Monday Midday Color - Cranky Calls, Big Breadth, Can't-Miss Swiss

Here's what's piquing my interest so far today.

Kanye Wouldn't Be Happy

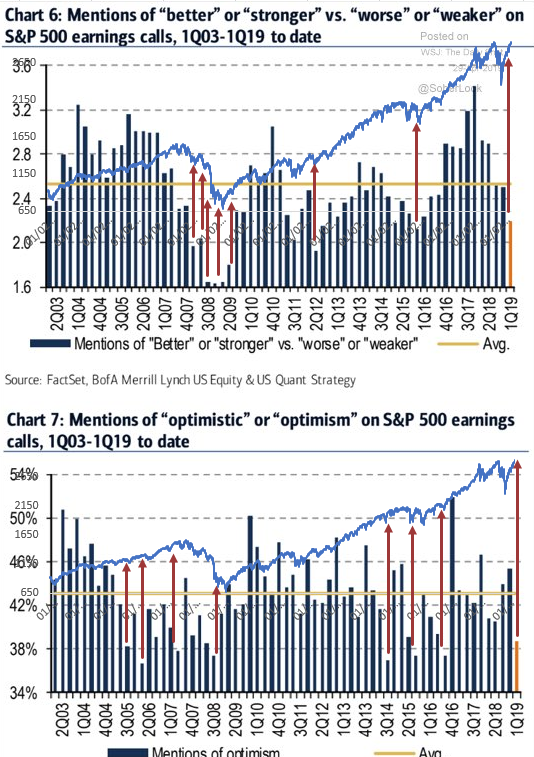

The WSJ, via BofAML, notes that companies aren't mentioning positive keywords much on their earnings calls. They searched through call transcripts over the past 16 years and show that there have been few mentions of optimistic-sounding keywords.

They pretty much pulled them from a Kanye West song.

The implications are ominous, but if we superimpose a chart of the S&P 500 over the keywords, we can see that it has mostly been a contrary indicator. It's awfully messy, but most of the times the call transcripts were this devoid of positivity, stocks rallied.

Breadth Review

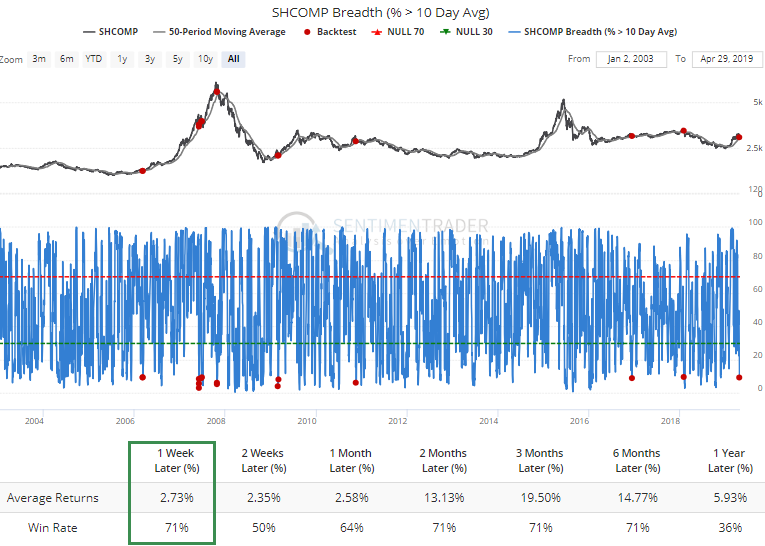

The swift selloff in Chinese shares has caused fewer than 10% of stocks in the Shanghai Composite to trade above their 10-day moving averages. When the index has rallied strongly enough to still be trading above its 50-day average at the time, it has usually rebounded over the next week.

A couple of these triggered soon after major peaks, though.

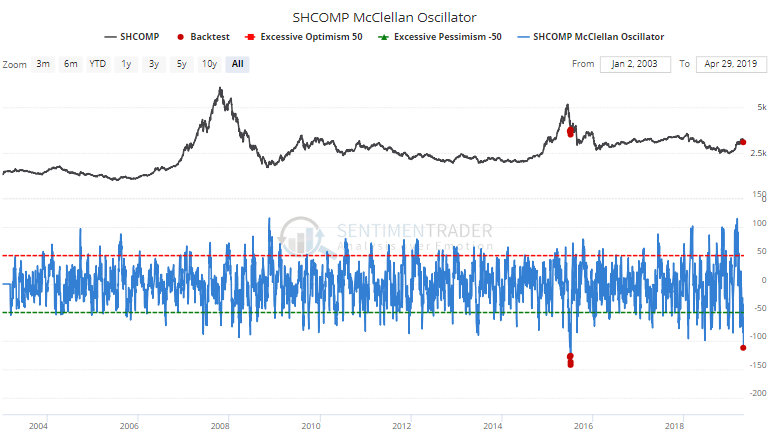

The pressure has been enough that the McClellan Oscillator for the index is at a near-record low.

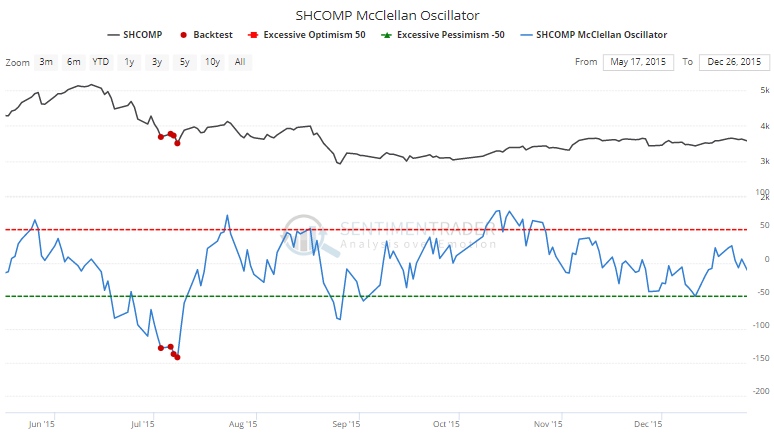

If we zoom in on that other time period from 2015 we can see how the Shanghai reacted. A shorter-term bounce, then trouble.

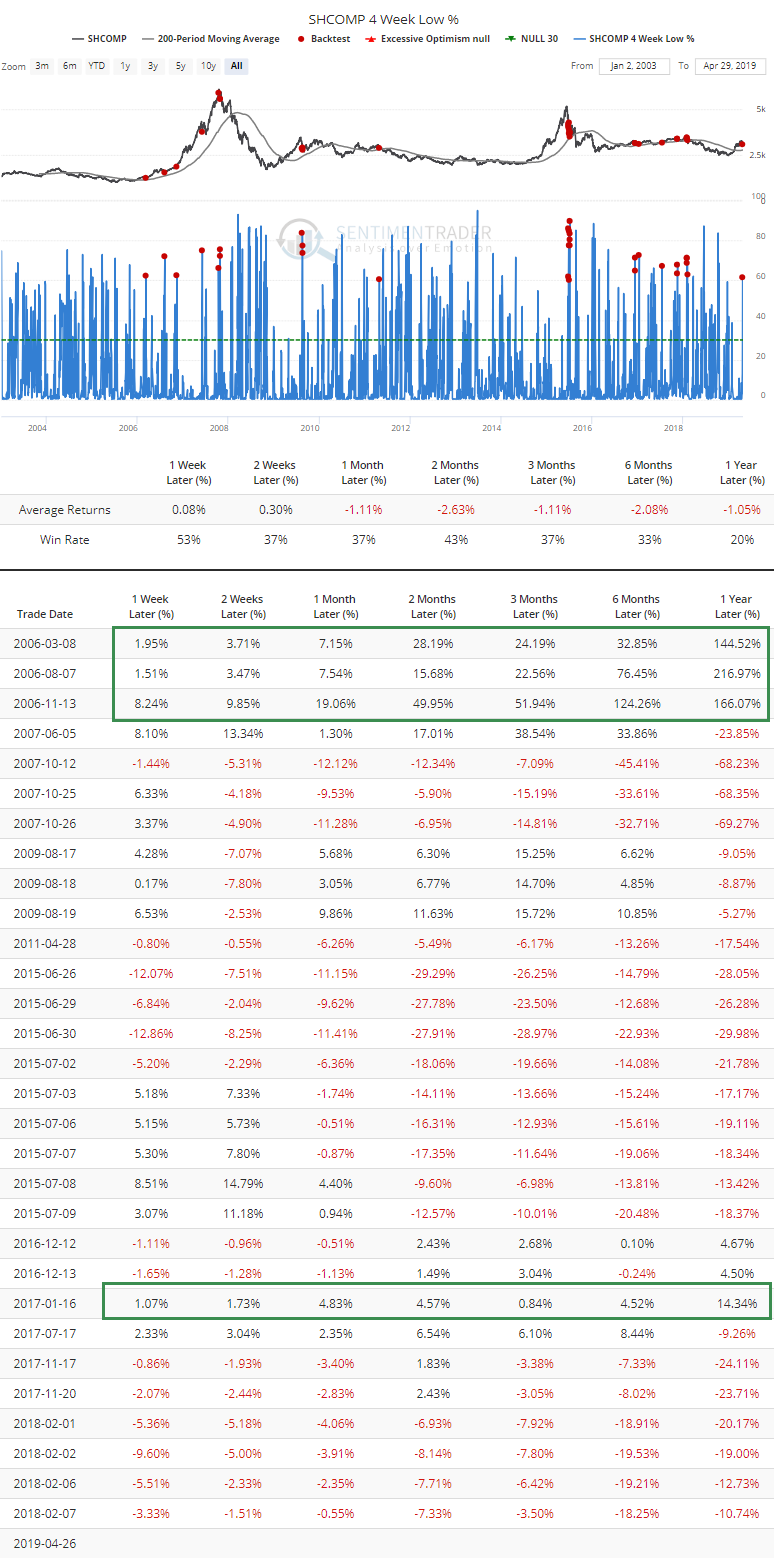

There has also been a surge in stocks on the exchange sliding to their lowest prices in at least a month. When the Shanghai was still in an uptrend at the time (above its 200-day average), we can see how hard it was for the index to regain - and sustain - its momentum.

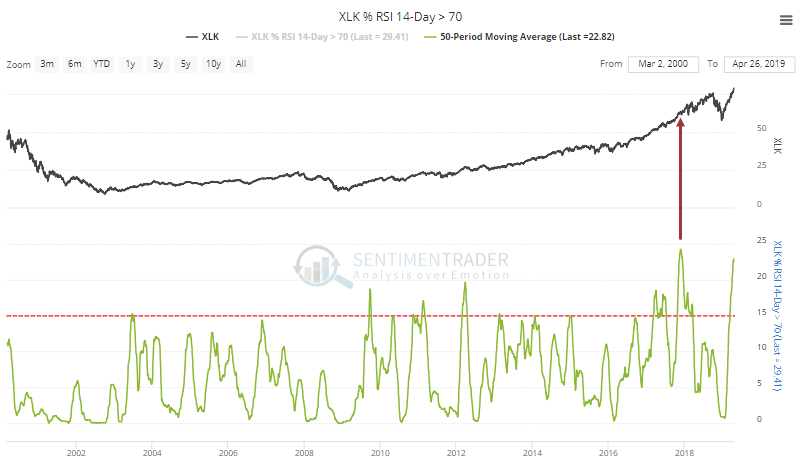

In the U.S. one of the more remarkable developments is that a daily average of nearly 23% of tech stocks have been in overbought territory over the past 50 days. In the past 20 years, there has only been one other time period that exceeded this.

When we zoom in on that 2018 time frame, we can see how choppy the moves in XLK became.

Flows

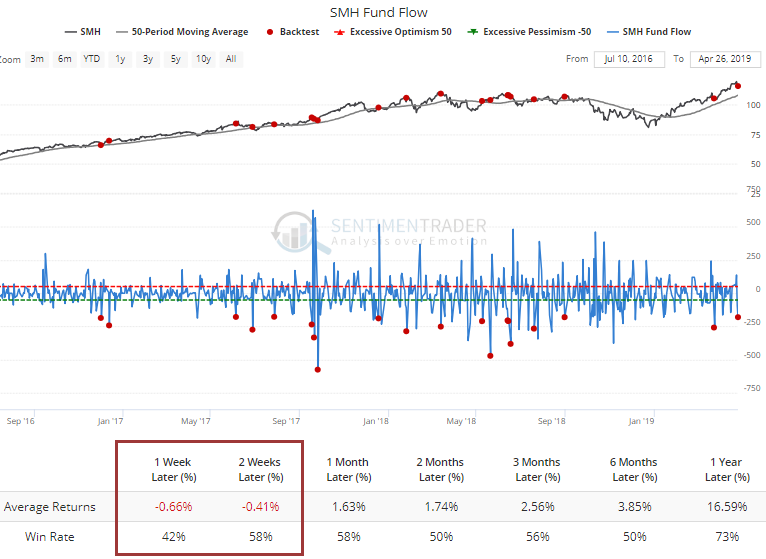

Investors yanked more than $175 million from the SMH semiconductor fund on Friday. When SMH was above its 50-day average at the time, outflows like this suggested at least a brief period of risk-off sentiment.

Swiss Can't Miss

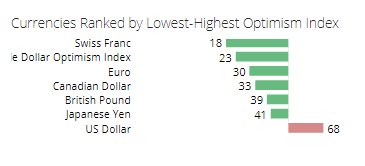

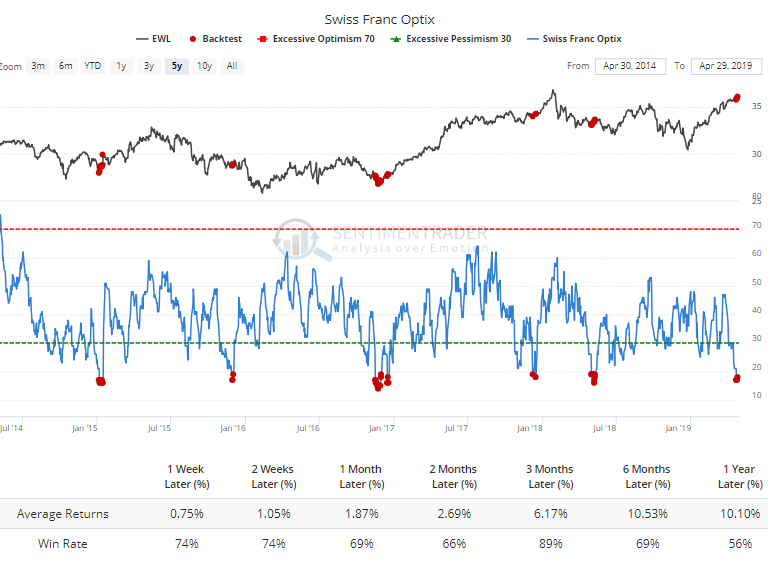

Swiss stocks have been on a tear lately, in spite (or because) of a drop in the franc. Speculators have been shorting it heavily, and that has helped push the Optimism Index below 20.

By far, it's the most-hated currency.

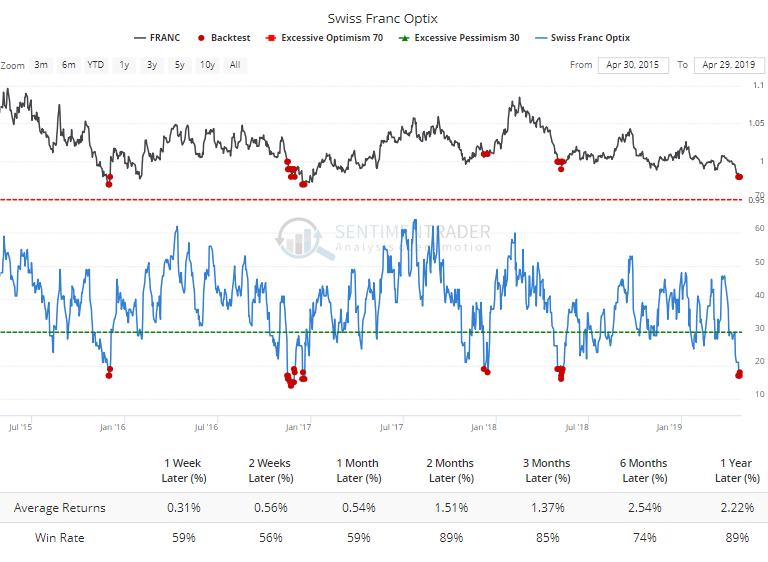

When the Optimism Index has been below 20 in recent years, the franc has tended to rebound.

There was that weird peg issue in 2015 which screws up the earlier numbers but when optimism toward the currency has been this low, it hasn't usually seen much of a further sustained decline.

For funds like EWL, that has been a boon, with gains 89% of the time over the next three months according to the Backtest Engine.

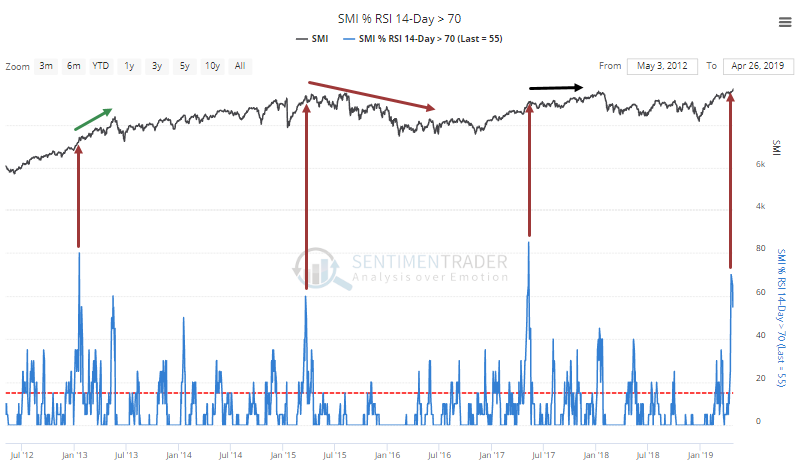

It seems uncomfortable assuming Swiss stocks could continue to power high just because optimism on the franc is so weak. After all, last week more than 70% stocks in the SMI index were overbought. That has led to mixed returns, though, and wasn't a contrary sell signal by itself.

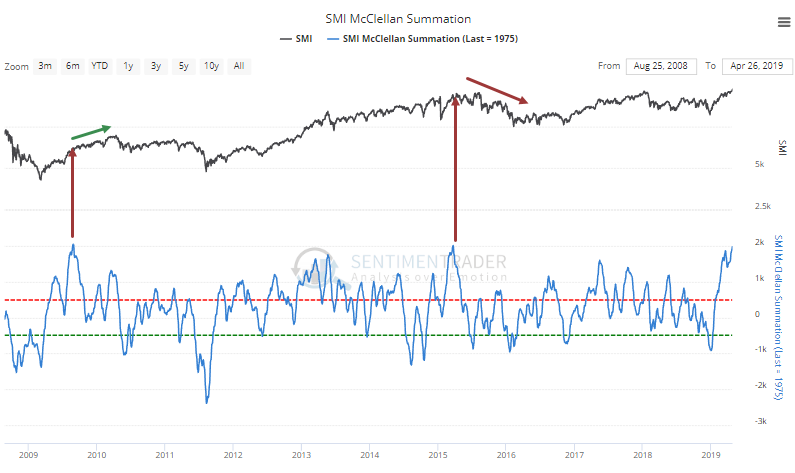

The advance has been so persistent that the McClellan Summation Index for the SMI is nearing 2000 for only the 3rd time. Of the others, one led to a big run-up, the other a peak, so again, it was mixed.