Medium-Term Risk Levels flashes green

Key Points

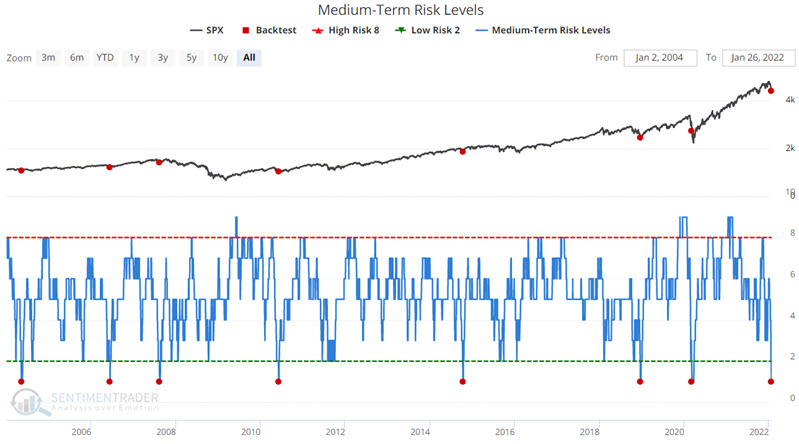

- Our Medium-Term Risk Levels indicator is a simple way to gauge whether the risk is presently high or low for stock investors in the intermediate-term time frame

- This indicator just reached a significant level and flashed an important signal in the process

Medium-Term Risk Levels

Our risk levels indicators are a quick way to gauge what our indicators and studies suggest. The higher the risk, the more likely the market is to decline. One way to look at it is in terms of cash. If the Risk Level is 0, that implies keeping 0% of our portfolio in cash (i.e., we would be fully invested). But if the Risk Level is 10, then we would be more inclined to keep 100% of our portfolio in cash (i.e., no exposure to stocks).

The chart below displays those times when Medium-Term Risk Levels fell below 2 to a value of 1. You can run this test in the Backtest Engine.

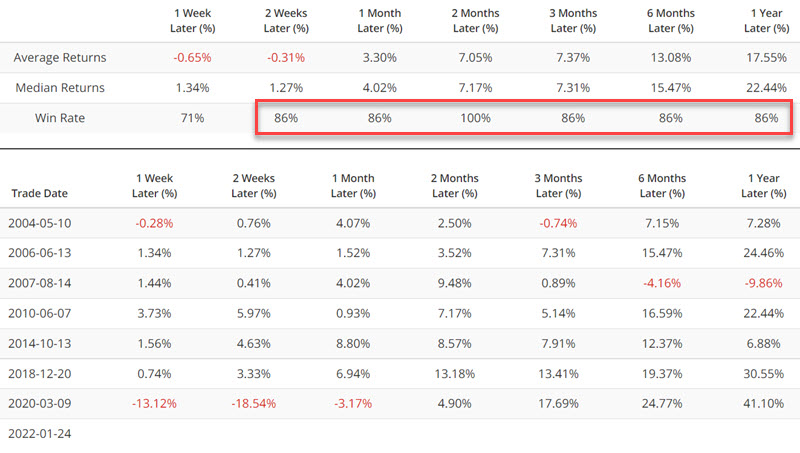

The table below displays a summary of S&P 500 performance following the signals highlighted in the chart above. The key thing to note is the consistently high Win Rate across all time frames.

As always, there is no guarantee that the latest signal will see the same type of results as those shown above. Still, in the face of all the growing negative sentiment, the latest signal provides one objective ray of hope for stock market investors.

What the research tells us...

The Medium-Term Risk Levels indicator just flashed a favorable signal. Stock market action following previous signals has generally been quite favorable, which suggests that stock investors and traders should be looking for bullish opportunities. That said, there is no guarantee that the latest signal will be on par with previous signals. Also, with the major market indexes presently in downtrends and with great uncertainty surrounding impending changes in interest rates and their potential impact on the stock market, investors must continue to focus on managing risks first and foremost.