Minutes Digest for Dec 04 2020

No bears anywhere

- Published:

2020-12-04 11:14:30 - Author: Jason Goepfert

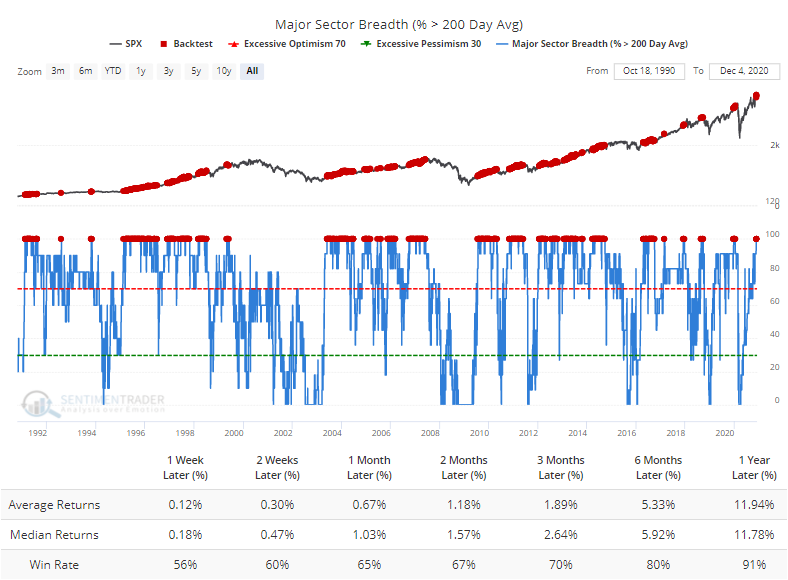

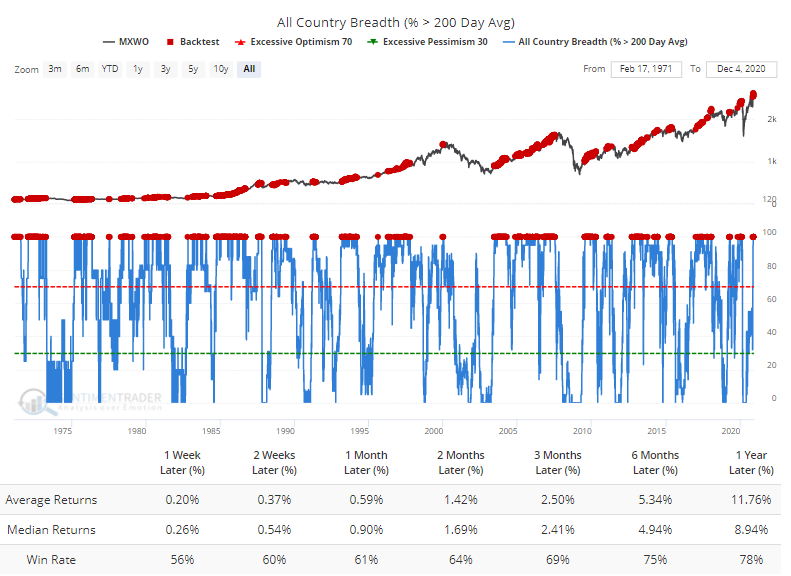

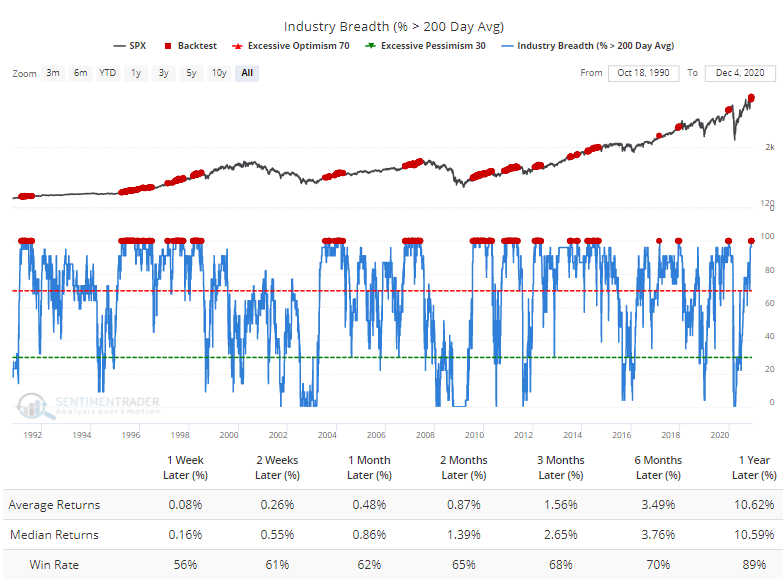

As noted earlier, every industry is now in an uptrend. By necessity, that means every broader sector is, too. That has generally meant more gains, with especially positive returns over the next 6-12 months.

And as we've seen in recent notes, it's not just the U.S. All major global indexes are now in uptrends, too.

Not a downtrend in sight

- Published:

2020-12-04 09:28:07 - Author: Jason Goepfert

Every major industry is now in an uptrend. While that sounds like it should scream "excess!", it's been more of a sign of healthy participation than it does anything resembling excess.

Some specific sectors, like financials, don't respond well when every stock is in an uptrend, but the broader market has done just fine, thank you. The Backtest Engine shows the S&P was higher 2/3 of the time over the next 3 months.

Options explosion

- Published:

2020-12-04 09:19:19 - Author: Jason Goepfert

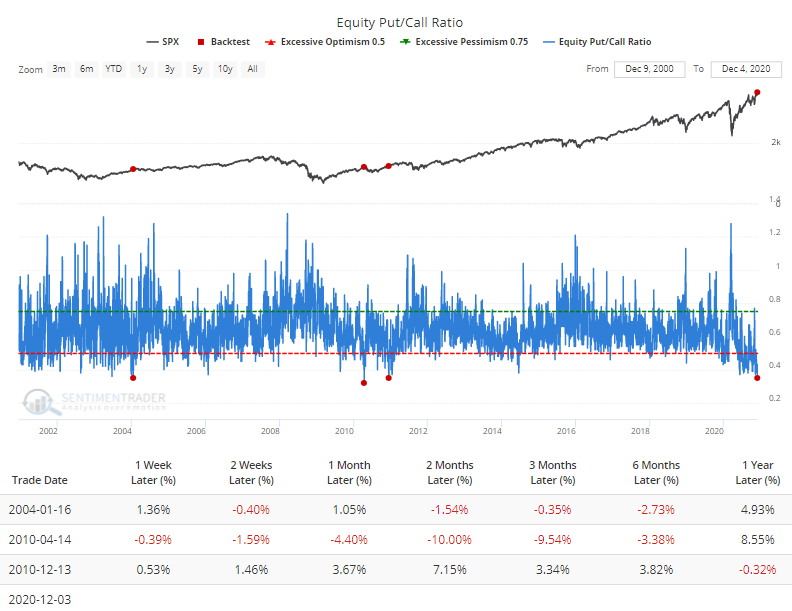

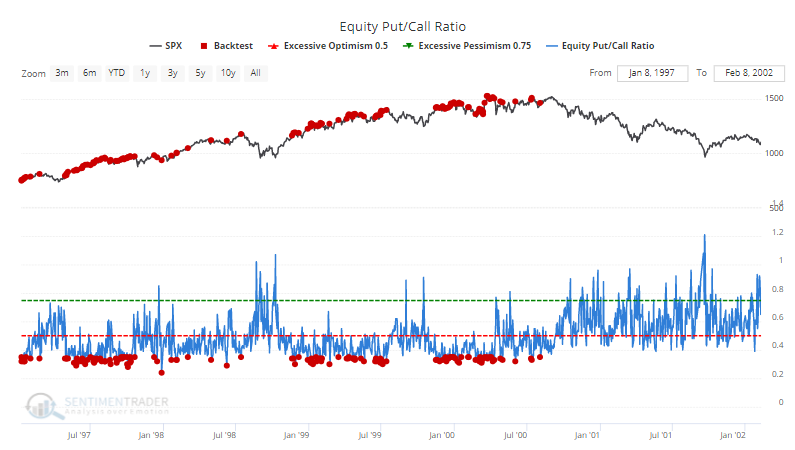

That put/call ratio on equities that printed yesterday is a little bit insane. Almost 3x calls traded for every put. The equity-only ratio has been below 0.35 only 3 times over the past 20 years.

It's worth emphasizing that "past 20 years" part, though, because the ratio was consistently lower than it is now prior to 2000, which did not consistently lead to weakness.

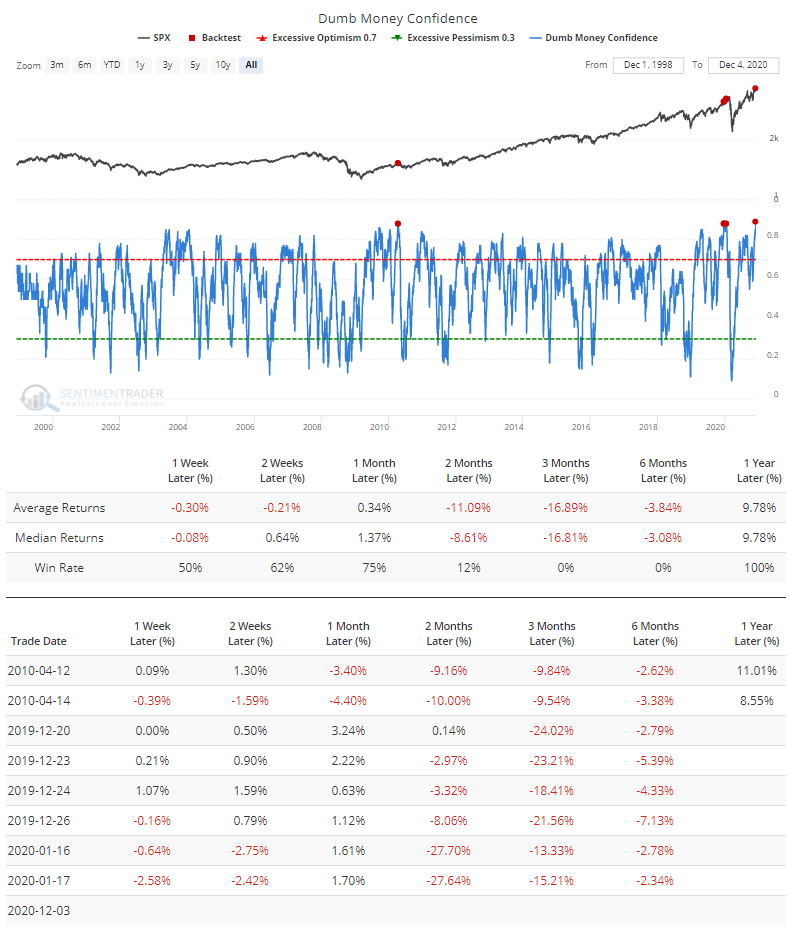

Dumb Money at record high

- Published:

2020-12-04 07:42:31 - Author: Jason Goepfert

In Thursday's Report, I noted that Dumb Money Confidence was at a record high, referring to the few days it had been slightly lower. Here's the full return table for those days. Stocks held up okay over the next 2-4 weeks, then...didn't.