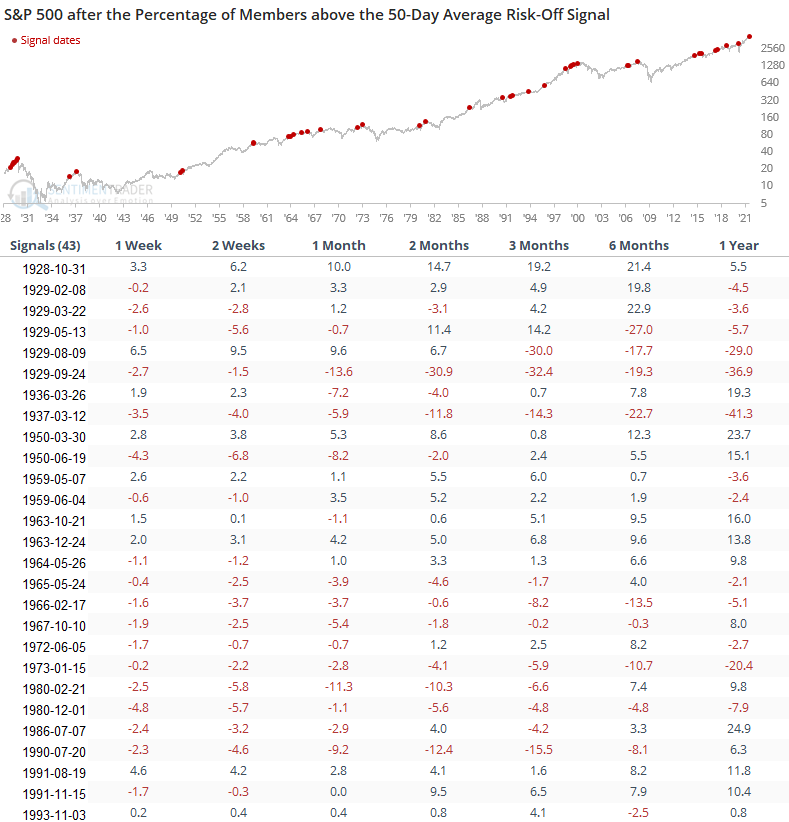

New Risk-Off Signal - Percent Above 50-Day

The percentage of S&P 500 members trading above their respective 50-day average registered a risk-off warning alert at the close of trading on 7/19/21. With the new signal, the Risk-Off Composite Model count as a percentage of components increases to 40%.

For a note with more details on the percentage of members trading above the 50-day average, please click here.

For a note with more details about the Risk-Off Composite Model, please click here.

CURRENT DAY CHART

The percentage of members above the 50-day average had been deteriorating for months. However, when the indicator fell below the threshold level for a risk-off signal, price momentum for the S&P 500 was strong, and the model avoided an alert. With the sell-off in the market over the last few days, the momentum condition kicked in, and a signal triggered at the close of trading on Monday.

HOW THE SIGNALS PERFORMED

Results are weak across all timeframes and the risk/reward profile looks unfavorable in the 1-2 week window.

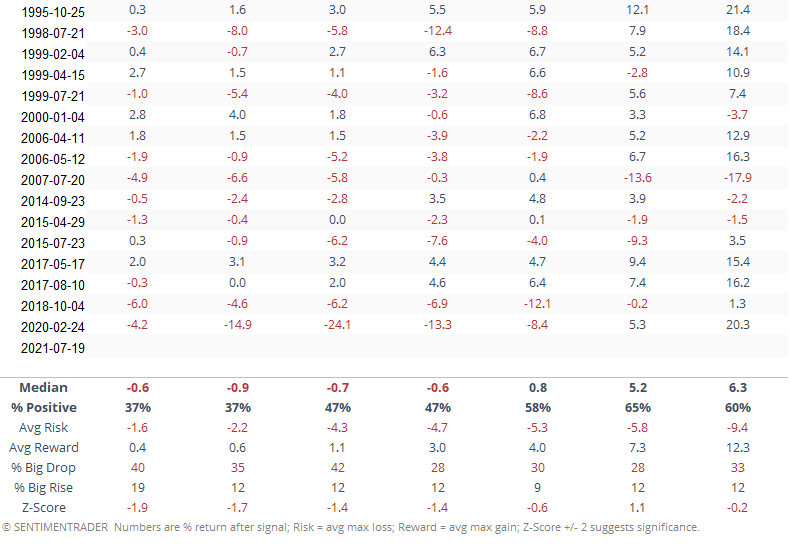

RISK-OFF COMPOSITE MODEL

The signal count as a percentage of components remains below the threshold level of 60% for a composite risk-off warning alert.

Please remember, the risk-off composite model is not a component in the Tactical Composite Trend Model. I use it as a secondary risk management tool for short-term trading.

You can follow the TCTM and the Risk-Off Composite Model on the TCTM "Live Page" on the website. Click here.

While the S&P 500 is down less than 3% from its all-time high, several economically sensitive groups are down significantly more and are now showing short-term oversold conditions. I will be monitoring the beaten-down groups for breadth thrusts and other price reversal signals. In particular, energy and airlines.

I have a general rule that says momentum thrusts overrule all else in the short term.