Minutes Digest for Dec 07 2020

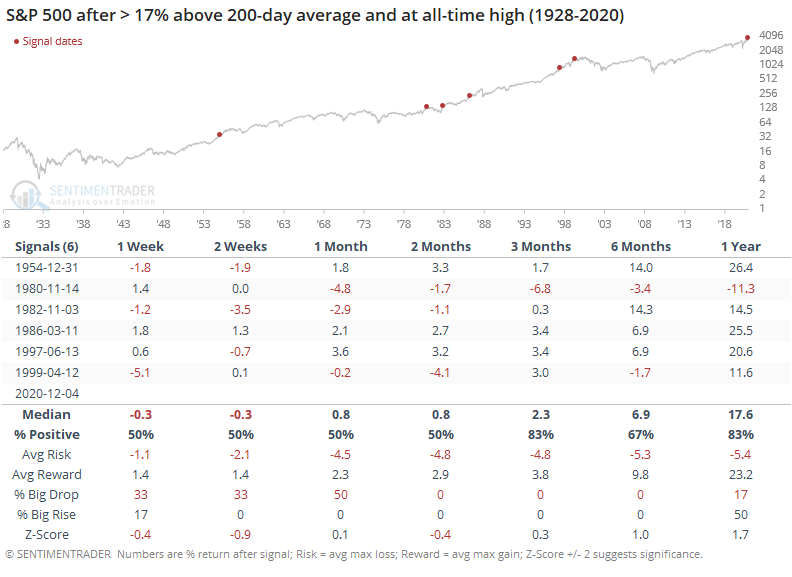

Streeeeeeetched

- Published:

2020-12-07 11:31:19 - Author: Jason Goepfert

Quite a chorus out there today about the S&P being super stretched above its 200-day average. Indeed it is, with some mixed results shorter-term. Mostly positive 3-12 months later with only a single loss of any significance.

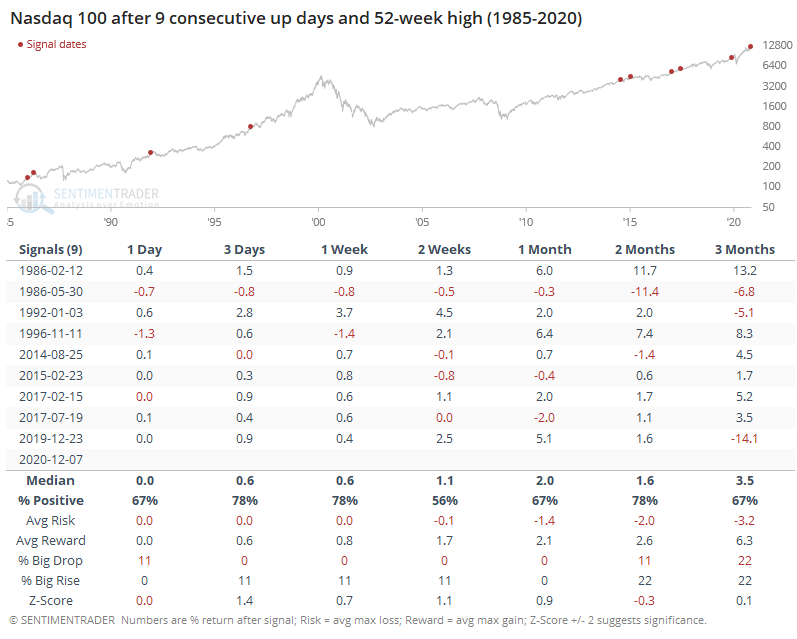

9 (or 10) in a row for NDX

- Published:

2020-12-07 09:11:53 - Author: Jason Goepfert

The Nasdaq 100 missed an up day by *this much* on November 23 otherwise it would join QQQ in trying to put in its 10th consecutive positive session today. As it stands, a streak of 9 straight up days is pretty impressive, and rare when also kissing a 52-week high.

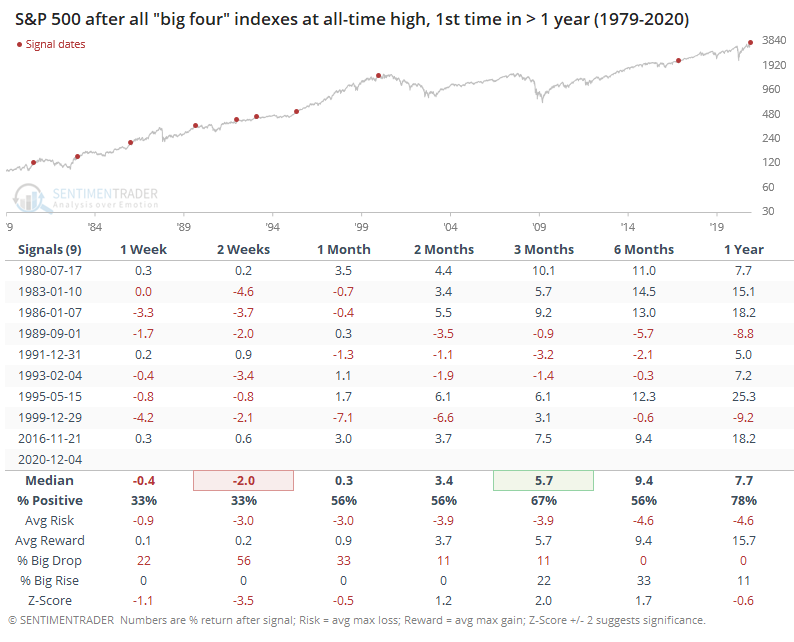

All 'big four' at record highs

- Published:

2020-12-07 08:45:06 - Author: Jason Goepfert

On Friday, the S&P 500, Dow Industrials, Nasdaq Composite, and Russell 2000 - the 'big four' - all closed at an all-time high for the 1st time in at least a year. That has preceded some short-term trouble as the gains got digested.

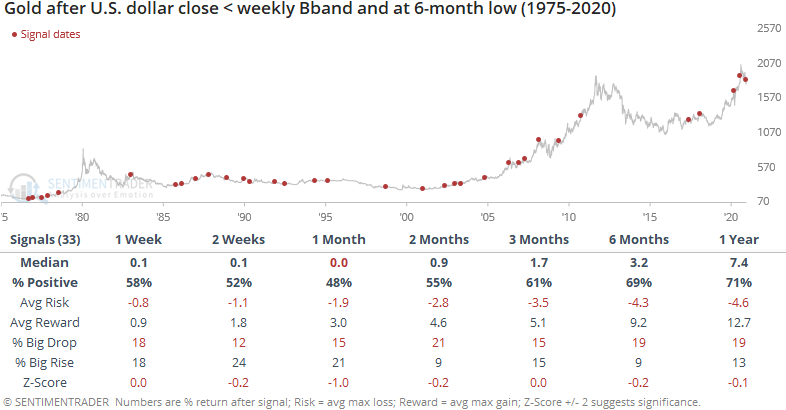

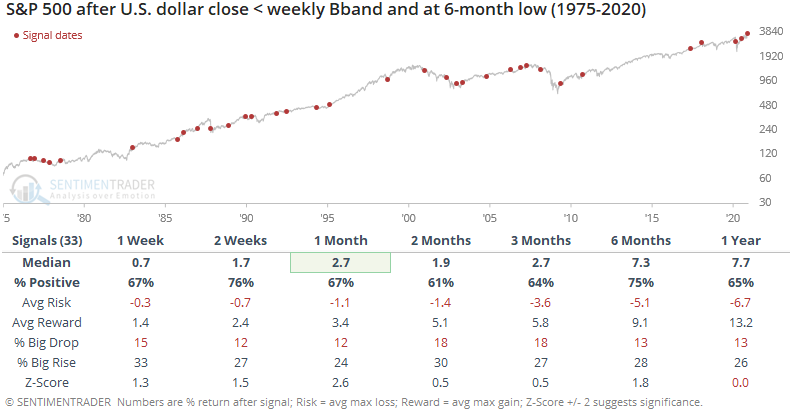

The buck's Bollinger Band

- Published:

2020-12-07 08:06:00 - Author: Jason Goepfert

The dollar closed below its weekly lower Bollinger Band and at a 6-month low. Historically, that's pretty stretched.

The buck has rebounded from these conditions several times, but more often than not, it just kept sinking.

It wasn't a particularly consistent sign for stocks.

Or even gold.