Minutes Digest for Jan 07 2021

World's richest

- Published:

2021-01-07 12:29:30 - Author: Jason Goepfert

The Tesla hype machine is running full bore today, as Elon Musk takes the crown for "world's richest." Ooh boy, that's going to get a lot of play.

It's also an interesting note on mood, not usually in a good way. There is a kind of magazine cover curse to this kind of thing. When Bezos got celebrated for his wealth, Amazon ran a bit more then...didn't.

Same with Buffett with Berkshire.

And Gates with Microsoft.

New high surge

- Published:

2021-01-07 10:06:20 - Author: Jason Goepfert

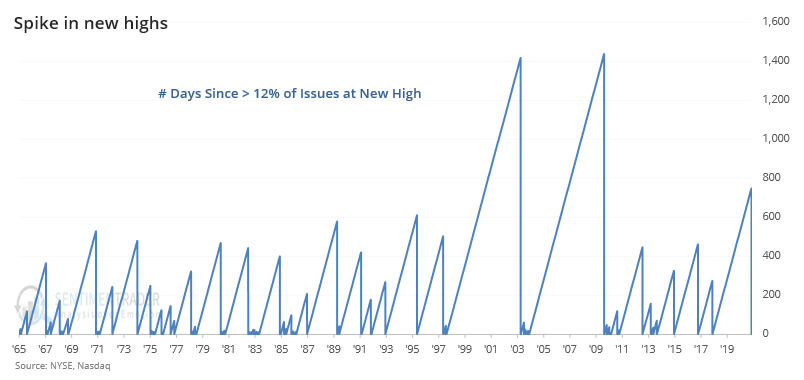

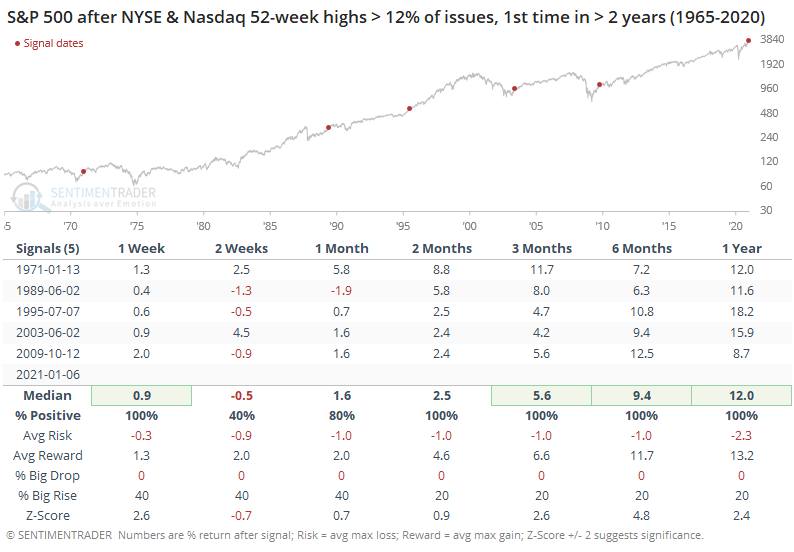

As Dean noted earlier, we just saw a surge in stocks hitting 52-week highs, with more than 15% of stocks within the S&P 500 hitting that milestone.

It was fairly broad, thanks to the jump in small-cap stocks. Enough so that an average of more than 12% of securities on both the NYSE and Nasdaq hit a 52-week high. That ends the 3rd-longest streak with fewer than 12% of issues hitting a new high since 1965.

Other times we saw more than 12% of issues at a new high, for the first time in more than 2 years, stocks continued to rally over the medium- to long-term. Momentum is quite a force.

Material stocks have not been basic

- Published:

2021-01-07 08:55:11 - Author: Jason Goepfert

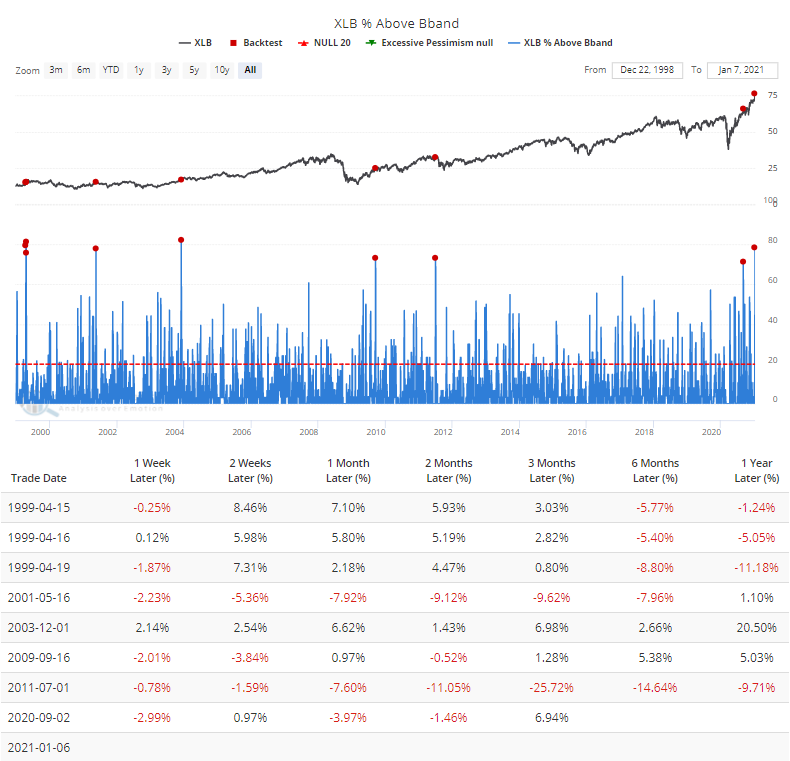

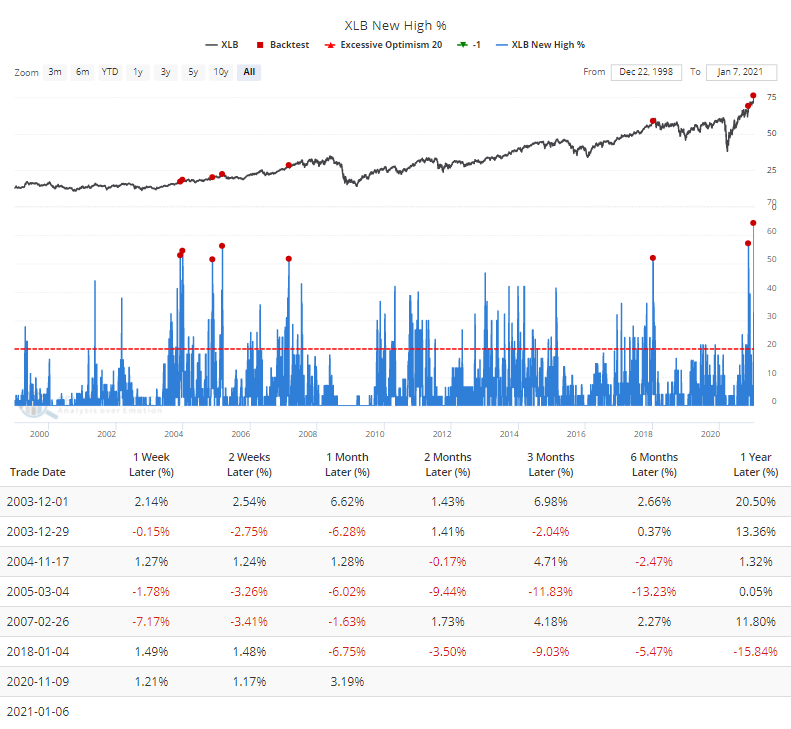

Basic material stocks saw a big cluster of interest on Wednesday, and it was enough to push more than 60% of them to a fresh 52-week high, the most in more than 20 years.

The Backtest Engine shows that other times more than half the stocks hit a new high on the same day, XLB tended to pull back at some point over the short- to medium-term.

Another potential issue is that the surge didn't come gradually, it happened all at once, pushing a huge majority of the stocks outside their upper volatility bands. Again, a jump like this in a normally staid sector has led to more negative returns than positive ones.