Minutes Digest for Feb 16 2021

TLT smashed

- Published:

2021-02-16 14:02:04 - Author: Jason Goepfert

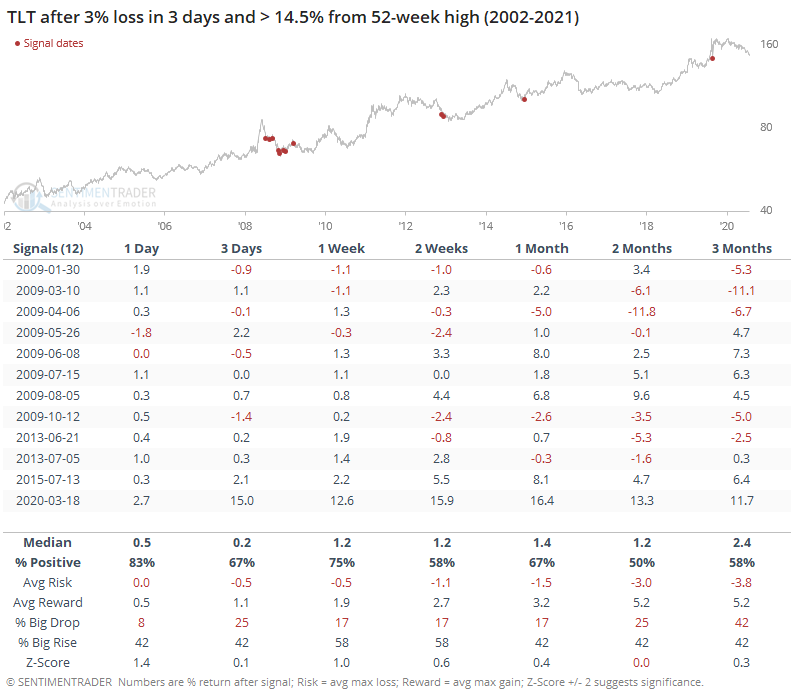

The go-to Treasury note/bond fund, TLT, has gotten hit hard the past few days, down about 3%, which is a large move relative to its typical gyrations. Losses over the past few months have driven the fund nearly 15% below its 52-week high.

Normally, we'd expect a consistent bounce-back after losses like this, especially for a vehicle that has been in an uptrend pretty much the entire 19 years it's been in existence.

After similar declines, it did have a moderate tendency to rebound over the next week or so, but it wasn't as strong of a signal as we'd like to see to suggest aggressive action.

Manic money

- Published:

2021-02-16 10:55:07 - Author: Jason Goepfert

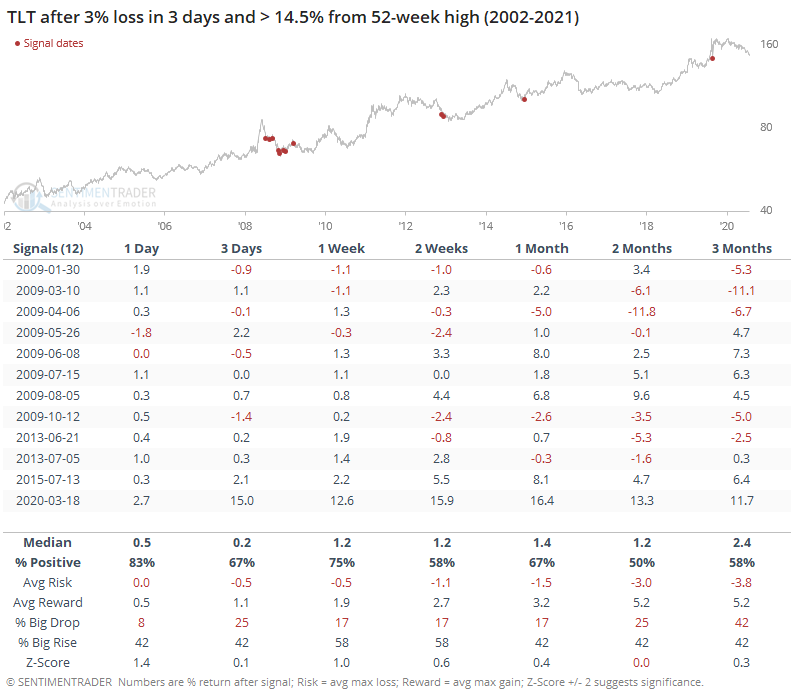

Last week, the NAAIM survey of active money managers showed the biggest amount of groupthink in the history of that survey. The latest monthly survey of big money managers from Bank of America isn't far off.

With a net 61% overweight to stocks among the managers, it's the 2nd-highest reading in 17 years. The only month when they had a higher allocation was January 2011.

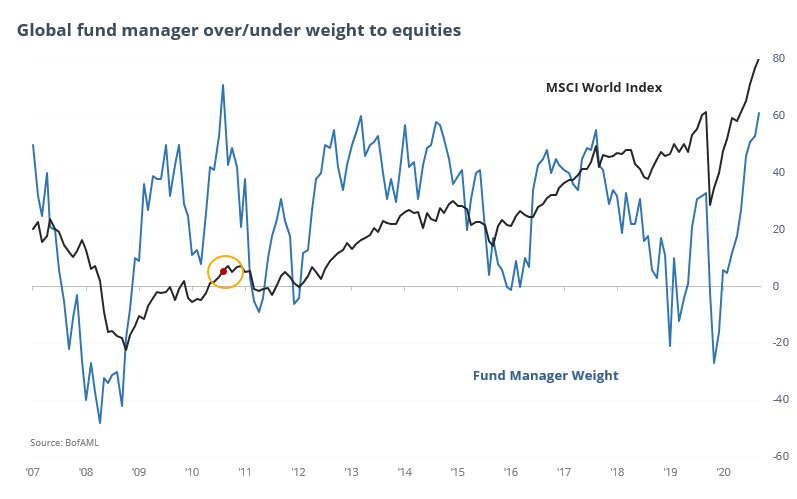

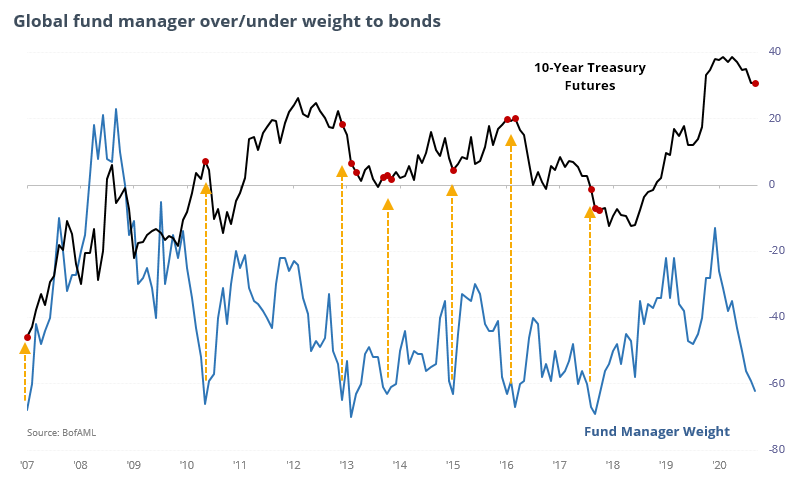

At the same time, they've given up on bonds, being more than 60% underweight.

The survey has a mixed record of being a contrary indicator. It's okay, and is more contrary than not at extremes, but it's less consistent than more common ones. That's typical for big-money types of surveys.

We could maybe take it as a minor warning for stocks and tailwind for bonds, but it's hard to place too much weight on it.