Low Volume Rally As Net Cash Shrinks

This is an abridged version of our Daily Report.

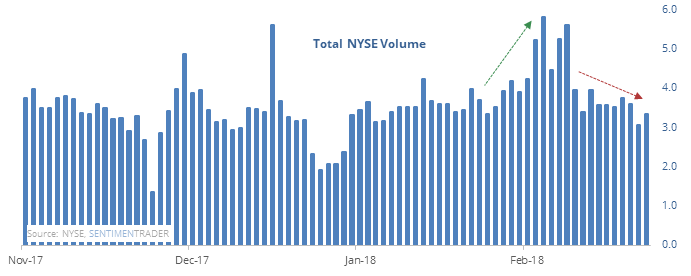

Low-volume rebound

Stocks have rebounded over the past two weeks on volume that is significantly below volume prior to the bottom.

That is an overplayed concern hyped up by textbook-slave technicians without much practical basis. Future returns and consistent was about equal whether a rebound was low- or high-volume.

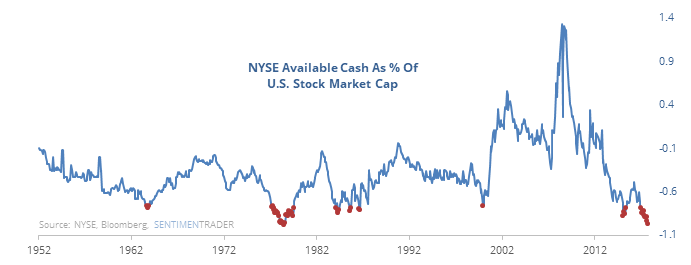

A marginal concern

Margin debt is high and cash levels are low, pushing the net level of cash to the 2nd-lowest level in history.

That sounds worse than it is, as prior periods with low net cash led to mostly positive returns.

Losing their luster

Gold mining stocks have been struggling and got hit hard again on Tuesday. By late last week, the GDX fund of gold miners had managed to rally only 5 days out of the past 20.

High confidence

The Conference Board reported that confidence among U.S. consumers is the highest since 2000. According to the Backtest Engine, there have been 63 months with confidence this high or higher since 1967.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.