Minutes Digest for Dec 29 2020

A weak record

- Published:

2020-12-29 10:00:00 - Author: Jason Goepfert

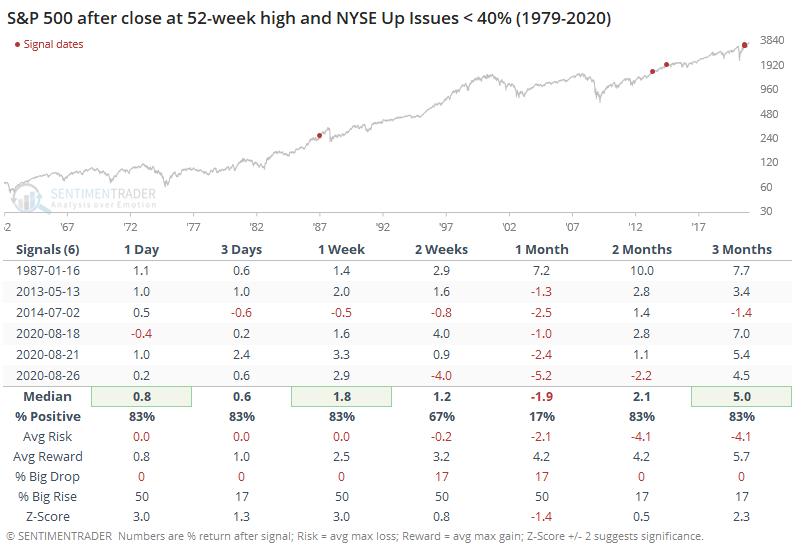

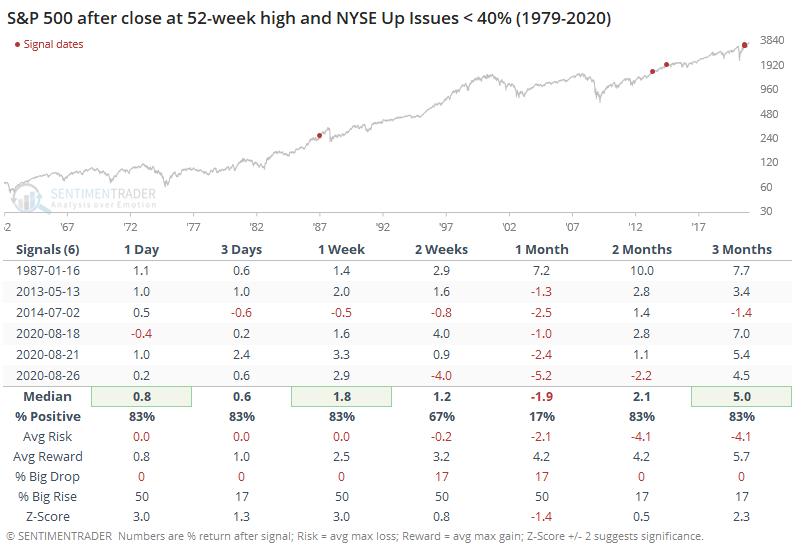

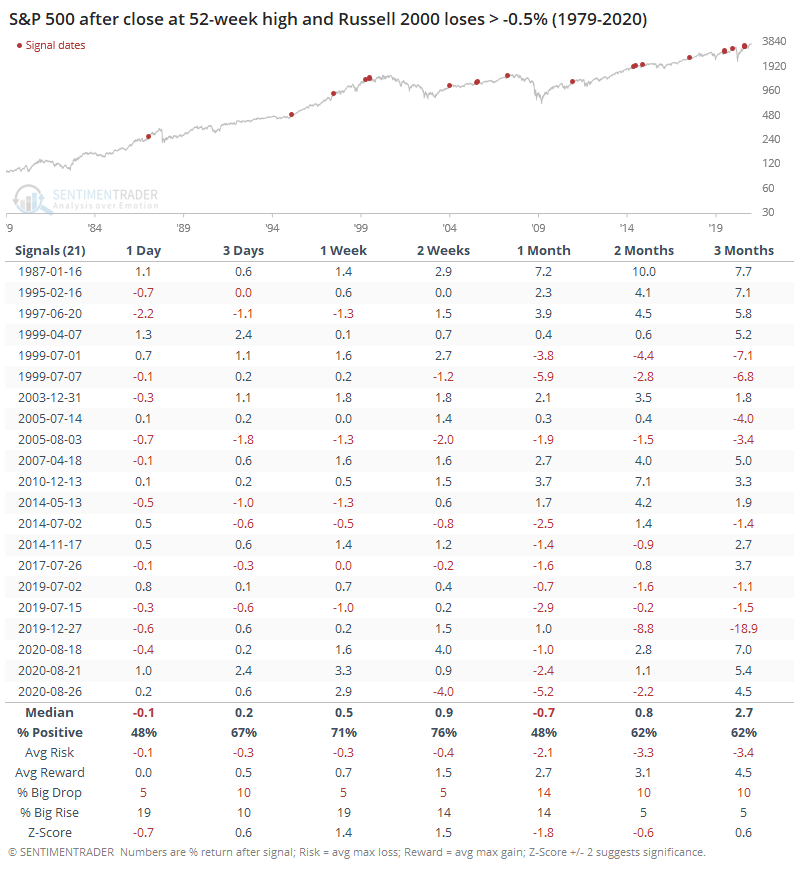

There is still a lot of time to go in today's session. But once again today, the weakness in small-cap stocks is pushing the breath figures lower. If we closed the session right now, it would be the 3rd-weakest NYSE breadth since 1962 for any day when the S&P 500 closed at a 52-week high. The other 2 more extreme sessions were both in August when we were pointing out similar oddities.

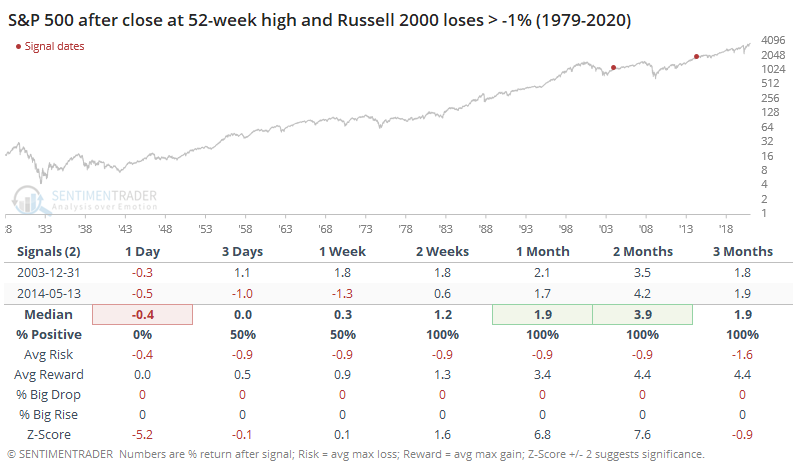

This would also be only the 3rd time the S&P has ever closed at a 52-week high on a day when the Russell 2000 lost more than 1%.

If we look at lesser extremes, it showed some weakness over the next month, especially in recent years.

Jump to new high on negative internal momentum

- Published:

2020-12-29 08:31:30 - Author: Jason Goepfert

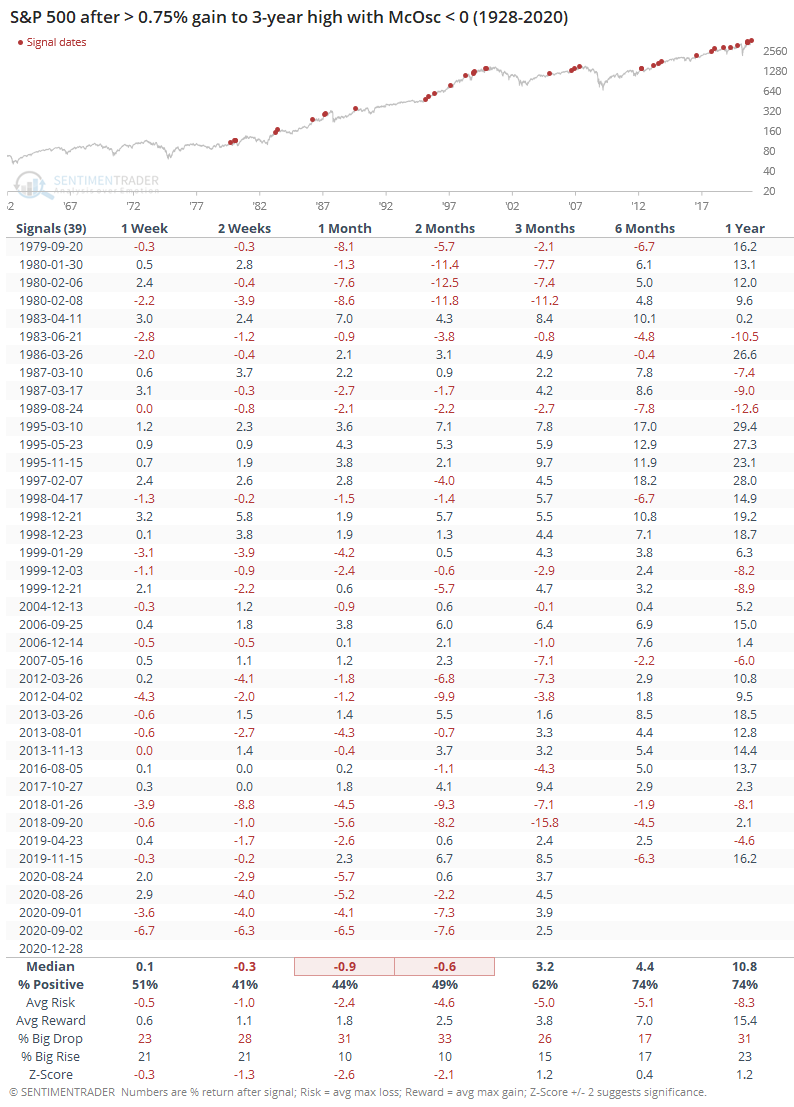

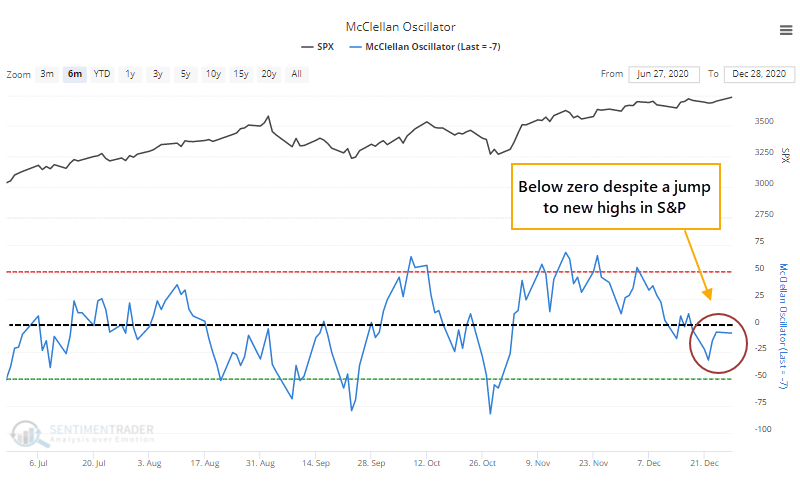

I noted yesterday that despite at least moderate gains in the major equity indexes, and new highs to boot, small-cap stocks were relatively weak and dragging breadth metrics lower. As a result, the S&P 500 rose more than 0.75% and to a new high, but the McClellan Oscillator is still in negative territory.

This is not a typical situation, and preceded weakness with consistency over the next 2-8 weeks. Even recent years, with some spectacular momentum runs, saw consistent weakness during the next 2-4 weeks.