Minutes Digest for Dec 01 2020

Leveraged long ETFs hit record

- Published:

2020-12-01 12:41:26 - Author: Jason Goepfert

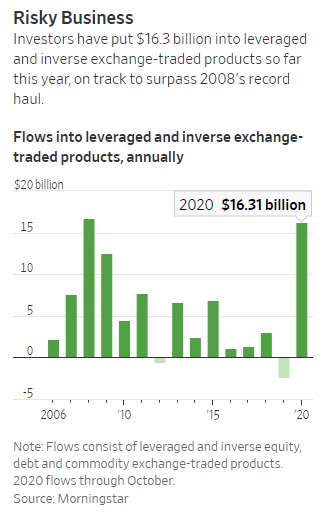

The Journal published an article recently showing the surge in asset tied to leveraged ETFs as (presumably) new traders scramble to get the most band for their buck.

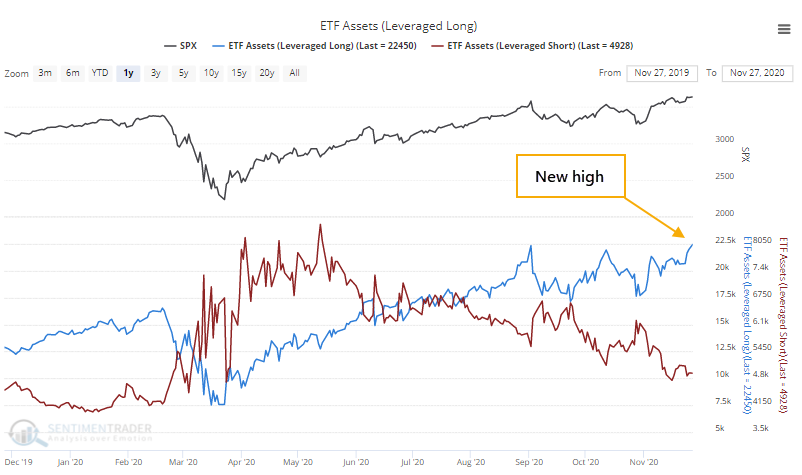

Seems clear that much of that is tied to leveraged long ETFs. Assets in the ones we track just hit a record high.

They just passed the peak from early September. Notably, though, assets in leveraged inverse (short) ETFs were $5.5 billion then, as opposed to "only" $4.9 billion now. Maybe a mild warning of complacency.

Gapping up to start the month

- Published:

2020-12-01 07:57:19 - Author: Jason Goepfert

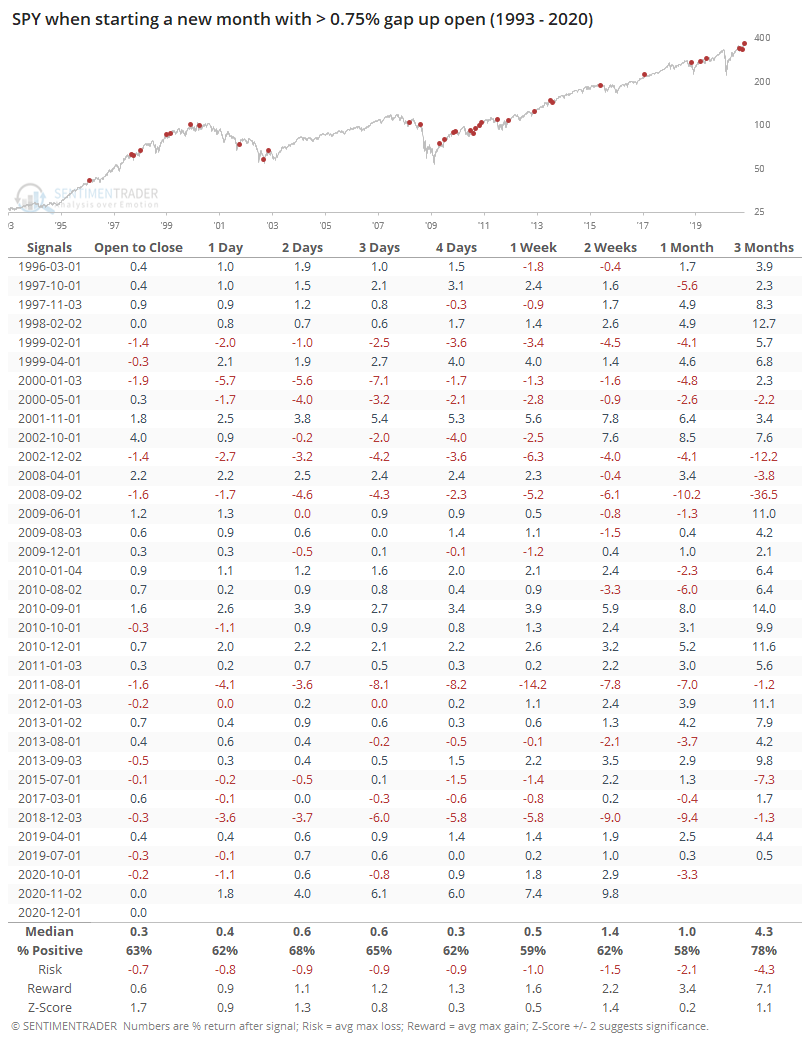

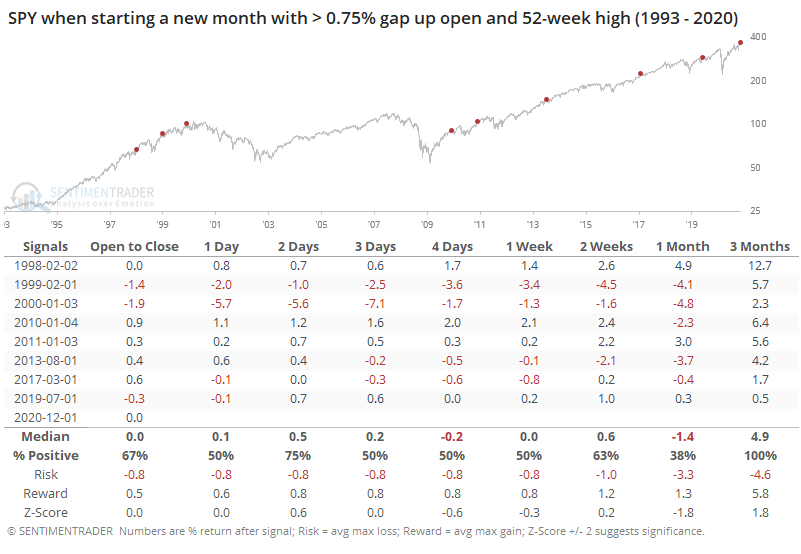

The most important ETF in the world is on track to gap up strongly to start a new month. That has mostly been a decent sign shorter-term, with SPY continuing to gain over the next 2-3 days in particular.

It was much rarer to see this at a 52-week high, which preceded a relatively poor risk/reward ratio over the next month, but by 3 months later, all of them showed gains.

5 in a row and a new low

- Published:

2020-11-30 13:35:35 - Author: Jason Goepfert

GLD hasn't been able to fully come back from some morning weakness and is threatening to be down 5 days in a row, sitting at a 100-day low. That's only happened a handful of times in its history, with mostly weakness over the next 20-90 days before bottoming. The squiggly lines in the bottom chart are GLD's price path going forward after each of the previous signals.

Emerging market vol spike

- Published:

2020-11-30 11:49:54 - Author: Jason Goepfert

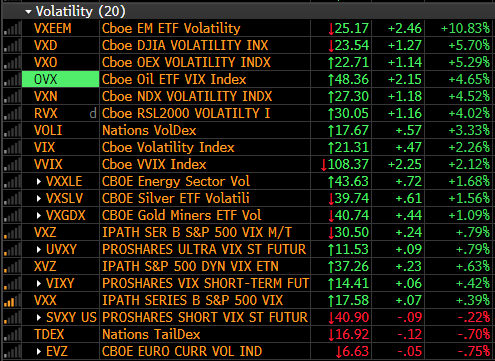

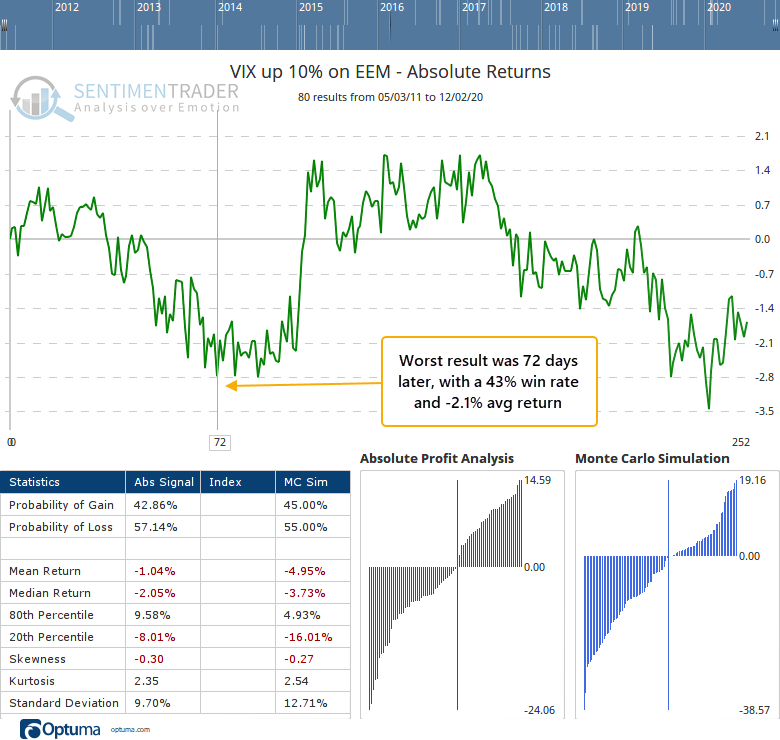

Out of all the volatility measures I watch, the one with the biggest gain today is VXEEM, the one tracking emerging markets. Makes sense, EEM is on the lower end of broad ETFs today.

If we look at EEM's returns following any day when its "fear gauge" spiked 10% but was still relatively low, below 26, then EEM's forward returns were quite poor. Its trough was 72 days later, when it showed a positive return only 43% of the time. A bit of a worry.

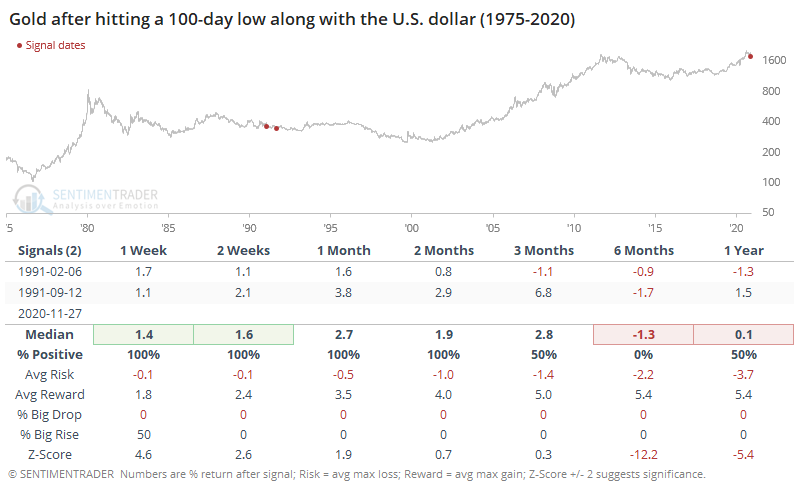

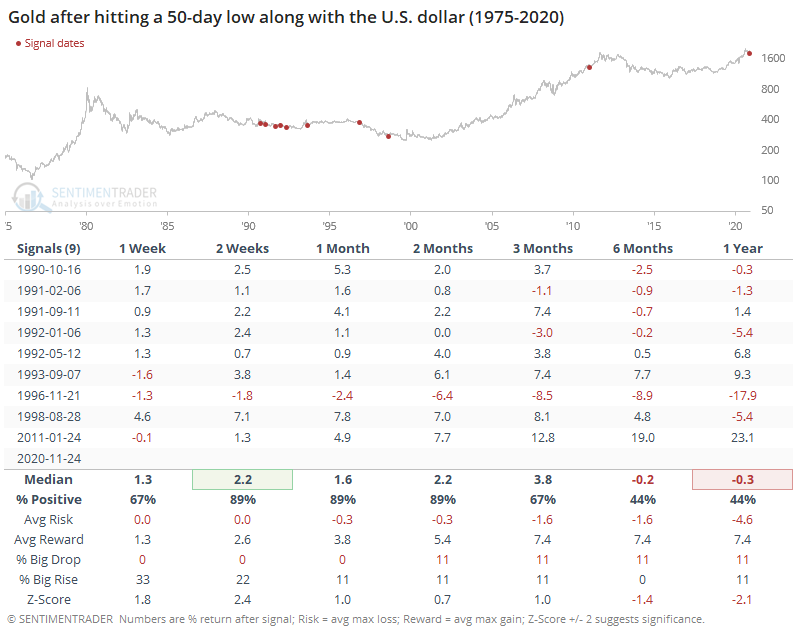

Gold and the dollar sink together

- Published:

2020-11-30 09:38:36 - Author: Jason Goepfert

This would be only the 3rd time since 1975 that both gold and the dollar hit 100-day lows on the same day.

Gold is *supposed* to rally when the dollar falls, but other times they dropped together didn't necessarily bode ill for the metal, at least for a while.

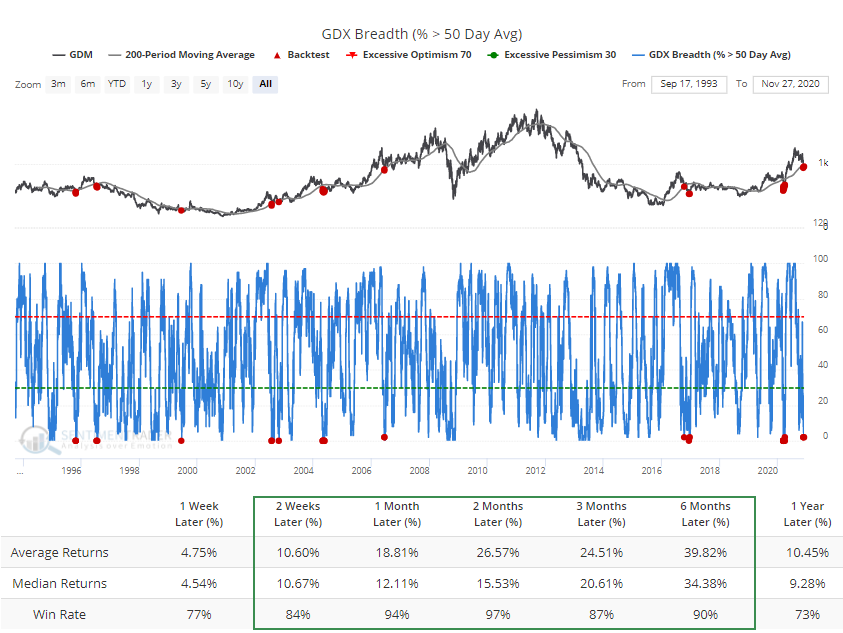

Minor uptrends in miners

- Published:

2020-11-30 07:50:50 - Author: Jason Goepfert

Looks like gold is going to get hit again today, which means miners probably will, too. Already, fewer than 3% of them are holding above their 50-day moving averages.

Look at those forward returns, though, when fewer than 3% of them are above their 50-day while GDM (base index for GDX) is below a rising 200-day moving average, reflecting a drop within a general long-term uptrend.

The next week in seasonality

- Published:

2020-11-30 06:50:01 - Author: Jason Goepfert

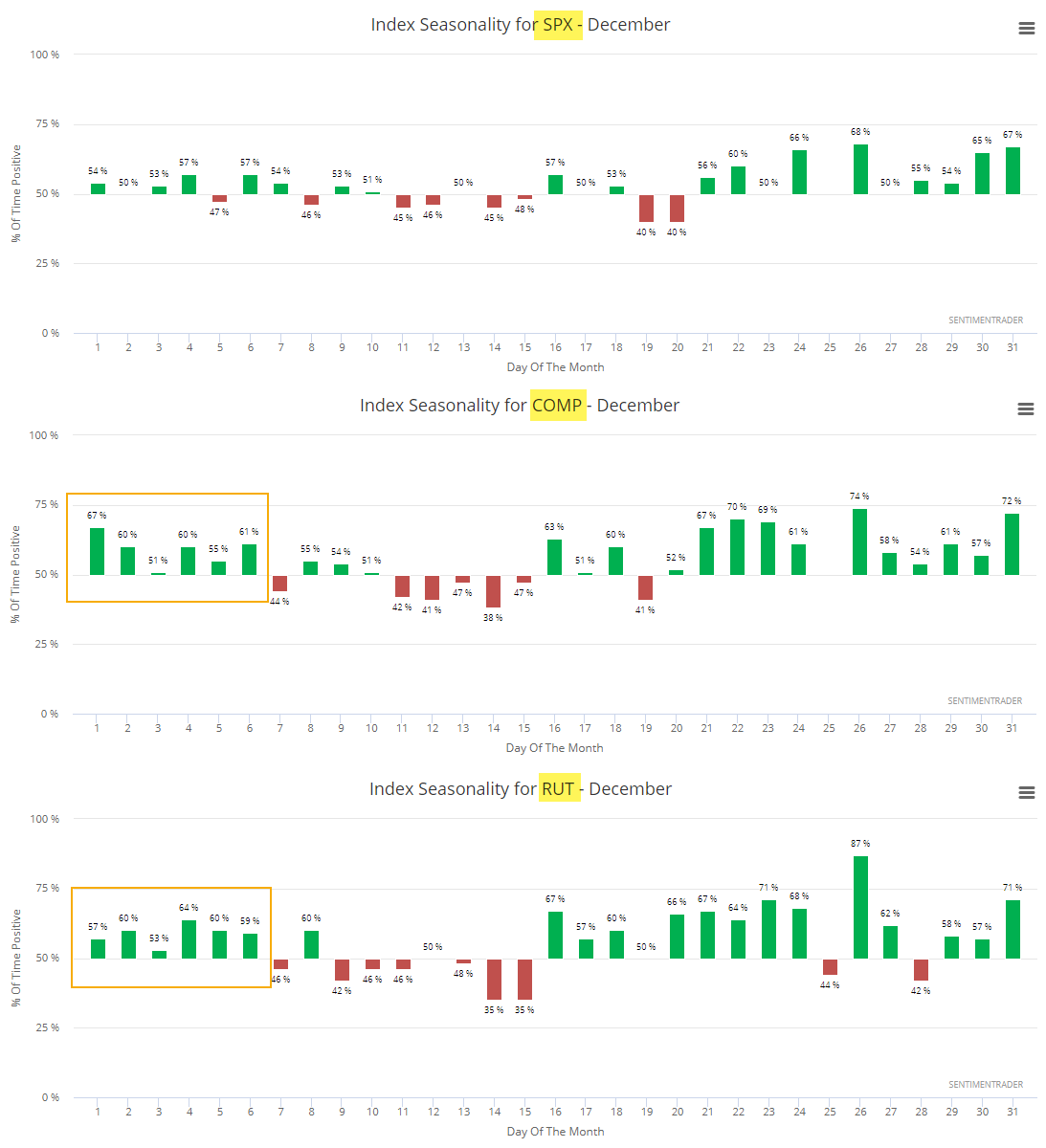

As we wind down November and head into the final month of the year, it's worth considering that the 1st week of the new month has tended to be a little more friendly to tech and small-caps than the S&P.