Medium-Term Risk Levels reached a meaningful threshold...

Key Points

- Medium Term Risk Levels (for stocks) recently hit it's lowest level for the second time in the past month

- While the sample size is small, market performance following previous signals suggests the potential for a market rebound in the near-term

Medium-Term Risk Levels

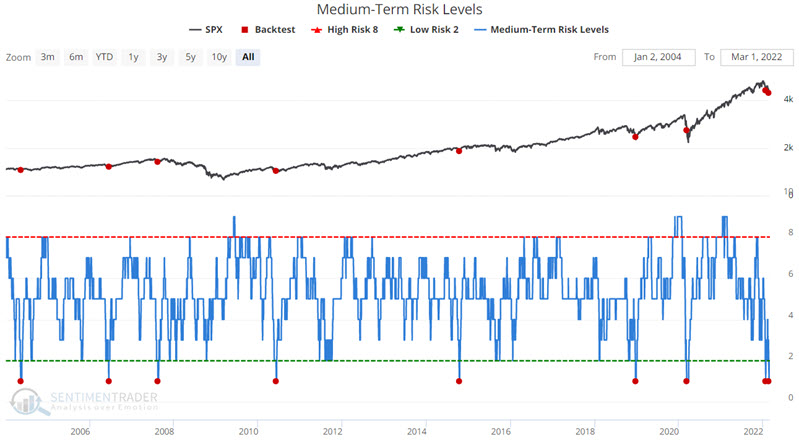

The chart below displays all days when Medium-Term Risk Levels drops from 2 or higher down to 1. You can run this test in the Backtest Engine.

Medium-Term Risk Levels dropped to a reading of 1 on 1/24 and 2/22. Does this matter? Let's consider previous market performance.

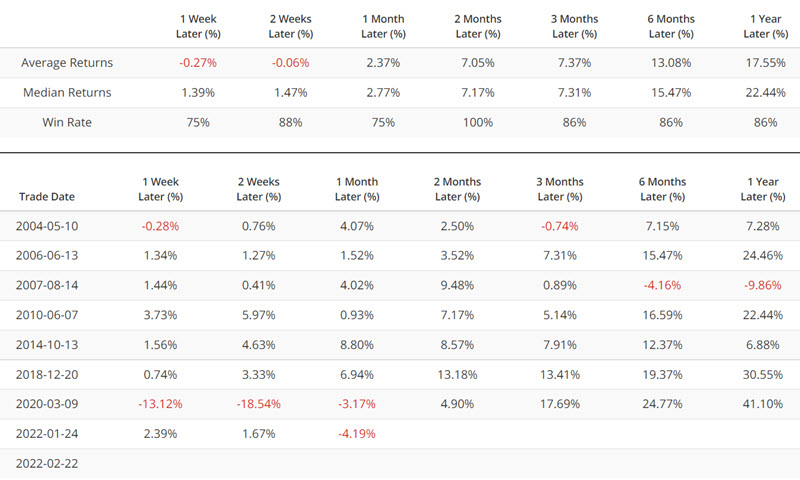

The table below displays a summary of the results.

The good news is the consistently high Win Rate across all time periods - particularly two months - and the steadily increasing Average % Return across each time frame.

Another perspective on performance

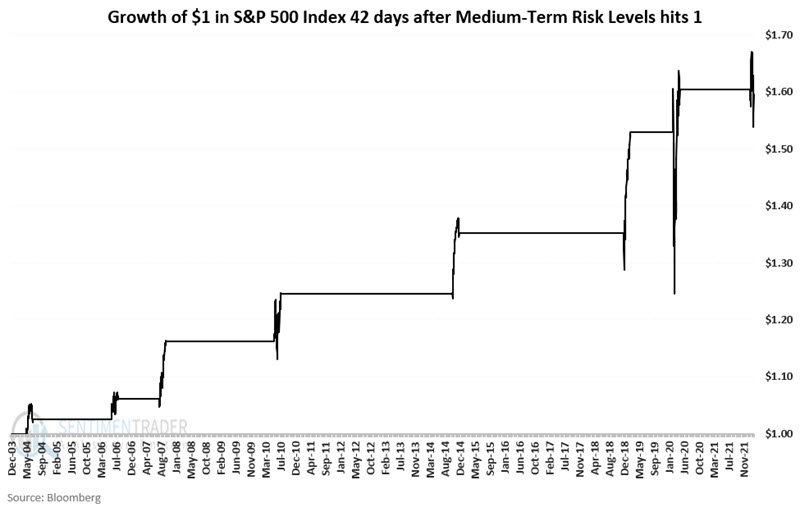

Let's consider the following approach to using these signals:

- Each time Medium-Term Risk Levels drops from above one to one, we will hold the S&P 500 Index for 42 trading days (2 months x roughly 21 trading days per month)

- If a new signal occurs while an existing signal is active, the holding period is extended for another 42 trading days

- So, if only one signal occurs, the holding period will be 42 trading days (i.e., roughly two months). If there are overlapping signals, the holding period will be longer.

The chart below displays the hypothetical growth of $1 invested in the S&P 500 Index only as described above.

What the research tells us…

Anytime the major market averages all drop below their respective long-term moving averages, there is the risk of a larger bear market overhanging the market. Such is the case today. The risk can be even higher when we can identify specific negative factors such as high inflation, rising interest rates, and war. So, investors should still retain a heavy focus on risk management.

That said, the purpose of following objective sentiment indicators is specifically to highlight when investor fear has become overdone and that the market may be due for an unexpected respite at the very least. The recent action of our Medium-Term Risk Levels indicators argues that this could be one of those times.