Monday Midday Color

Here's what's piquing my interest so far today.

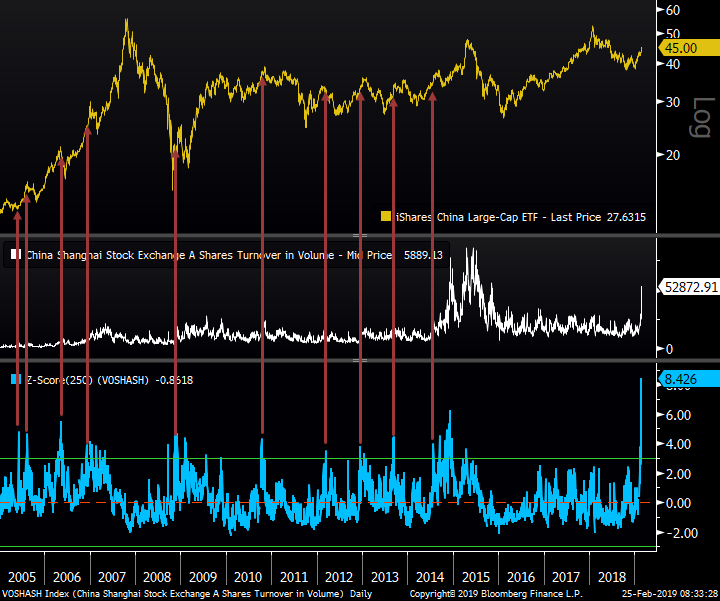

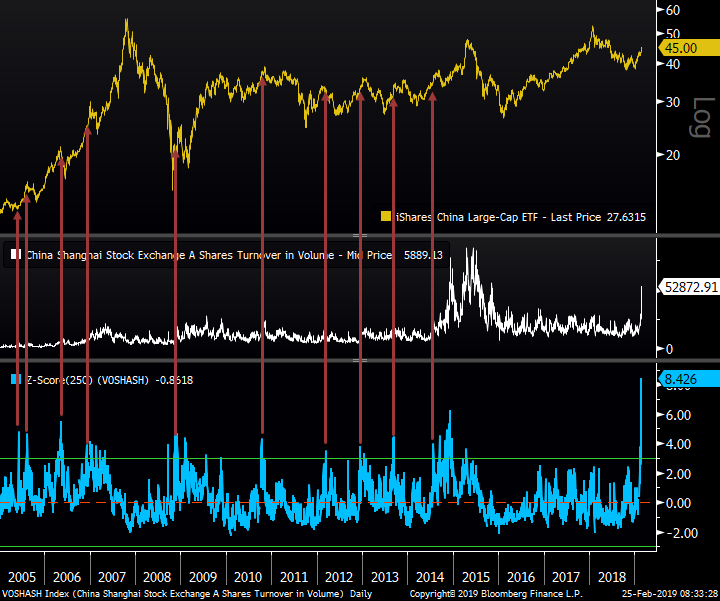

As noted by Bloomberg, volume in Chinese A-shares spiked on the President Trump's optimistic trade tweets. Unlike most other markets, volume in Chinese shares tends to spike on rallies, not declines. Today's volume was 8 standard deviations above the 1-year average, the highest ever.

Other spikes tended to precede short-term plateaus in FXI, the most-established U.S.-based fund tracking Chinese shares. The volume is not directly related to the shares tracked in FXI, but if we make the assumption that a-shares volume is a reflection of enthusiasm for Chinese shares in general, it can make sense to compare them. Reasonable people could certainly disagree.

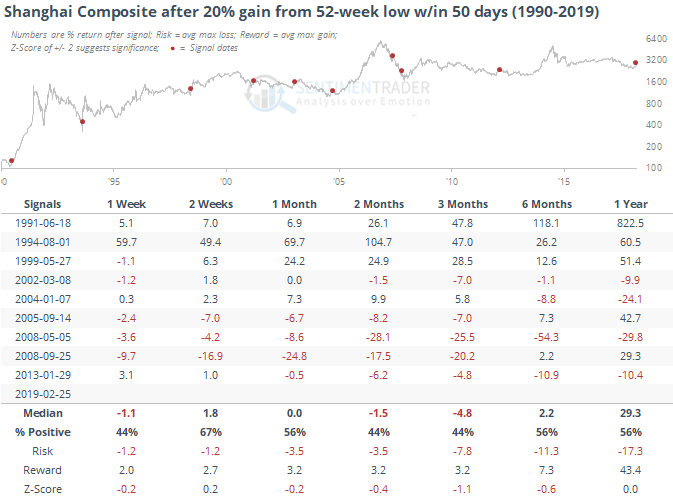

The rally in China has pushed the Shanghai Composite more than 20% off its 52-week low, within only 50 days of that low being set. The past few times, rallies like this have led to a pullback, while prior to 2005, it was the initial kick-off move to something larger. Watching to see if buyers persist in the week(s) ahead should be telling which is the better set of precedents now.

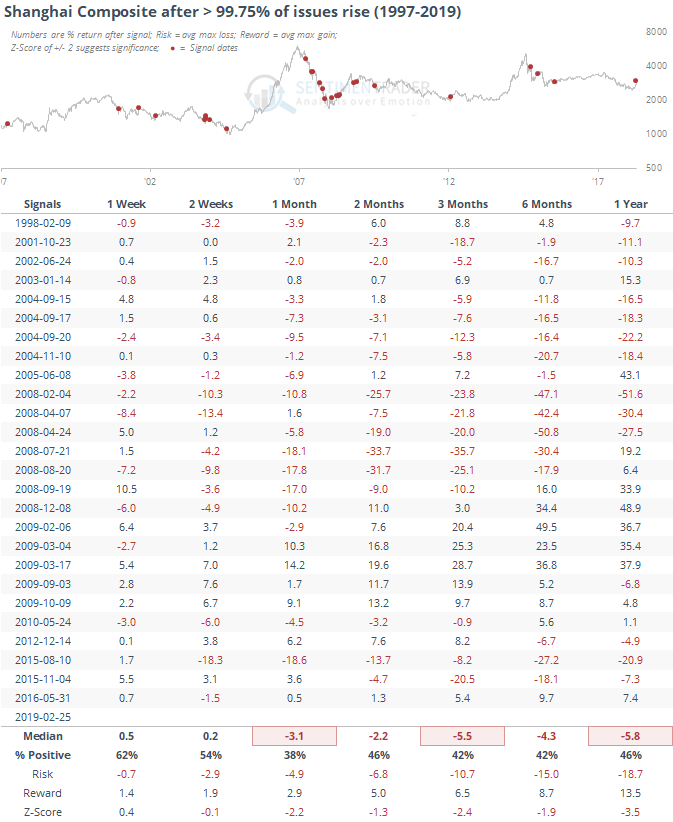

The rally was almost universal, with only 2 stocks in the Shanghai Composite declining on the day. That's one of the most lopsided sessions in over 20 years.

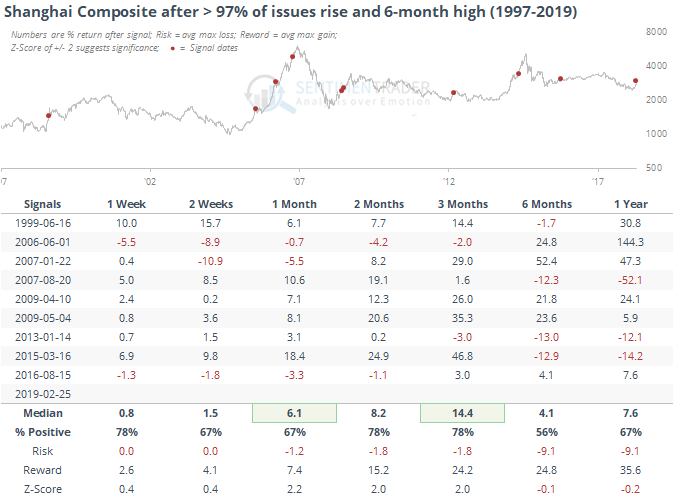

That doesn't look encouraging, but it gets quite a bit better when we look at the best breadth days when the Shanghai was also trading at at least a 6-month high at the time (which eliminates most of the bear market readings).

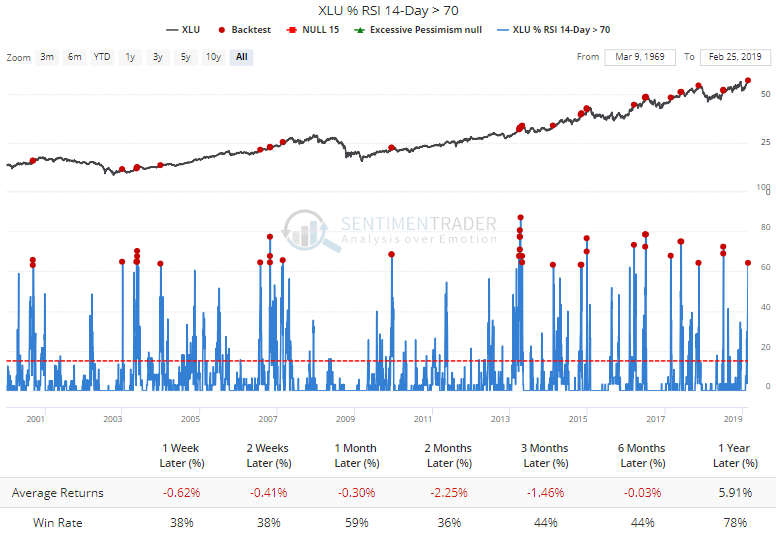

Utilities have been on quite a tear, with more than 60% of them currently showing overbought RSI conditions. XLU has not held up very well after other times these normally staid stocks have enjoyed such a move.

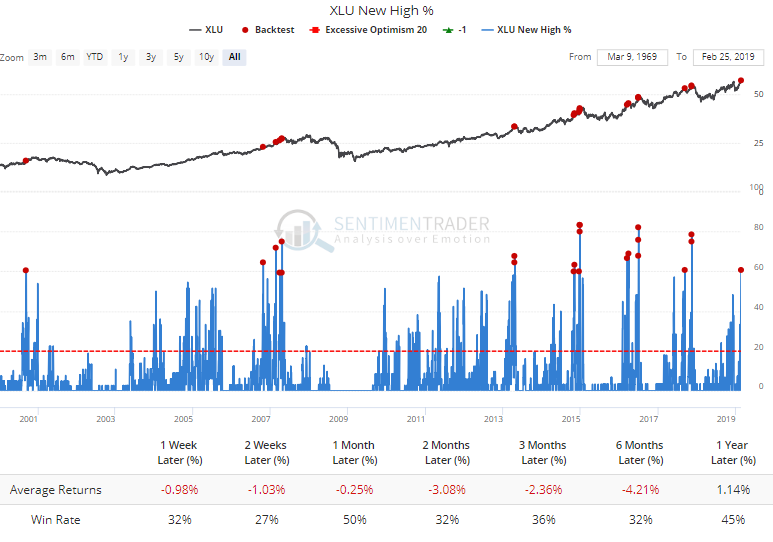

The move has triggered new 52-week highs in 60% of these stocks, a rarely-achieved level that has also tended to coincide with exhaustive buying pressure.

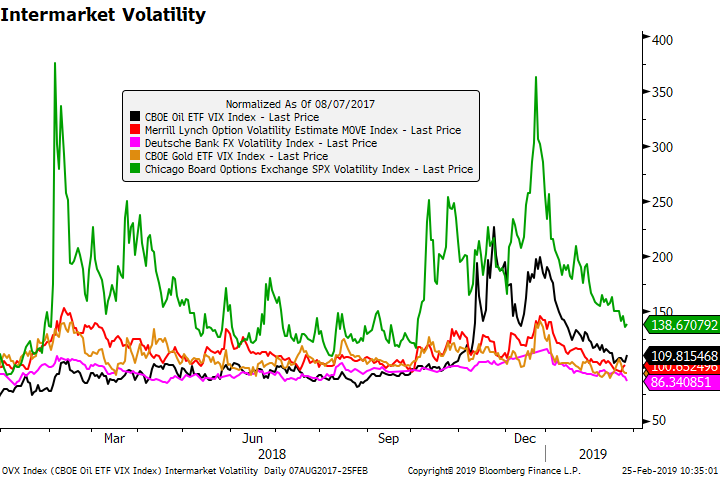

There has been a lot of chatter lately about not only the VIX, but also MOVE, the bond market volatility gauge which is nearing all-time lows. But it's been pretty much everything, as most volatility gauges are nearing their lows again.

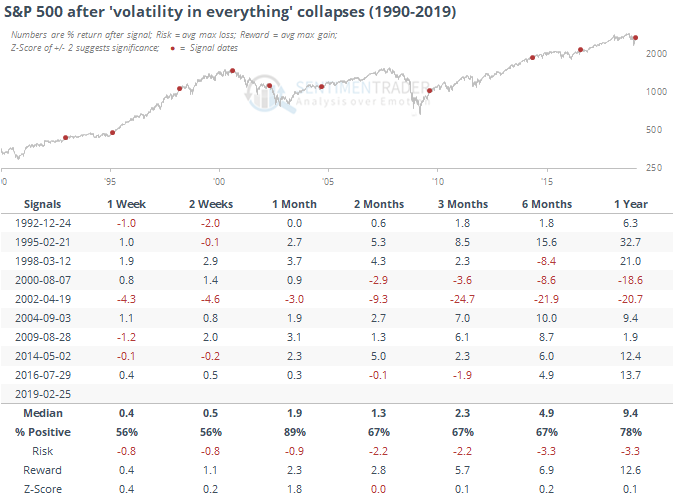

When the "volatility in everything" has collapsed before, it wasn't necessarily a sell signal for stocks. Mostly random. These are times when the average implied volatility for the markets in the chart above fell to the bottom 10% of the 52-week range.

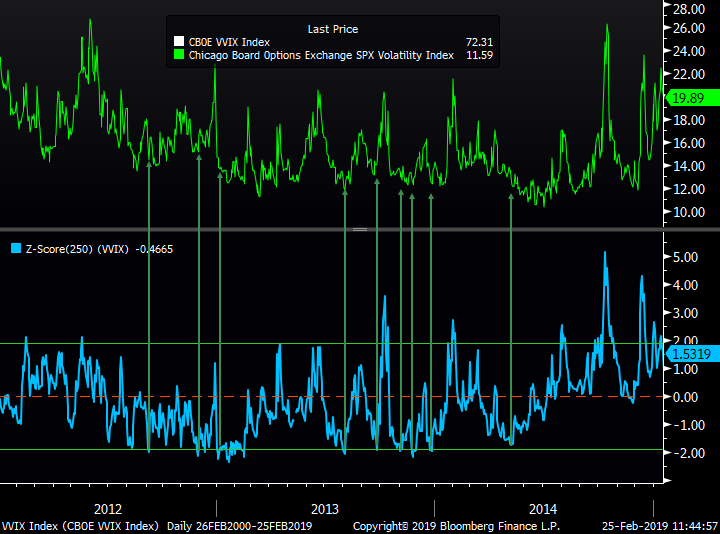

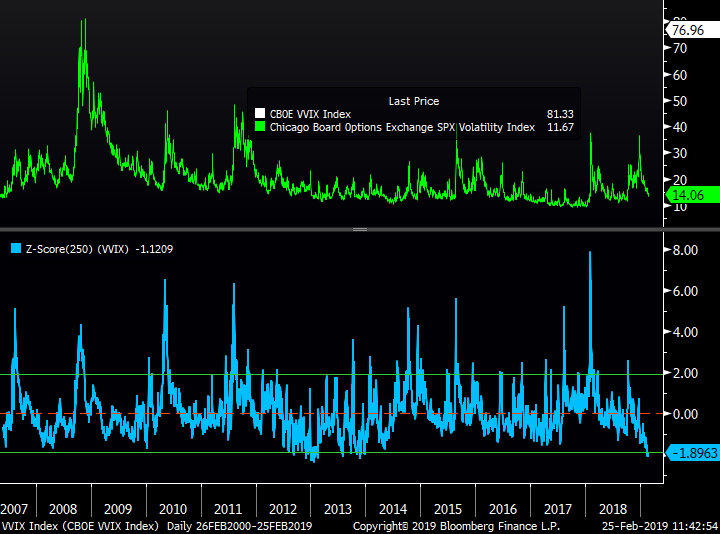

Even the volatility of the VIX has collapsed. The VVIX index is down to its lowest level in years. Expressed as standard deviations from its one-year average, VVIX is nearly 2 deviations from average (lower green band).

The only time period when it got this low was in 2012-2014, typically leading to a spike in the VIX sooner rather than later (again, however, it's questionable to try to trade this using any of the popular volatility ETFs which degrade quickly if held beyond a few days).