Nearing Records for Super Strong Trends

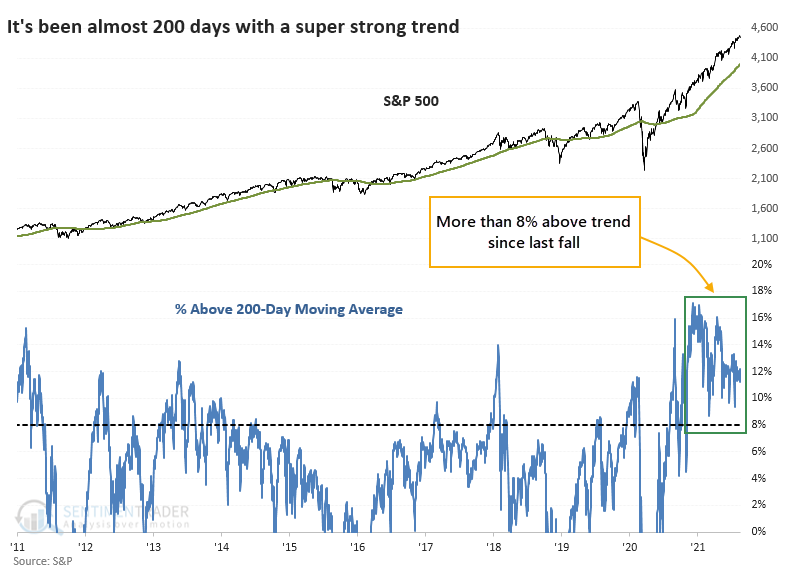

This has been a year for the record books, as we've seen from several different perspectives lately. We can add to that the length of super-strong trends in both the S&P 500 and Dow Industrials.

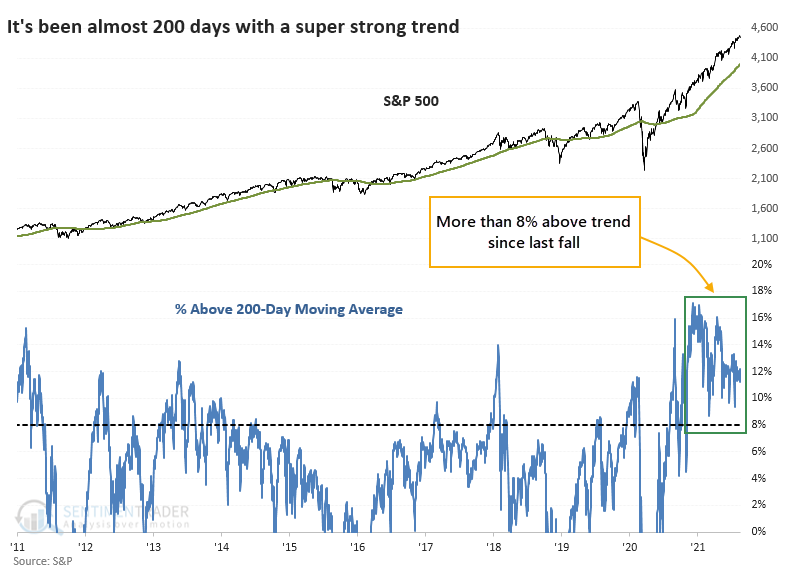

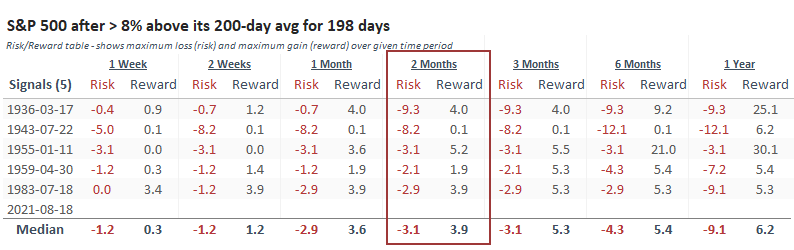

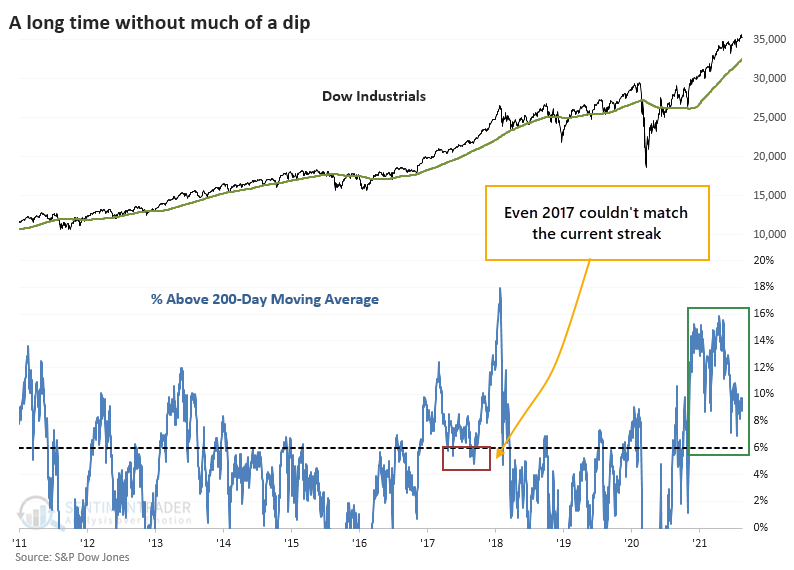

The S&P has been more than 8% above its 200-day moving average since last fall.

At nearly 200 consecutive trading days this far above trend, the current streak ranks among the best in the S&P's history and the longest in 40 years.

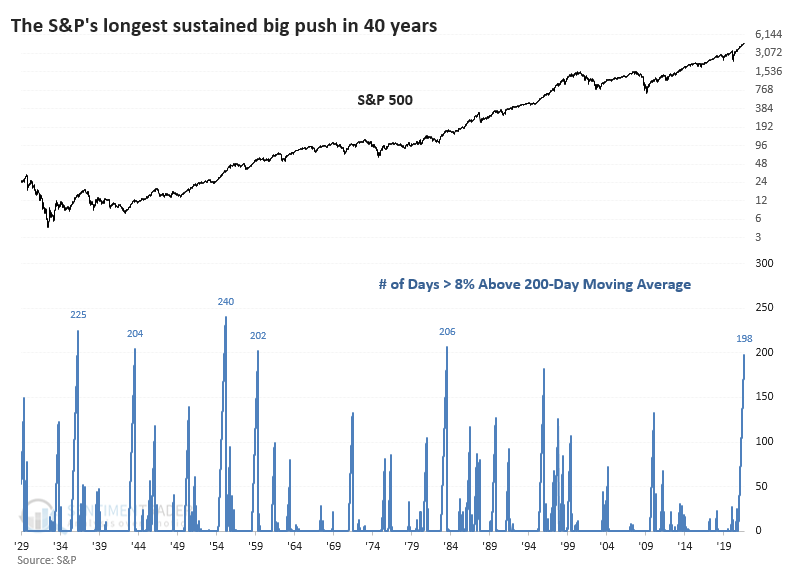

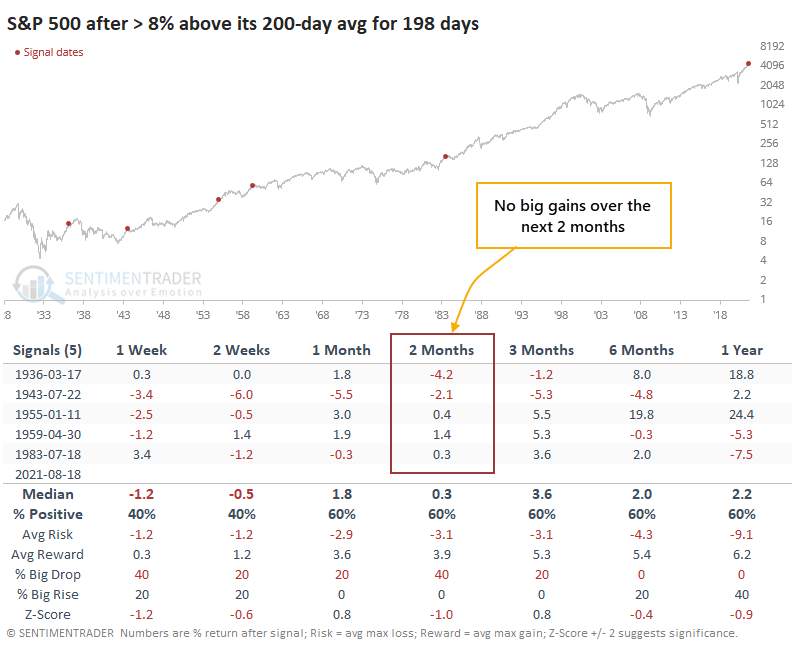

By the time it reached the current length, other super-strong trends saw buyers take a break.

Looking at the Risk/Reward Table, the 2-month time frame was uninspiring. Three of the five signals had a higher risk than reward, and the other two weren't much better.

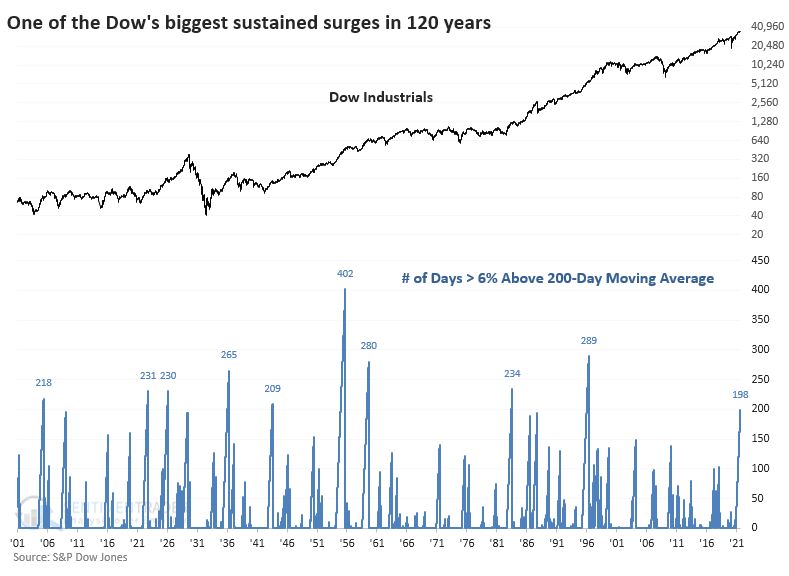

The Dow hasn't been quite as strong, holding "only" 6% above its long-term moving average. Even the momentum market of 2017 couldn't match this.

For the Dow, this ranks among the longest super-strong trends in 120 years.

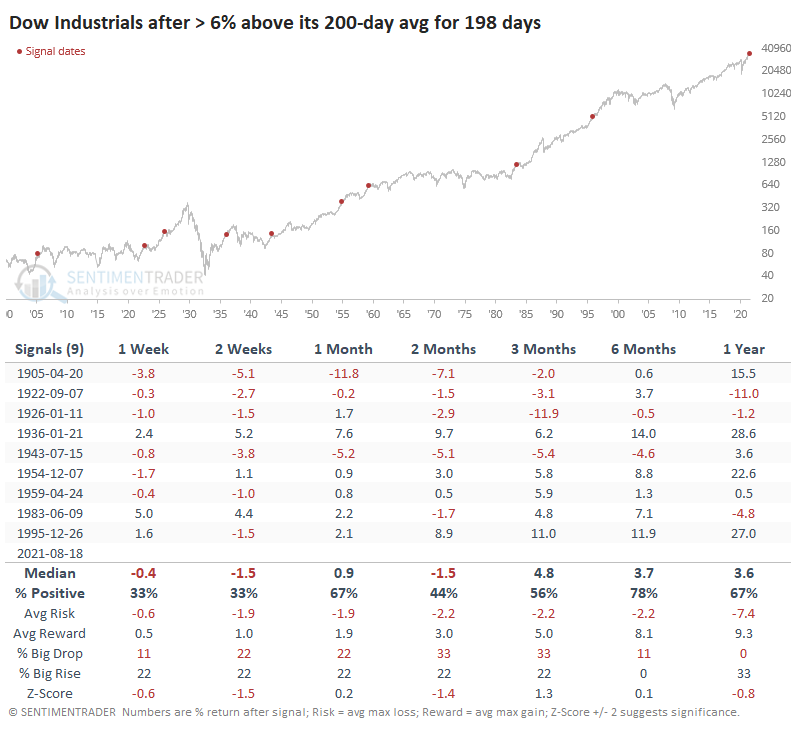

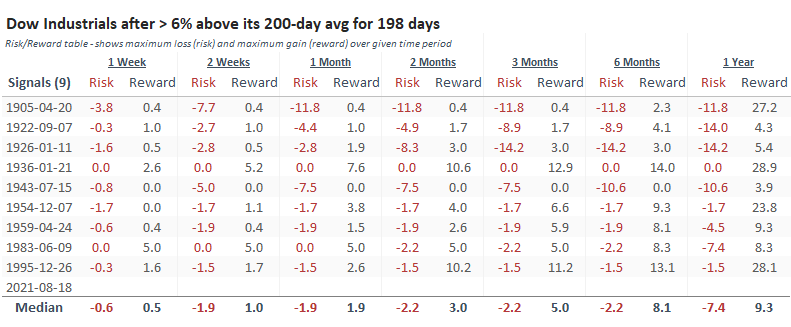

The Dow also tended to struggle with inconsistent returns after such a massive run. Only 3 of the 9 signals ended up leading to runaway bull markets, with the others preceding negative or tepid short- to medium-term returns.

The Risk/Reward Table for the Dow shows that the index had more risk than reward over the next month after 5 of the 9 signals. It is worth noting that since 1950, the Dow's four precedents led to shallow risk up to six months later and at least +8% of upside.

There is no question that momentum in 2021 has been impressive and on the cusp of record-breaking in some respects. Looking for comparisons brings up only small sample sizes, making it tough to rely on for guidance.

Still, the momentum streaks that we've looked at from different perspectives have been somewhat consistent in their message - by the time buyers have persisted to the degree they have now, for as long as they have now, future returns over the coming months were mediocre at best, and often negative. But whatever pullbacks or corrections they preceded tended to be limited, with almost none of them leading to sustained bear markets.