high level of investor fear which often signals the worst losses are near an end.

For all the fear and uncertainty in that article and others like it at the time, they were published on the date circled in the chart below.

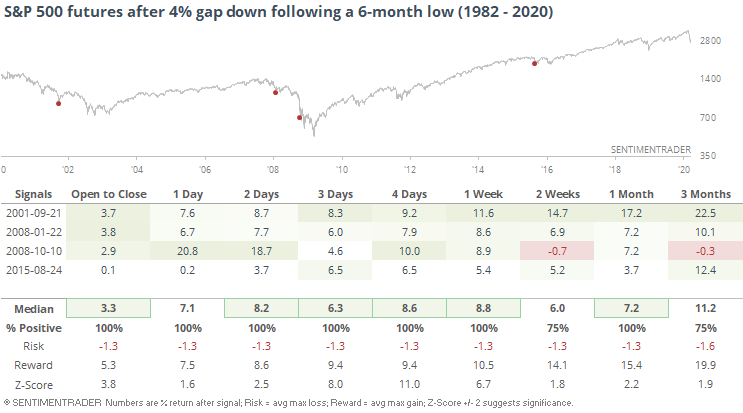

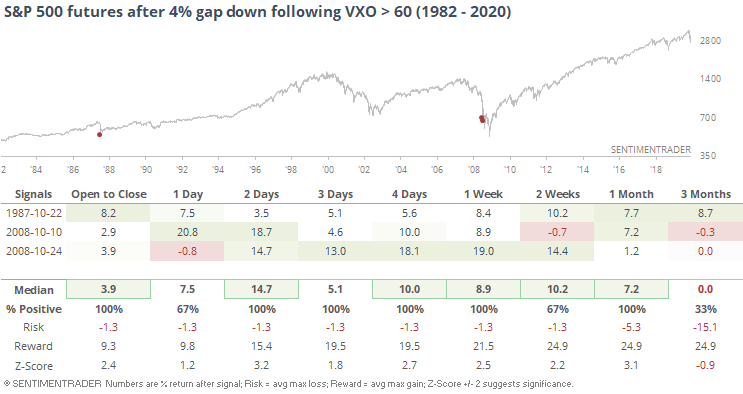

Regardless of all the talk and levels of panic, stocks are still in the grips of that secondary about of selling pressure. At the moment, futures are indicated to gap down more than 4%. For what it's worth, there have only been a few times futures lost this much at the open when already sitting at a 6-month low the session before.

Similarly, this would mark one of the largest-ever gaps down after a day when fear had already been rampant the day before.

As we saw on Monday, historical comparisons only go so far. That was the only session in the history of the futures when they'd gapped down that much and failed to close above the open. We should be seeing an increasing number of rumors about underlying financial plumbing and exposed market players over the course of the day and possibly even into the weekend. By the time we hear about them, they are typically already priced in.

For me personally, I am already fairly exposed due to a heavy overweight in plunging energy stocks. But if we get to a point today where implied volatility truly explodes, with a VIX north of 70 or so, I will almost certainly raise my exposure, as always with a medium-term, multi-week or multi-month outlook. I have absolutely no idea how bad the virus will ultimately get, its impact on the economy, or if there will be a global coordinated fiscal and monetary response. It is just a pure reaction to the level of hysteria that has overtaken markets, and which have triggered a few other times in history, always with a different cause but consistent outcome.