Nasdaq's Summation Index turns positive for first time in months

Key points:

- The McClellan Summation Index for the Nasdaq has turned positive

- This ends a streak of several months in negative territory

- Moves above zero have led to strong 1-year forward returns in the Composite

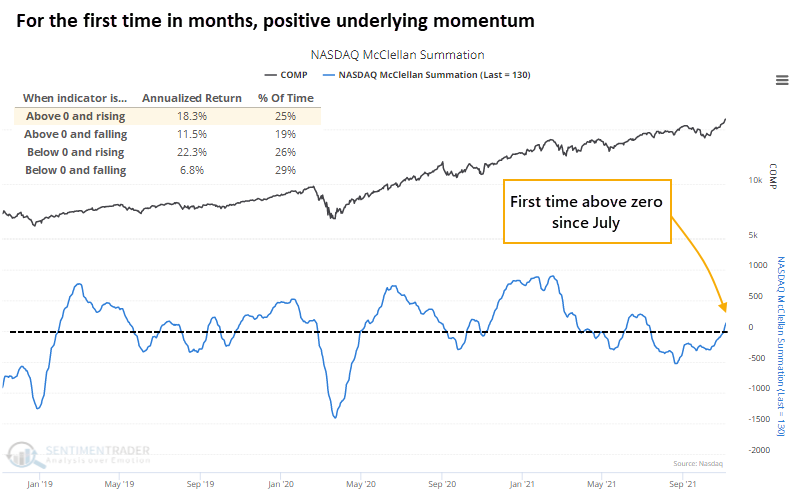

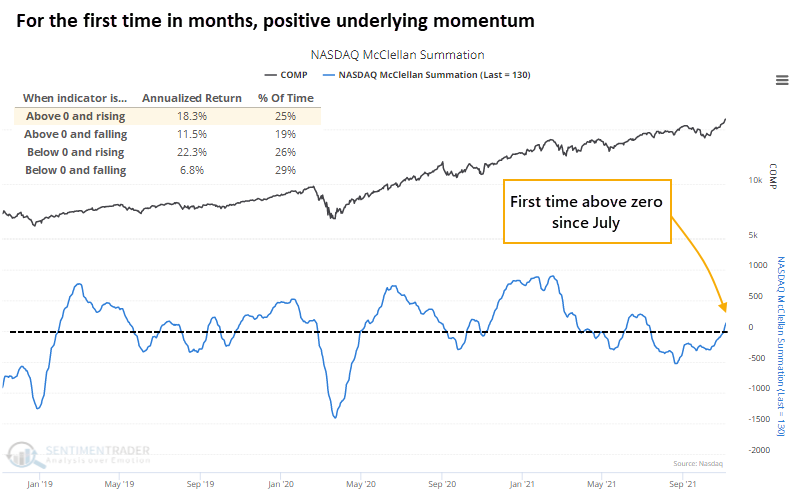

Internal Nasdaq momentum is positive for the first time since July

For the first time in months, the momentum in securities traded on the Nasdaq exchange has turned positive. After a furious rally to start the year, so many stocks were churning that breadth on the Nasdaq couldn't surpass its highs at the start of the year. By mid-summer, it turned outright negative and stayed there until last week.

This has ended a streak of 77 days in negative territory for the Nasdaq McClellan Summation Index, among the longest streaks since the end of the Global Financial Crisis.

Only 6 other periods saw the Nasdaq's Summation Index stay in negative territory for longer. After those streaks ended, the Nasdaq Composite gained an average of nearly 19% at some point within the next year.

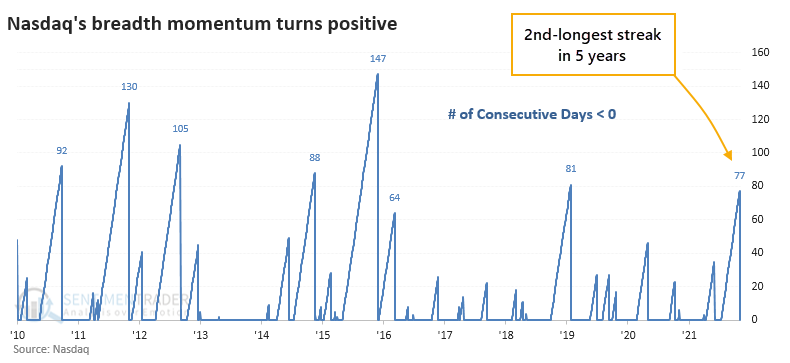

Returning momentum coincides with new highs

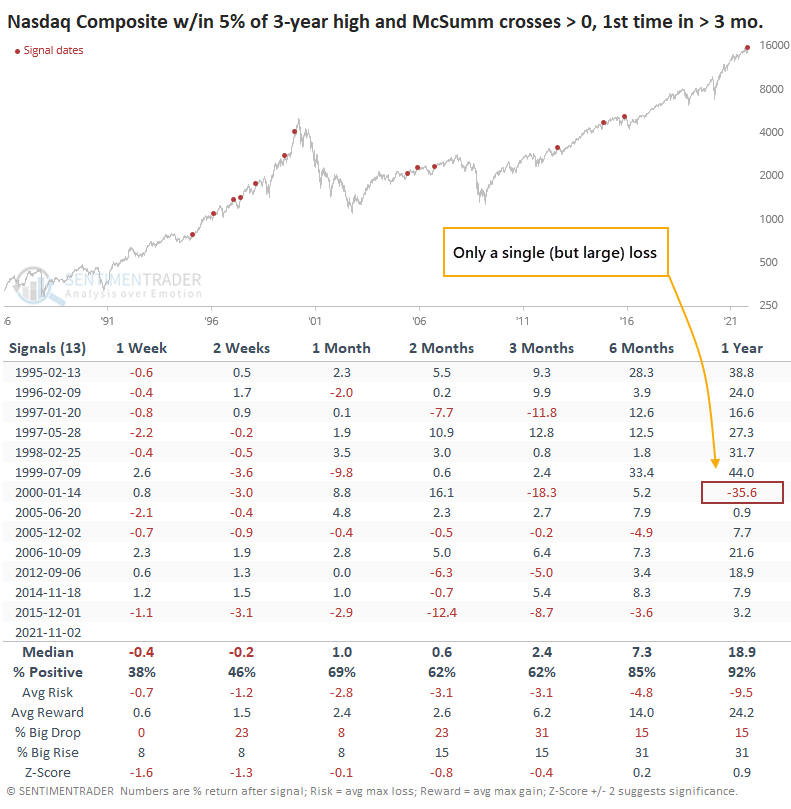

What's especially notable about the current flip to positive momentum is that it triggered as the Nasdaq Composite was on a run to new highs. Since 1986, there have been 8 similar signals.

After those signals, the Nasdaq tended to chop around for a while. All 8 of them saw a negative return in the Composite at some point over the next 2-8 weeks. But all 8 of them also recovered strongly, showing a positive return over the next year each time. The Composite's median return a year later was 21.5%, nearly 2 standard deviations above random.

If we expand the sample size by including times when the Nasdaq was at least out of correction territory, results were similar.

After these signals, the Nasdaq often encountered some short-term pushback as sellers saw a chance to get out after suffering losses. But over the next 6-12 months, positive results were the norm. A year later there was only a single loss, though it was a massive one.

What the research tells us...

When the McClellan Summation Index for any sector or index is in positive territory and rising, it tends to be the best possible scenario for future returns. That's where the Nasdaq is sitting now. While short-term returns can be poor, or inconsistent at best, long-term returns have been very positive after the Summation Index turns positive following months in negative territory.