Minutes Digest for Jan 04 2021

Volatility jump

- Published:

2021-01-04 13:58:30 - Author: Jason Goepfert

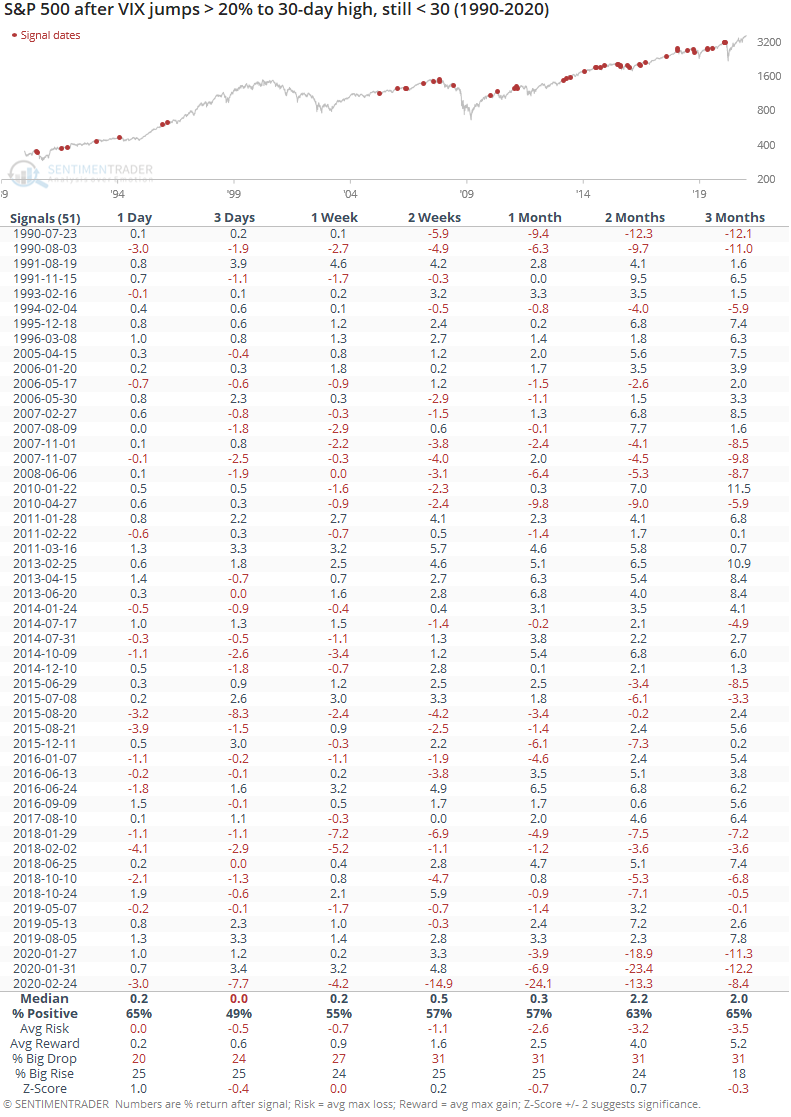

Volatility is spiking, with the VIX up more than 20% today alone. That seems like a big spike, but it has been relatively common. Below, we can see the S&P 500's forward returns after the VIX rises 20% or more to at least 30-day high, but was still below 30 at the time. Returns were a tiny bit below random in the very short-term, but surprisingly average afterward.

Options traders still feeling it

- Published:

2021-01-04 09:24:57 - Author: Jason Goepfert

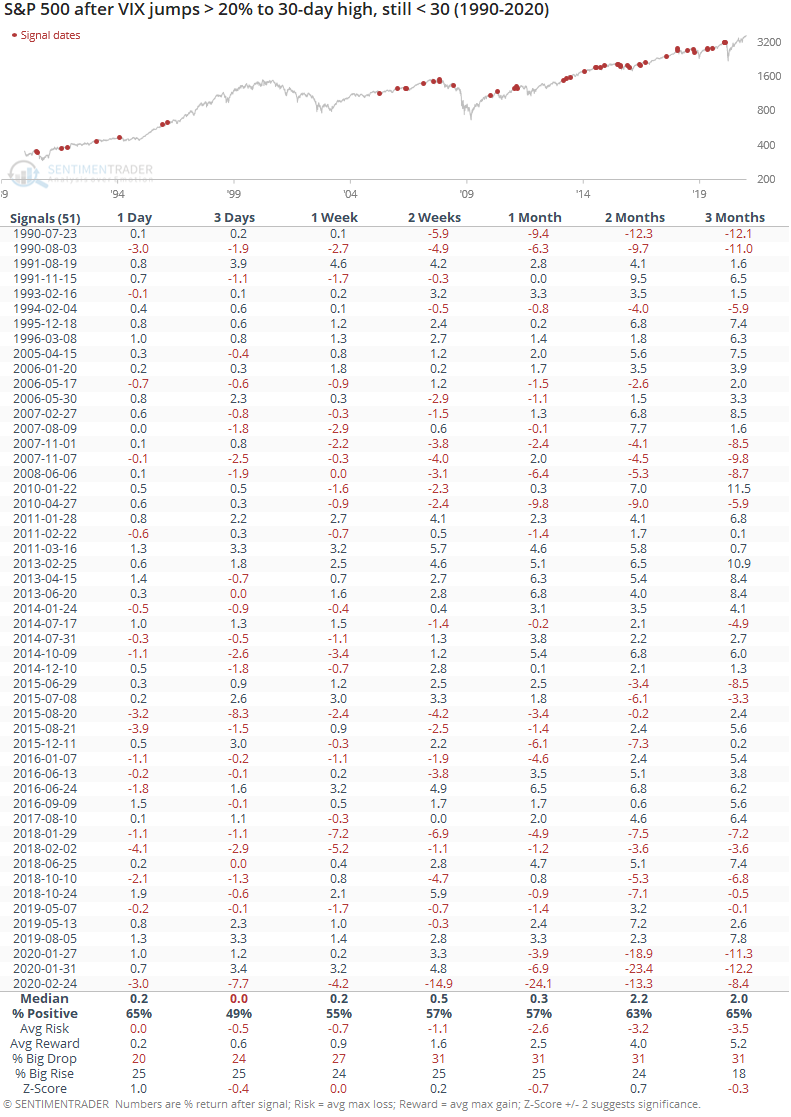

The push to new highs last week didn't dampen options traders' speculative fervor at all, and why would it? For the week, the smallest of traders spent nearly $3.50 buying call options to open for every $1 in puts they bought. The Backtest Engine shows the results of other times they were so confident. That 1-2 month time frame was unkind.

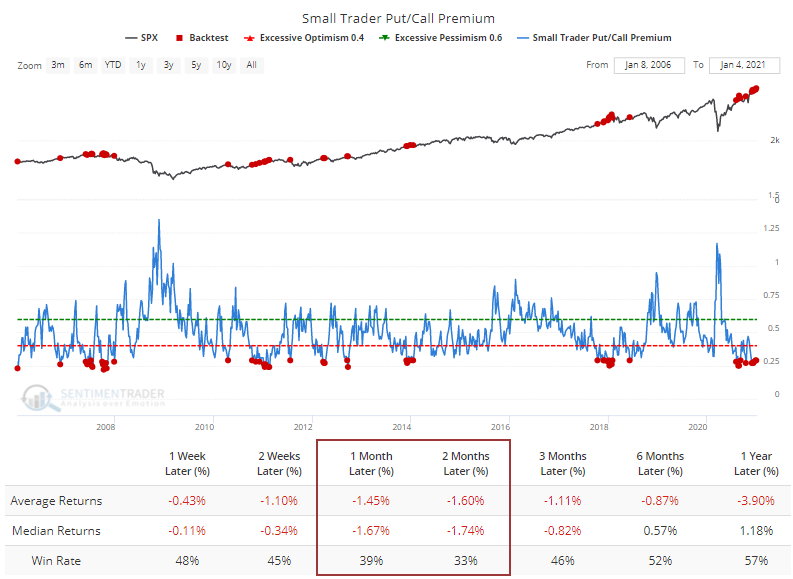

Dealers often take the other side of these trades, and according to Squeezemetrics, they're heavily positioned to sell underlying stock on any meaningful move higher. The 20-day average of Gamma Exposure has neared a record high. Other times it approached these levels, forward returns were horrid.

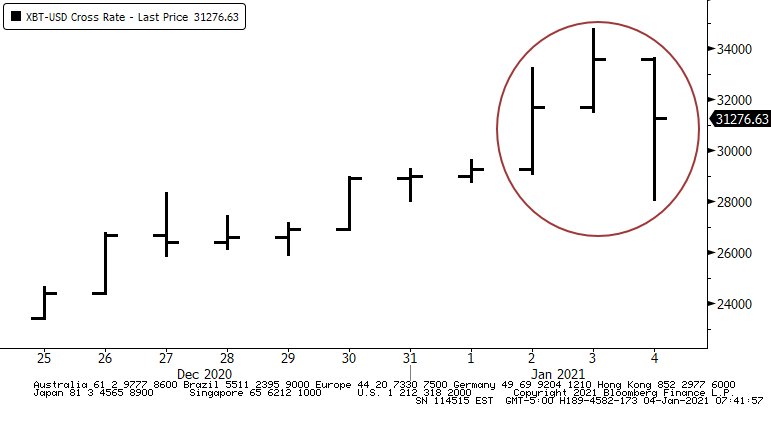

Bitcoin gets bitten

- Published:

2021-01-04 06:47:05 - Author: Jason Goepfert

The hype over bitcoin and other alt coins reached a fever pitch over the past week or so, including some wild trading over the holiday. To start the week, the "currency" is suffering a big reversal a day after a big jump to a new high.

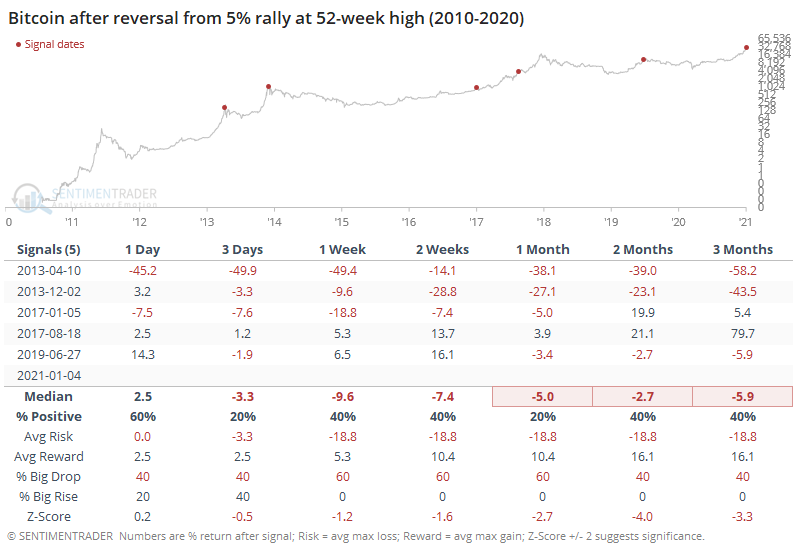

Similar reversals have preceded some rough patches for those true believers.

When we zoom in, we can see that except for August 2017, bitcoin endured some sickening volatility after these reversals.

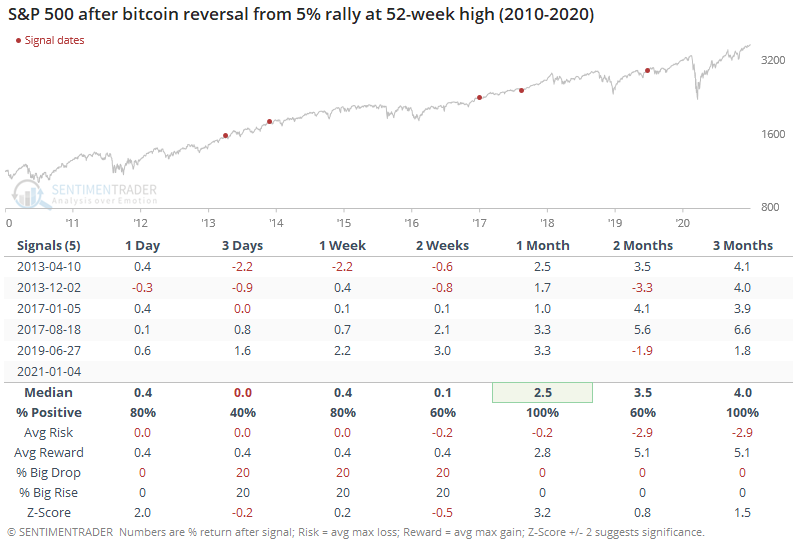

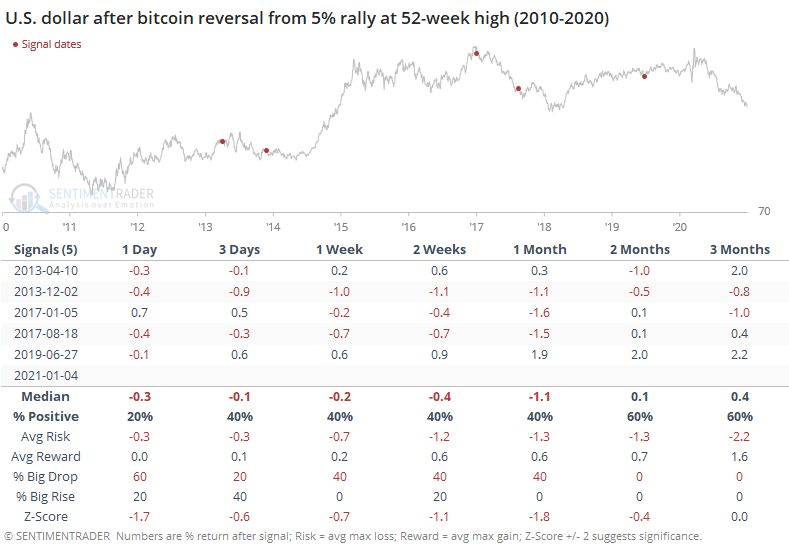

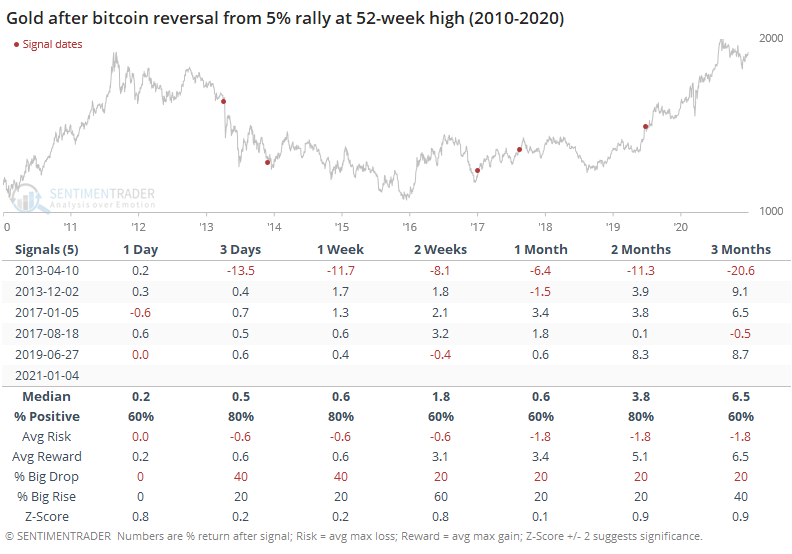

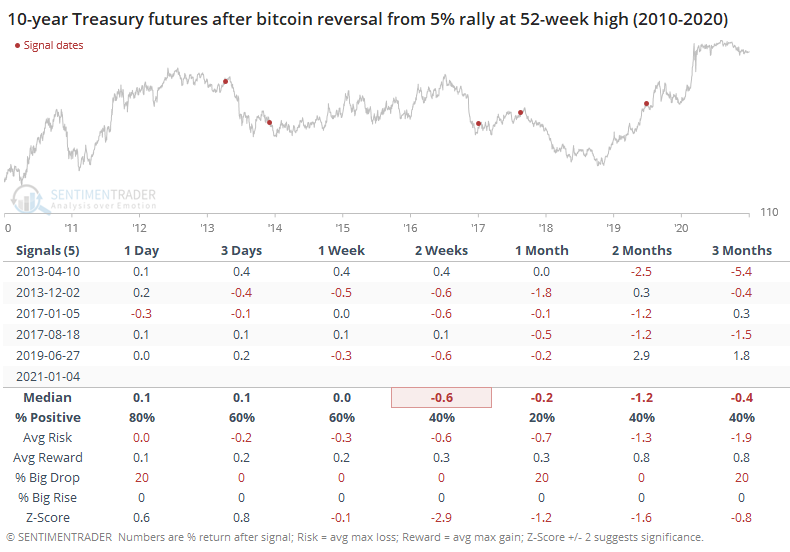

If we rely on the questionable idea that bitcoin is a proxy for risk sentiment, then perhaps these reversals would precede consistent behavior in other assets. It didn't really, as we can see below. Maybe in recent months, "bitcoin as a risk asset" has become a better theory but in the past it was mostly unrelated.