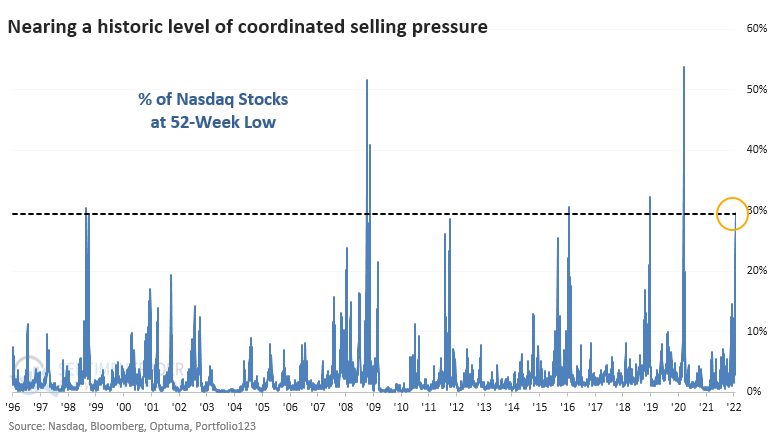

New lows on the Nasdaq near a 25-year record

A jump in new lows on the Nasdaq

Despite Monday's reversal, many more stocks on the Nasdaq exchange touched a 52-week low during the day. Now, more than 30% of stocks on the exchange have plunged to that extreme on the same day. That's the 18th-highest figure since 1996.

Even though this was exceeded before the final plunges in 2008 and 2020, the Nasdaq Composite's forward returns were impressive. Over the next year, the Nasdaq showed a gain all 17 times.

We focused on the historic level of speculative activity in the options market early last year. In all available data, we'd never seen risk-seeking behavior like that. Since then, many of the riskiest securities have been cut in half.

We've also seen the curious behavior of traders quickly turning bearish or trying to hedge on smaller and smaller declines. That was indeed the case last week. Heading into the weekend, there had never been more put options traded on U.S. exchanges. Protective put volume was more than 100% higher than the average of the past 200 days.

| Stat box Over the past 10 days, the SPY fund that tracks S&P 500 stocks has had an average outflow of more than $1 billion per day. According to our Backtest Engine, there have been 93 other days in the past decade with such a large 10-day outflow, after 83 of which the S&P 500 rallied over the next 3 months. |

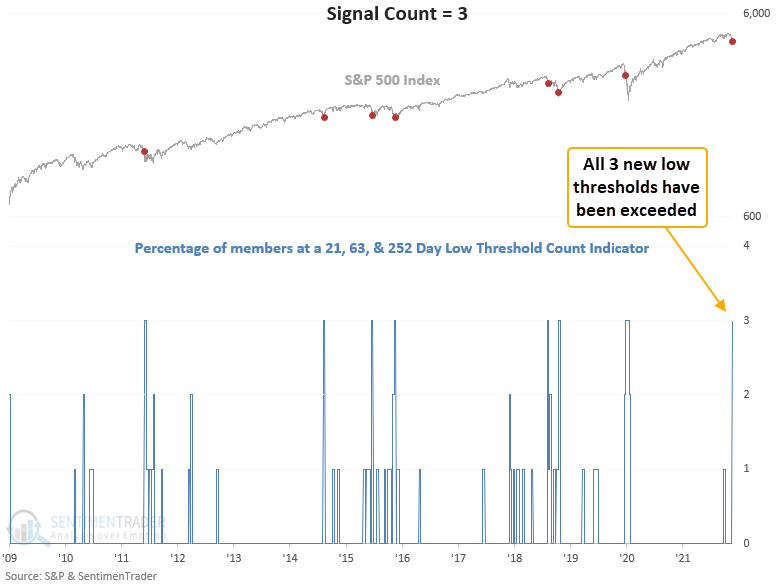

Multi-timeframe lows among S&P 500 stocks

It's not just the Nasdaq that has been seeing a jump in new lows.

Dean assessed the outlook for the S&P 500 when the percentage of 21, 63 & 252-day lows exceed similar threshold levels to Monday's session. New lows must exceed 73%, 38%, and 5%.

This signal has triggered 50 other times over the past 94 years. After the others, S&P 500 future returns were positive across all time frames, with the best risk/reward profiles coming in the 2 & 6-month windows. However, none of the time frames show a risk/reward profile that looks overwhelmingly appealing, especially given the current level of market volatility.