Minutes Digest for Dec 09 2020

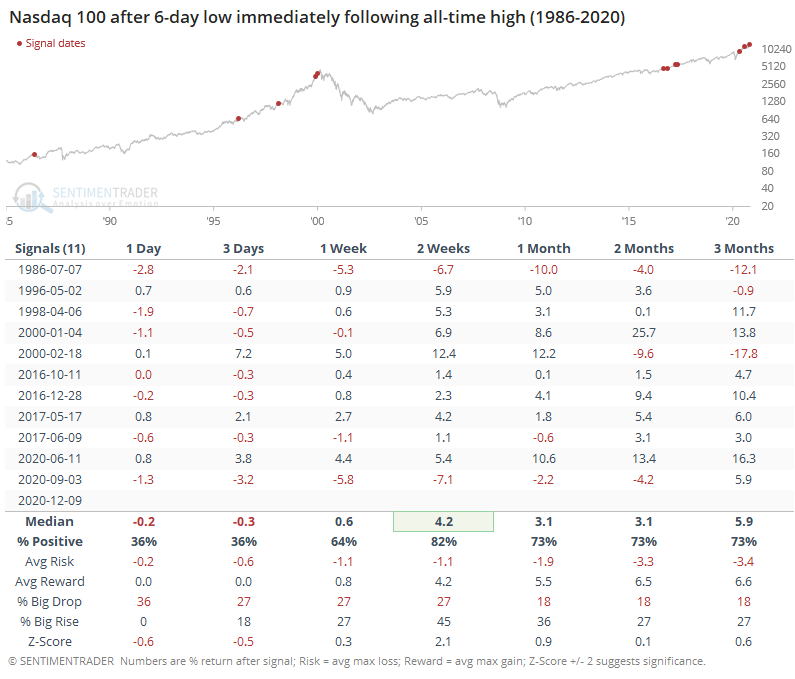

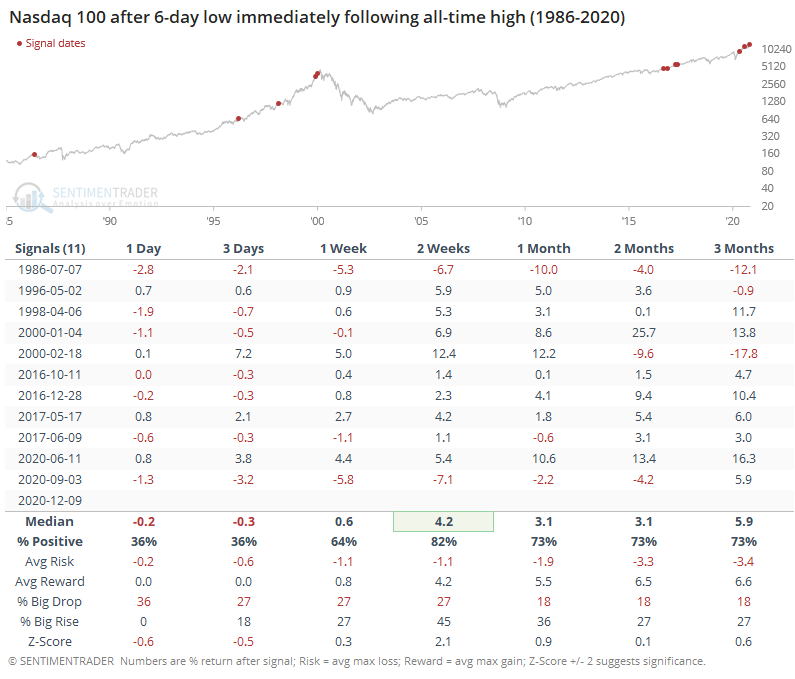

NDX reversal

- Published:

2020-12-09 14:17:07 - Author: Jason Goepfert

Quite a nasty reversal there in the Nasdaq 100. If it sticks into the close, then the NDX will have cycled from an all-time high to a 6-day low in one day. That's preceded some very short-term downside follow-through, then rebound over the next couple of weeks.

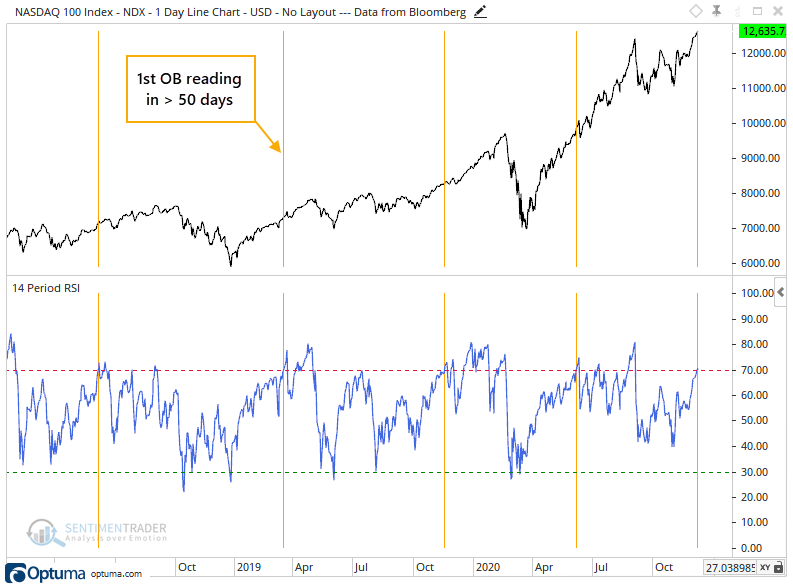

Big tech is bigly overbought

- Published:

2020-12-09 08:13:32 - Author: Jason Goepfert

Sarah Ponczek from Bloomberg pointed out that for the first time since September, big tech has driven the Nasdaq 100 to an overbought RSI reading.

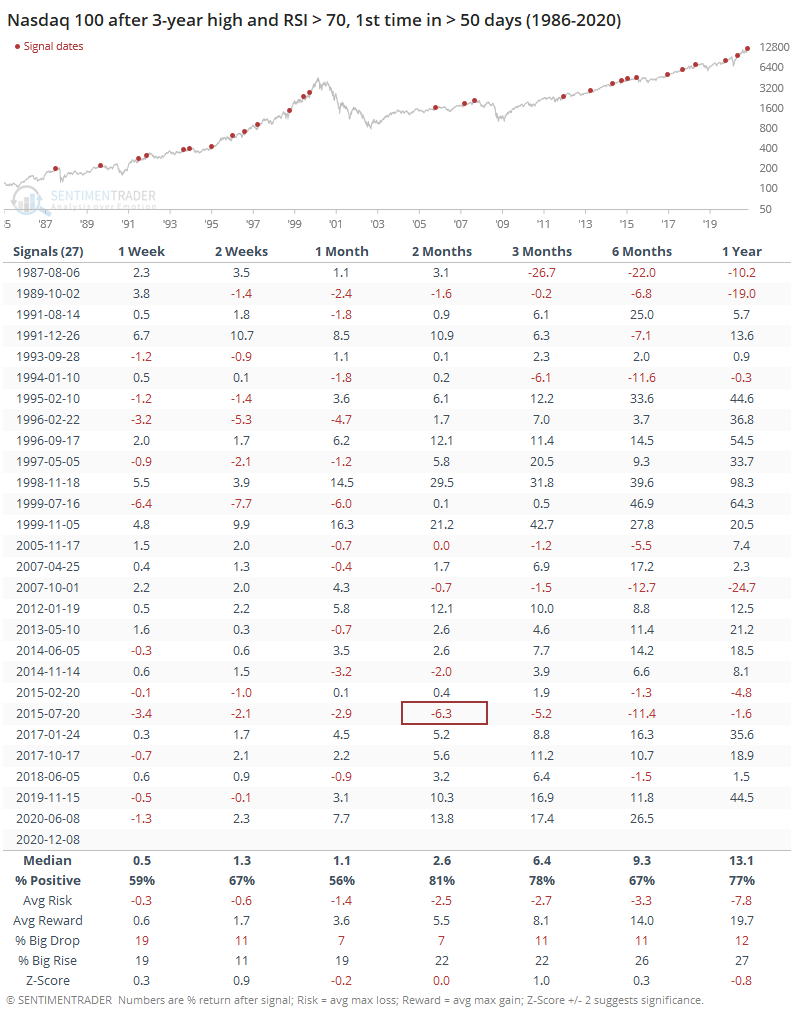

Looking at forward returns when the NDX hits overbought for the 1st time in 50 days and with a multi-year high to boot, they were mostly good. Over the next 2 months, there was only a single loss of more than -2%, which is pretty incredible given there were 27 signals. Momentum, man.

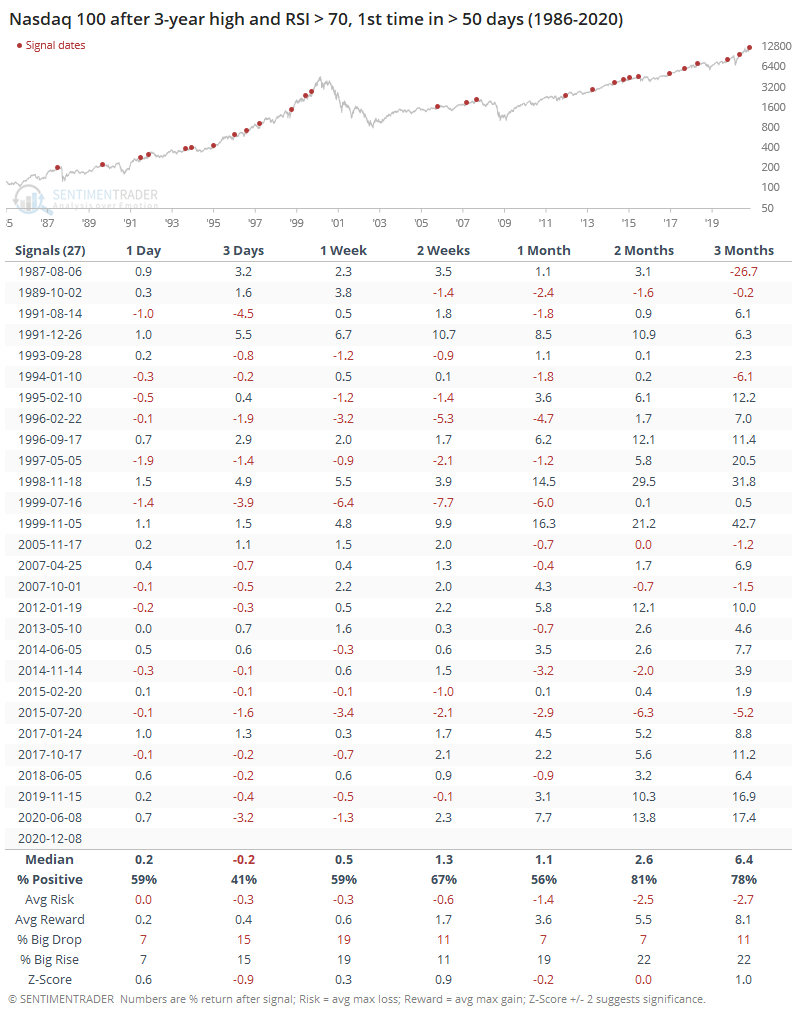

If we look at shorter-term returns, then we can see a consistent pullback over the next 3 days. That's about it.

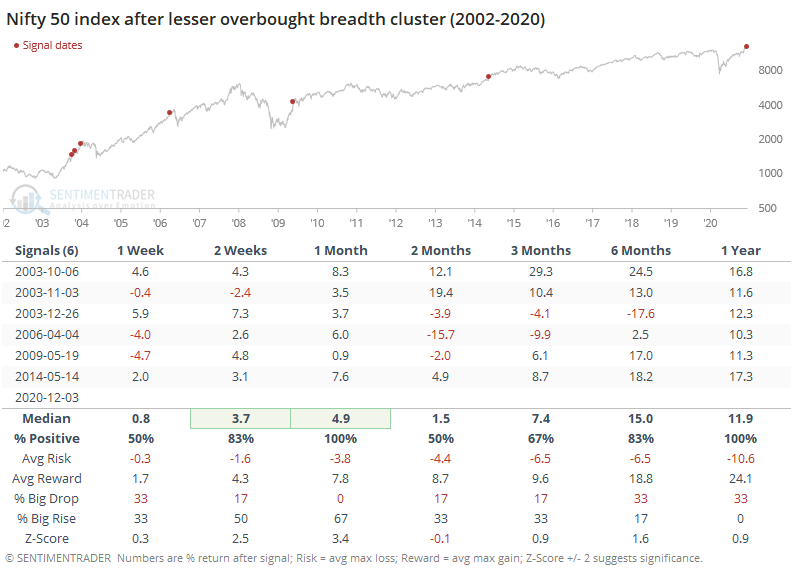

Nifty Nifty

- Published:

2020-12-09 07:50:11 - Author: Jason Goepfert

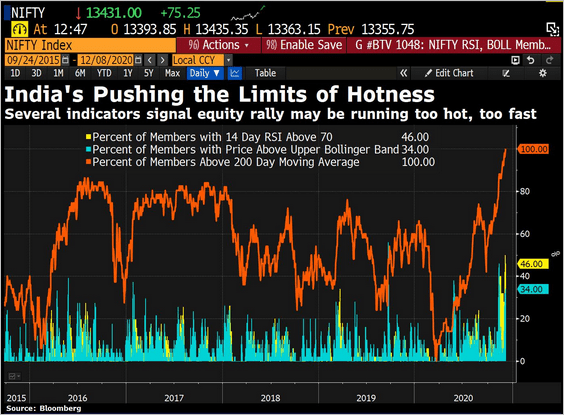

Bloomberg pointed out that among all the impressive breadth readings across the world, India's Nifty 50 index is sporting among the best.

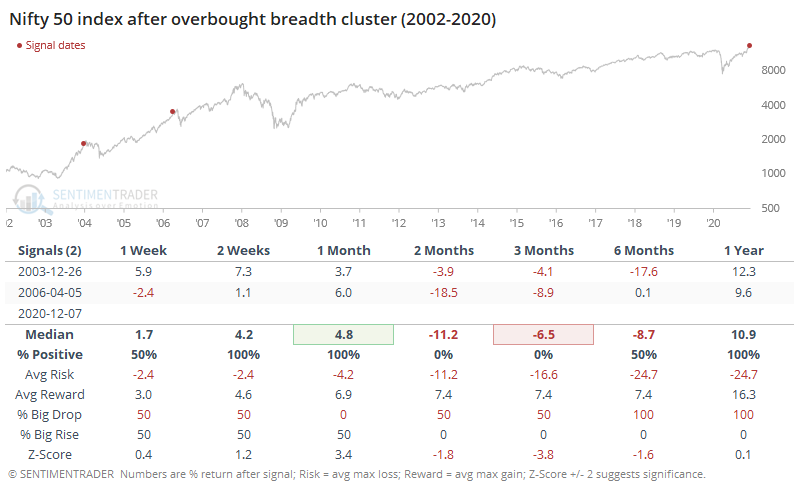

The data go back to 2002, so looking at all other times that at least a third of stocks in the index were overbought and outside their upper Bollinger Band, and at least 95% of them were in uptrends, there were only 2 precedents. Both led to hefty losses over the next 2-3 months then saw the uptrends resume.

If we relax the parameters to 30% of stocks overbought and outside their volatility bands, and 90% in uptrends, then it was a similar pattern - more short-term follow-through, with some medium-term pullbacks to work off the overbought conditions, and double-digit gains over the next year.