New Feature - Screens

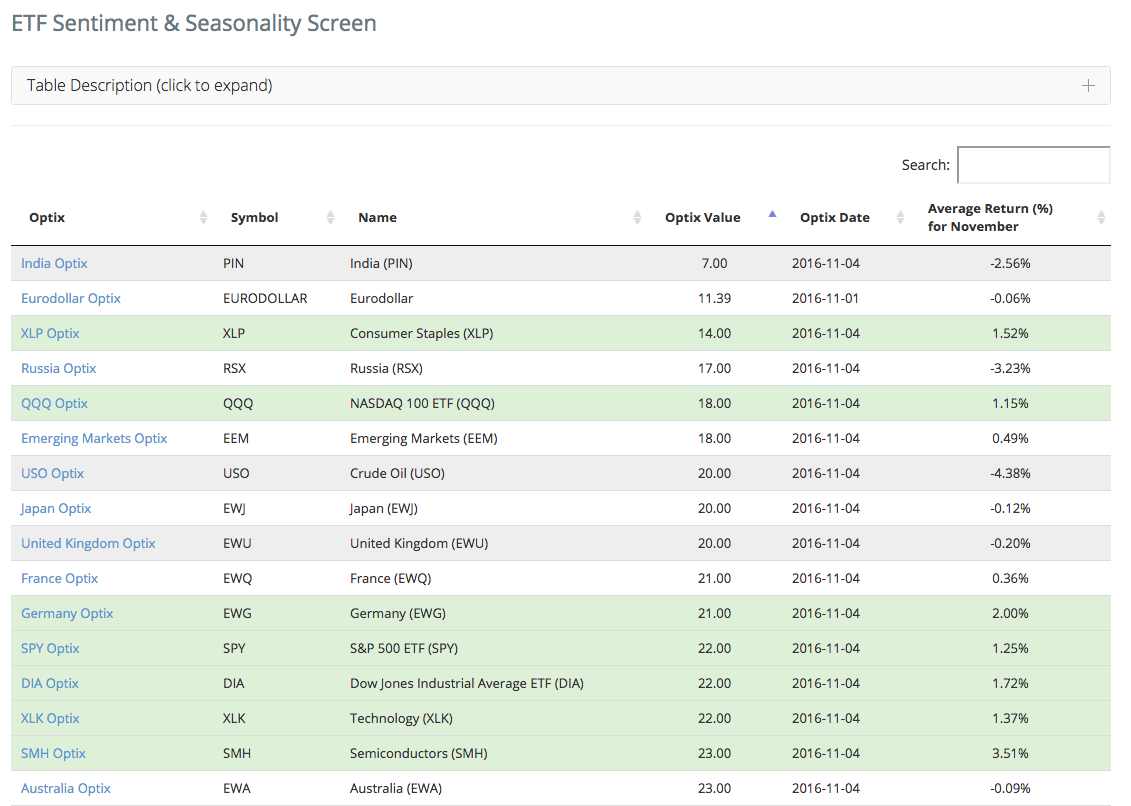

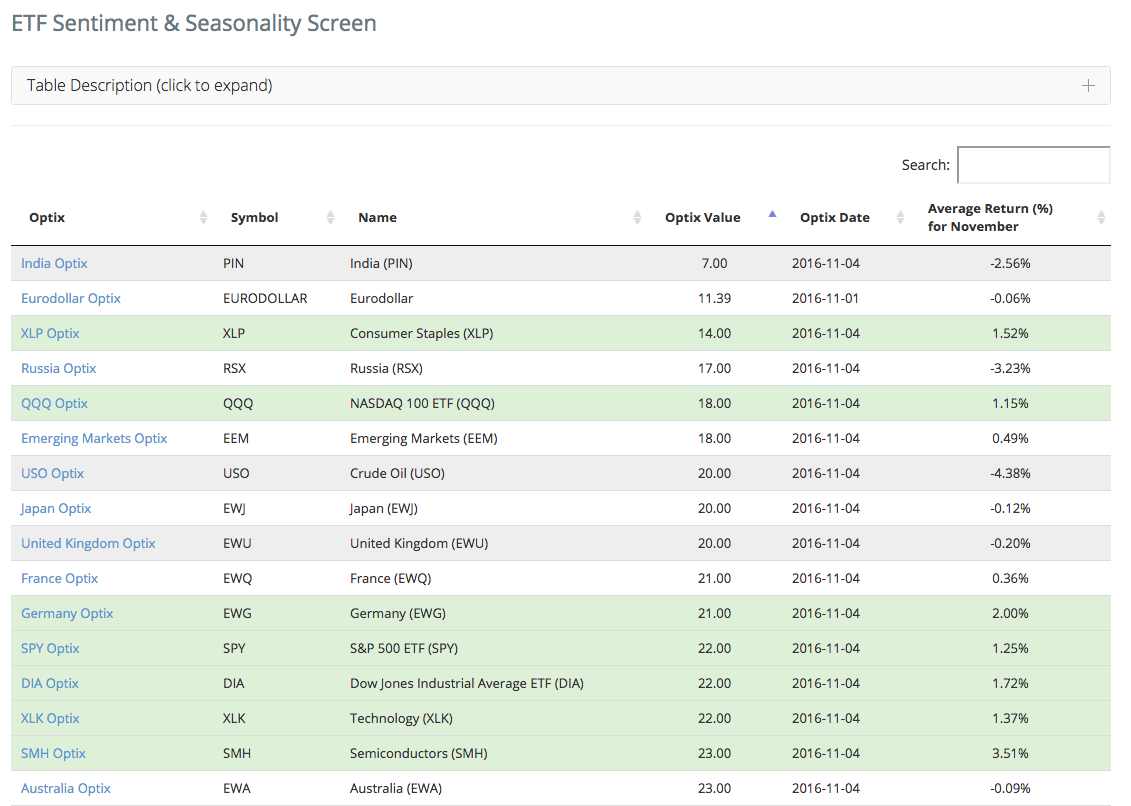

Over the weekend, we released a couple new feature on the site called "Screens". With this feature, users can now begin to screen for setups that have historically led to good returns.

The first screens are combining Sentiment & Seasonality for commodities and ETF's. A form of these screens was provided in the blog post titled "Seasonality And Sentiment Screen".

The screens can be found in their respective areas on the site (under the Commodities and Sector and Country ETF's menus) as well as in the "More" menu (all screens will be added to the More -> Screens menu).

The screens are built to highlight those ETF's and Commodities that have Sentiment readings (via our Optix indicator) and Seasonality returns that fall into specific ranges. For example, an ETF with an Optix value <= 20 and Seasonality returns >= 0.5% would be considered one to watch for a move higher. In these screens, the ETF's and Commodities that meet our criteria are highlighted Green (expectations to move higher) and Red (expectations to move lower).

Note: The description on the Screens page (expand the Table Description navigation menu to see the descriptions) are incorrect for the ETF screen and will be updated soon. The values should be:

- ETF's:

- Seasonality Returns >= 0.5%, Optix <= 20 - Positive expectations

- Seasonality Returns <= -0.5%, Optix <= 80 - Negative expectations

The screens are available at:

Samples of the screens for ETF's and Commodities are provided below.

[caption id="attachment_953" align="aligncenter" width="601"] Figure 1: Sample ETF Screen Nov 7 2016[/caption]

Figure 1: Sample ETF Screen Nov 7 2016[/caption]

[caption id="attachment_952" align="aligncenter" width="600"] Figure 2: Sample Commodities Screen Nov 7 2016[/caption]

Figure 2: Sample Commodities Screen Nov 7 2016[/caption]

As always, remember to keep an eye on the "Whats New" page to keep informed of changed to the site.