NDX Breaks 50-Day, Breadth Momentum Rolls Over

On a quick administrative note, we've now added priority email support for all Premium members (which you are if you're receiving this). Instead of emailing admin, send requests to premium "at" sentimentrader "dot" com and it will automatically go to the top of our priority list.

Market-wise, there are a couple of signals that look like they're going to trigger today that have some shorter-term repercussions.

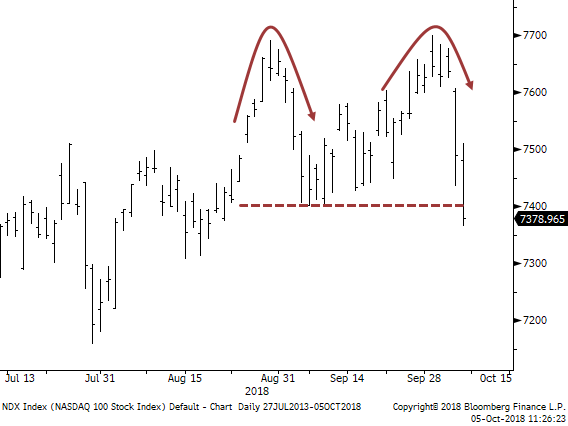

The Nasdaq 100 is putting in what most technicians would suggest is a double-top.

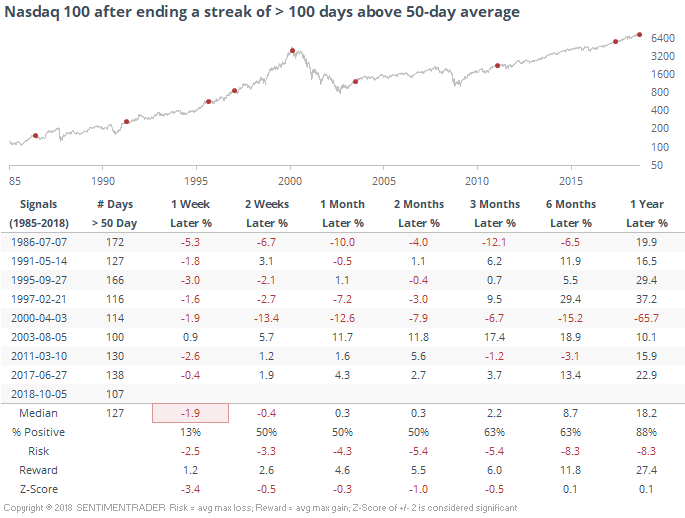

And for the first time in over 100 days, it's on track to close below its 50-day average. That has led to further losses over the next week almost every time.

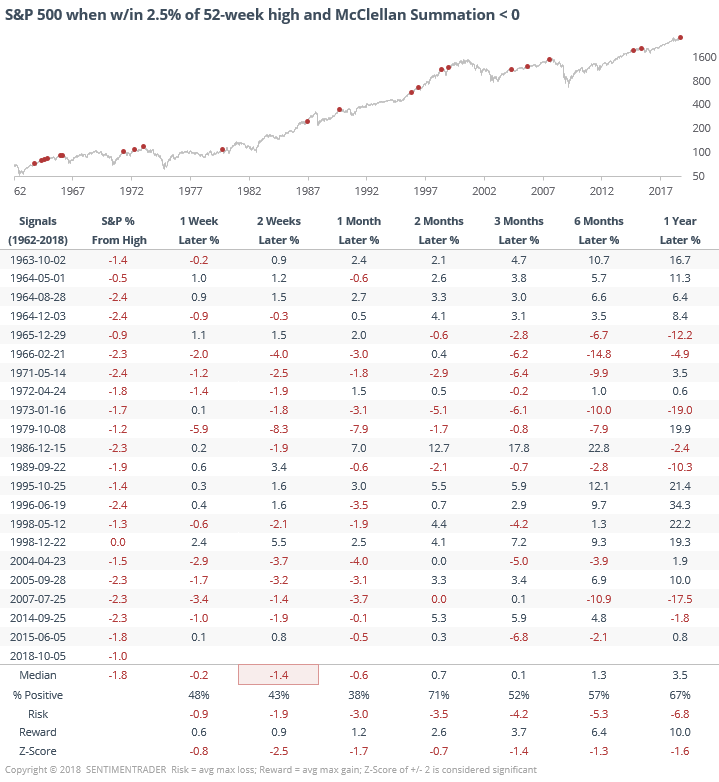

In addition, the McClellan Summation index, a longer-term view of the momentum in underlying market breadth, is on track to close in negative territory for the first time in six months. What's more unusual, though, is the context - it's happening when the S&P is still relatively close to its highs.

Given all the other negatives that have popped up in recent reports, it seems increasingly unlikely that the recent selling is going to lead to an imminent rebound back to the highs.

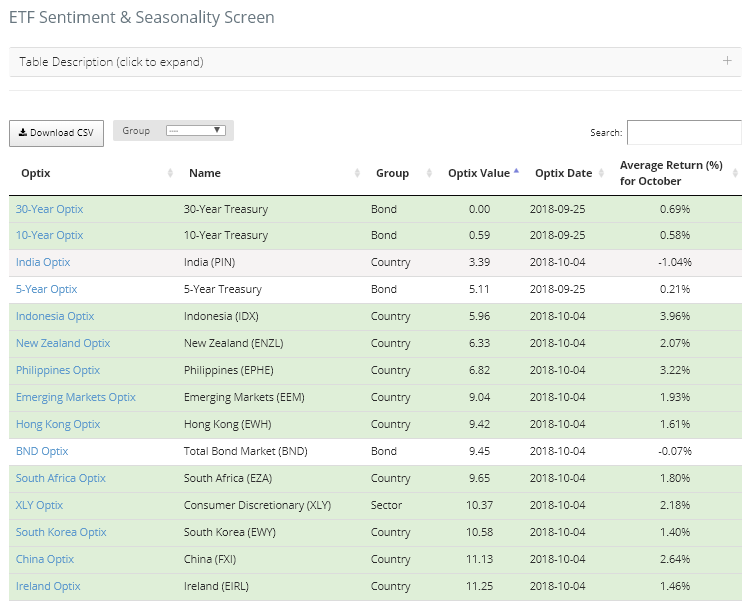

About the biggest positive here is seasonality. After today, the ETF Sentiment & Seasonality screen is going to be even greener than it is now. The suggestion there is that if markets are going to hold at all to their typical seasonal pattern, then short-term weakness over the next 1-2 weeks would lead to positive returns. I'm personally not putting as much weight on that, given all the recent negatives.