Over 6 Months Without Even a 5% Haircut

The bears tried. They failed but seem to be making another run today.

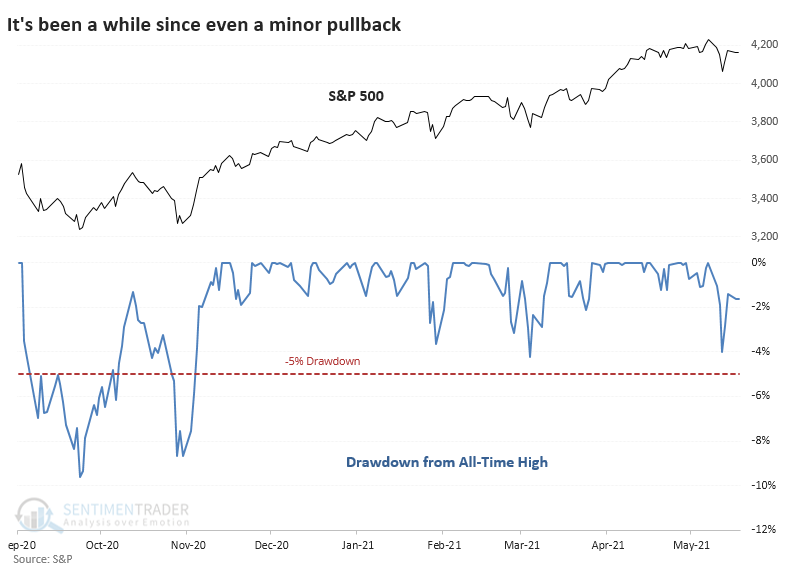

After letting some air out of Tech stocks and some former highfliers, bulls have made a stand and kept the broader market steady. Once again, sellers failed to push the S&P 500 down even 5% from its peak. It got close last week but held above that threshold.

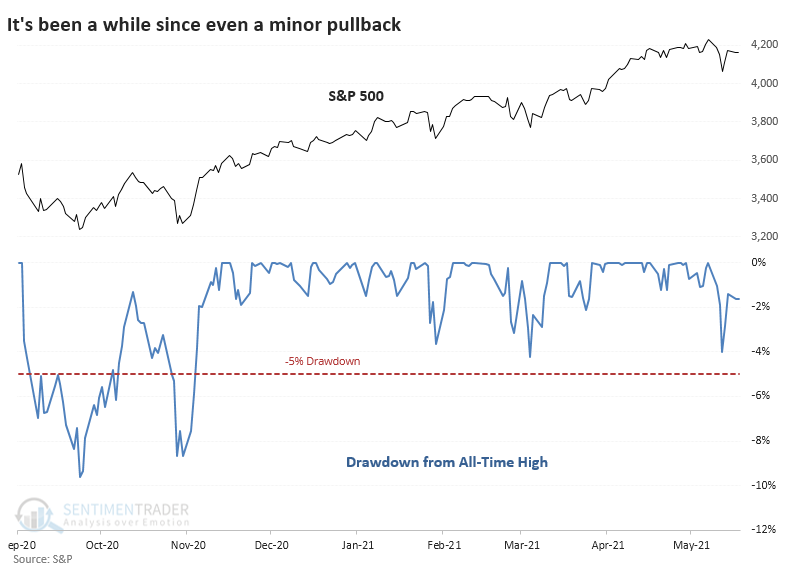

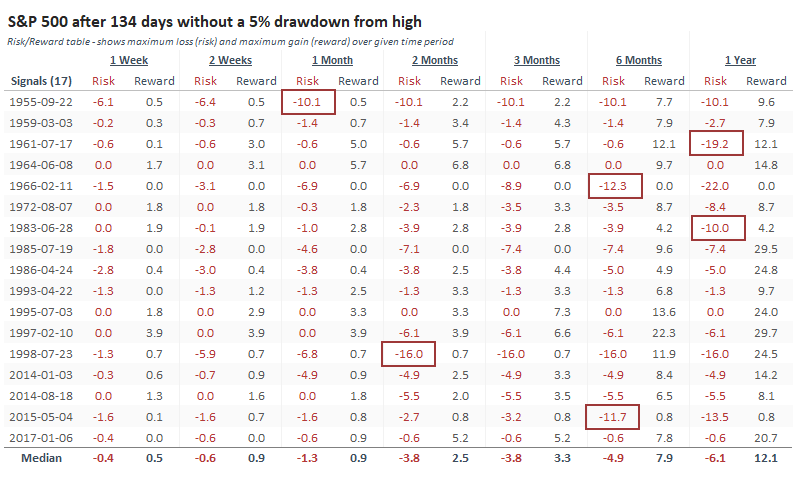

The index has now gone 134 trading days without a 5% pullback. That's the 18th-longest streak since 1928, and it would take only a few more days to push it into 15th place.

MOMENTUM CONTINUED...WITH A PAUSE

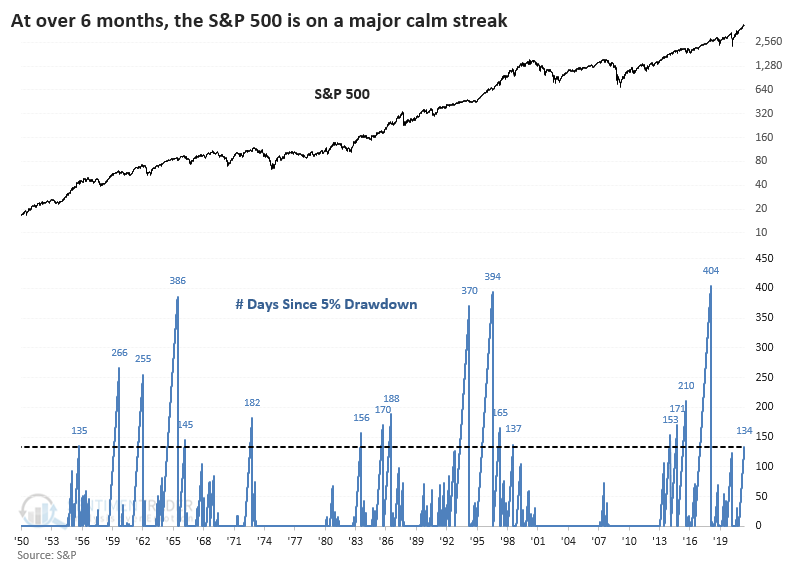

Once it got this extended, the S&P's returns over the next month were poor. Even up to 3 months later, its risk outweighed its reward. But as we've seen with so many momentum studies, when buyers have been so persistent, they didn't give up easily, and there were few large declines to speak of.

The Risk/Reward table highlights those signals when the index fell more than 10% from the signal date. Only 2 out of the 17 signals suffered that fate within the first 3 months. Within the next year, 6 of the 17 suffered at least a 10% drawdown, though only 1 extended to 20%.

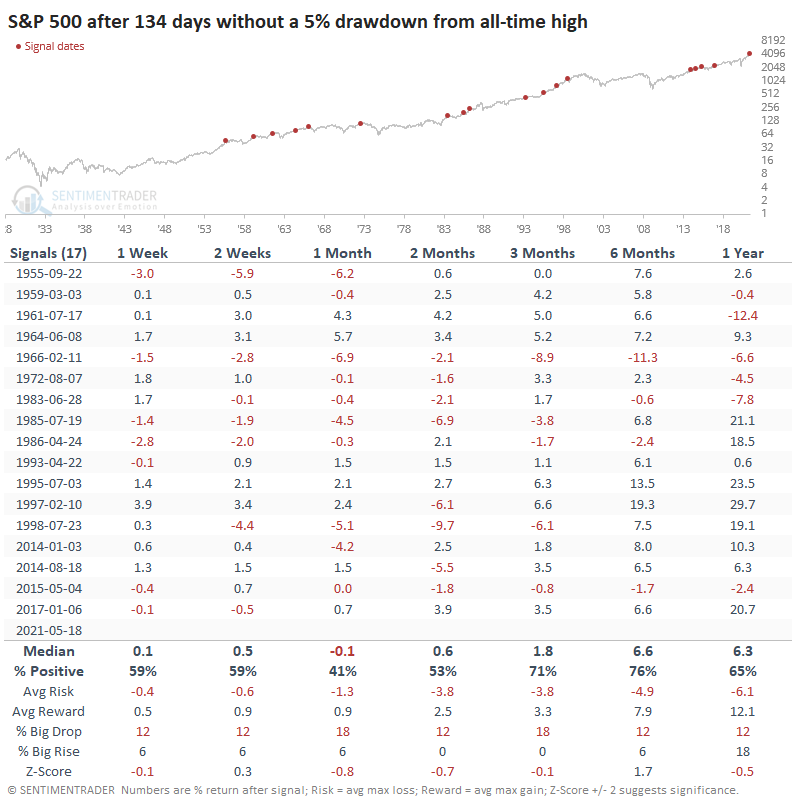

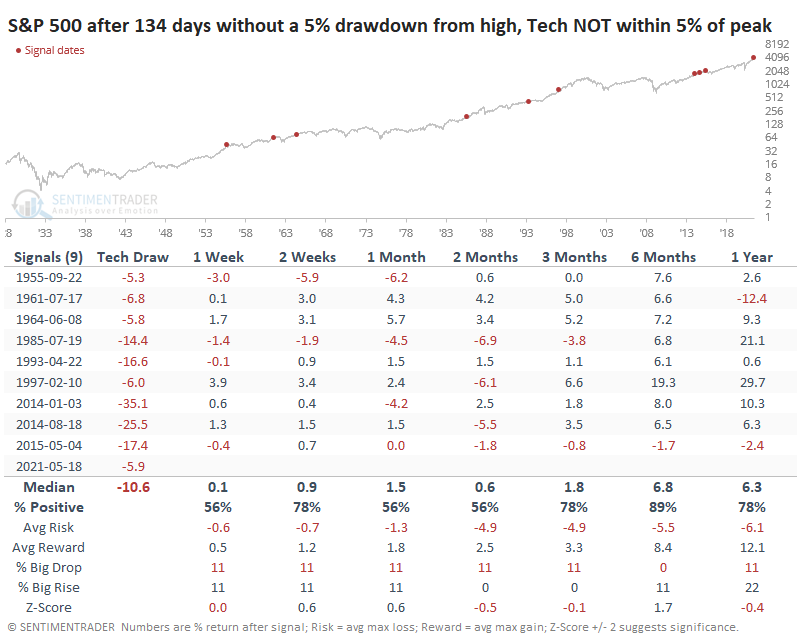

An interesting wrinkle with our current situation is that Technology stocks have already fallen by more than 5% from their peak and remain so.

When Tech was leading the S&P to the downside, it didn't make things worse - if anything, returns were a bit better. It still wasn't a great sign over the medium-term, but over the next 6 months, there was only a single small loss.

We've seen time and again in recent weeks (and months) that momentum like we've witnessed so far in 2021 has a habit of preceding choppy medium-term conditions. Such intense buying interest typically doesn't just dry up for long, however, and 6-12 month returns tend to be above average.