Pinned in the Discouragement phase of a Typical Sentiment Cycle

Key points:

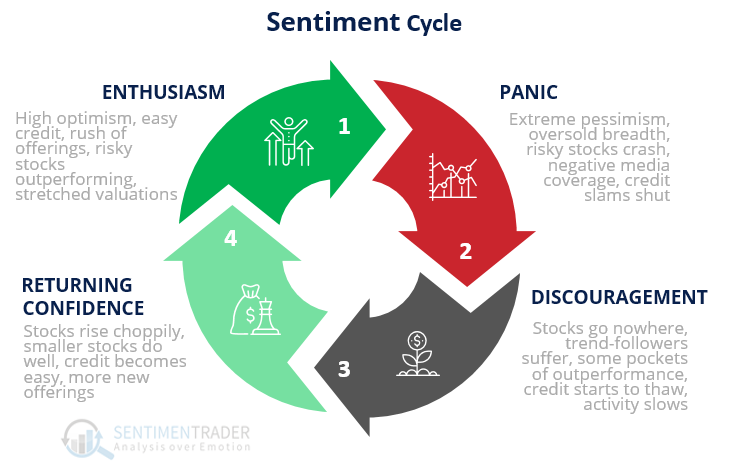

- A correlation of price action to the Typical Sentiment Cycle shows that investors are discouraged

- They've been pinned in this phase for months on end

- When sentiment has been discouraged for this long, stocks typically rallied over the next 6 months

Investors have been discouraged for months, with no sign of returning confidence

The Typical Sentiment Cycle shows that investors have mostly given up and are woefully discouraged.

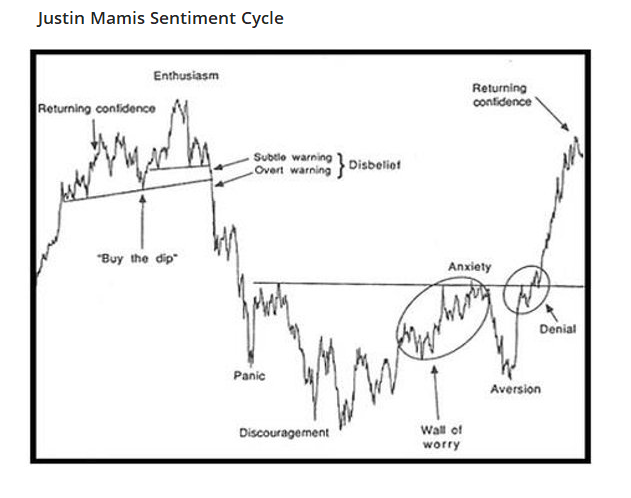

A popular heuristic uses some version of the Cycle popularized by Justin Mamis in his 1999 book, The Nature of Risk. The Mamis chart encompasses the price path of U.S. stocks from roughly May 1990 through March 1991.

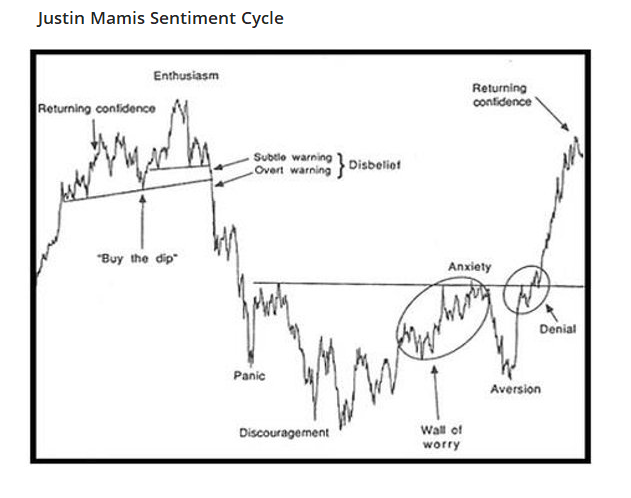

There are essentially 4 major parts to the cycle:

1. Enthusiasm - High optimism, easy credit, a rush of offerings, risky stocks outperforming, stretched valuations

2. Panic - Extreme pessimism, oversold breadth, risky stocks crash, negative media coverage, credit slams shut

3. Discouragement - Stocks go nowhere, trend-followers suffer, some pockets of outperformance, credit starts to thaw, activity slows

4. Returning Confidence - Stocks rise choppily, smaller stocks do well, credit becomes easy, more new offerings

When we looked at this in mid-March, it was apparent that the probability we were in the Panic phase was rising rapidly. Stocks bounced for a few weeks, then rolled over again.

That disappointing price action caused us to move past the Panic phase and into the Discouragement one, where it has been stuck for months. Discouragement is basically the opposite of Returning Confidence, so it's no surprise that the two have been pinned at opposite extremes.

If we add those two correlations together and look over the past 90+ years, we see that the current reading is quite extreme. In the chart, we combine them and average the readings over the past three months.

When it has gotten this discouraging, for this long, stocks rallied over the next six months. Out of the ten signals, only the one from 1932 preceded a negative six-month return. The signal in 1947 gave up its gains during the subsequent six months, but the others preceded sustained gains.

What the research tells us...

No two market cycles are ever exactly alike, and investors never behave in exactly the same way. But human emotion is about the most stable market force out there, and people generally react in a similar way to price action. Based on how they've behaved in recent months, they've reached a point of extreme discouragement. That has been a boon for long-term returns.