News stories

The media generally loves market volatility because it's far more attention-grabbing when you write headlines about "THE MARKET IS EXTREMELY VIOLENT AND VOLATILE!". The more they help readers hyperventilate, the better they'll do from a business perspective. Even famed internet marketer Tai Lopez is trying to cash in on the stock market's action. (Can you imagine if they wrote headlines titled "Stocks Have Done Nothing Recently"? No one would read those articles).

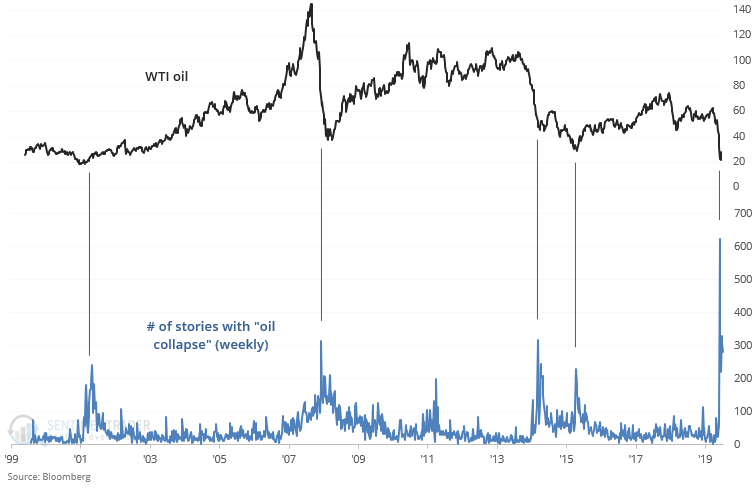

Now that the stock market is neither crashing nor soaring, much of the attention has gone towards oil and coronavirus-related events. The number of media stories mentioning "oil collapse" is still extremely high, and this was before oil fell below zero.

At a quick glance this is bullish for oil:

Such low oil prices have generated record demand for storage tankers, which are being used to store excess crude which can be sold later at higher prices. I live by the beach in an oil-producing country near Dubai, and there are 3 tankers anchored just offshore:

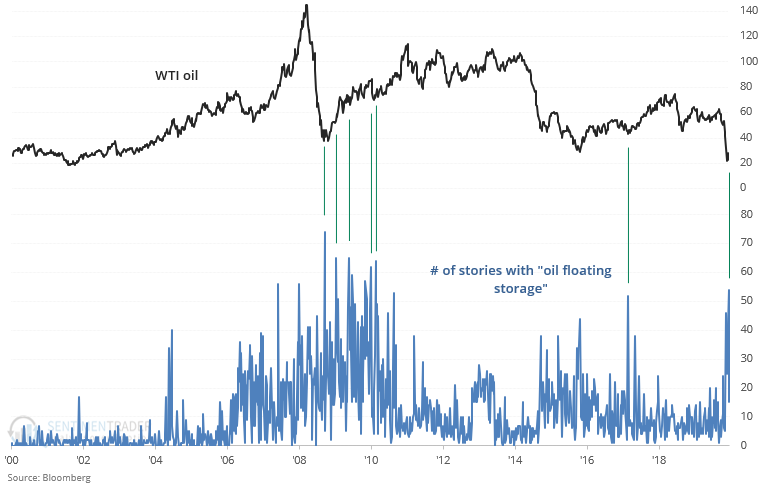

As you may suspect, there have been a lot of media articles mentioning "oil floating storage". Once again, this figure is before oil crashed below zero:

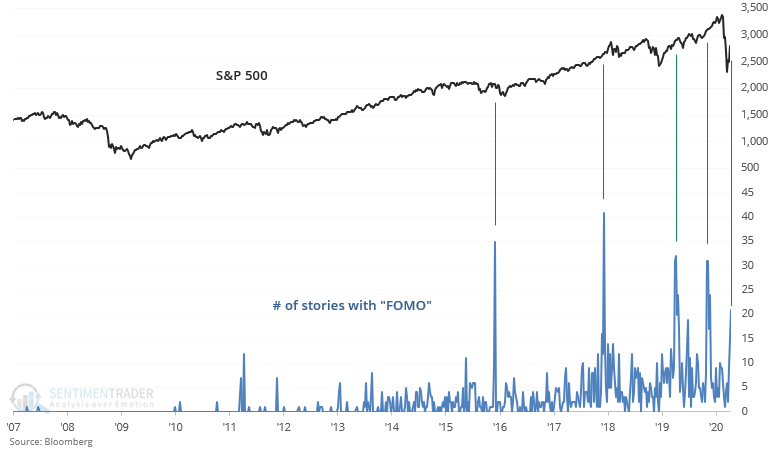

Things are different in stock-land, where stocks have refused to pullback despite a strong rally. The number of media stories mentioning "FOMO" is rising, particularly when it comes to tech darlings. Large historical spikes weren't good for stocks - they usually led to a correction immediately or in the months ahead:

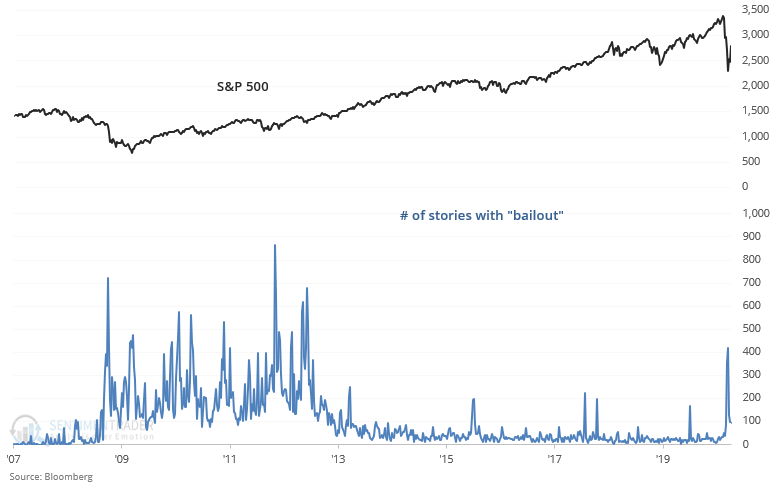

And lastly, the number of media stories mentioning "bailout" spiked as stocks tanked and are now subsiding.