Leading indicators continue to contract

Key points:

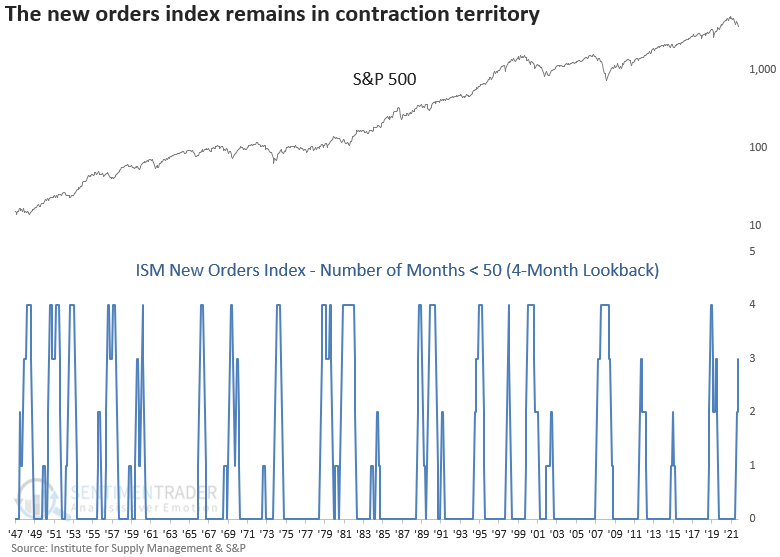

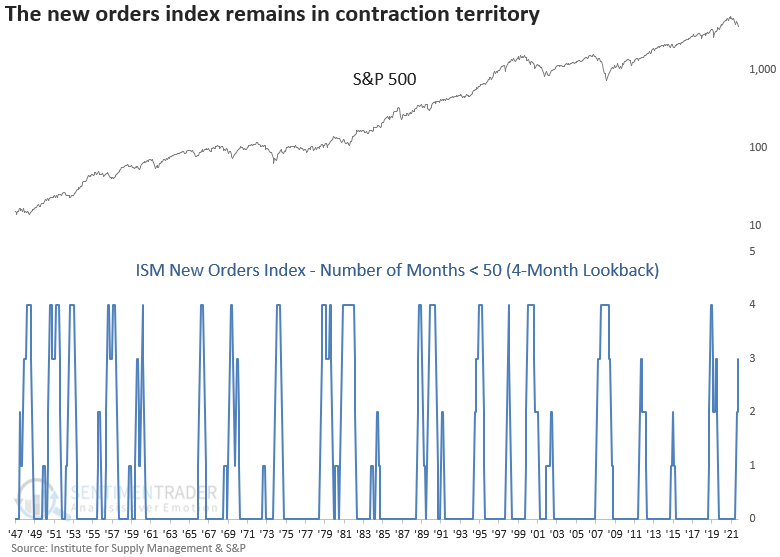

- The ISM new orders index has closed in contraction territory in 3 out of 4 months

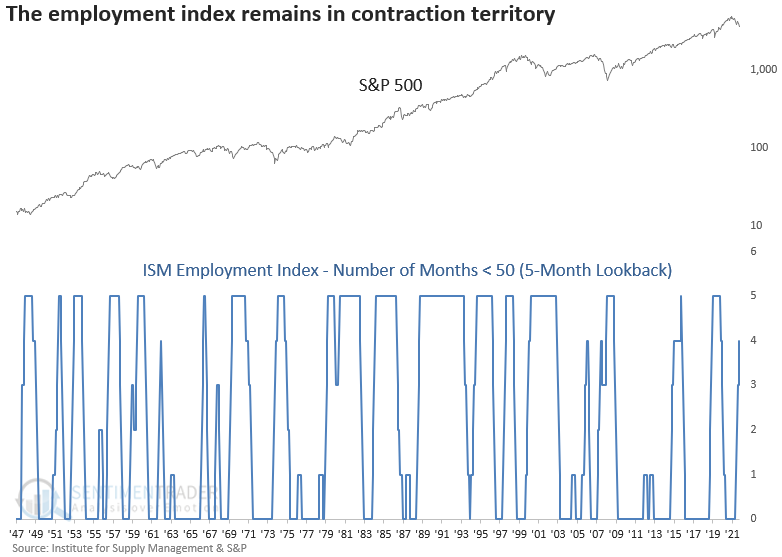

- The ISM employment index has fared worse, with a contraction in 4 out of 5 months

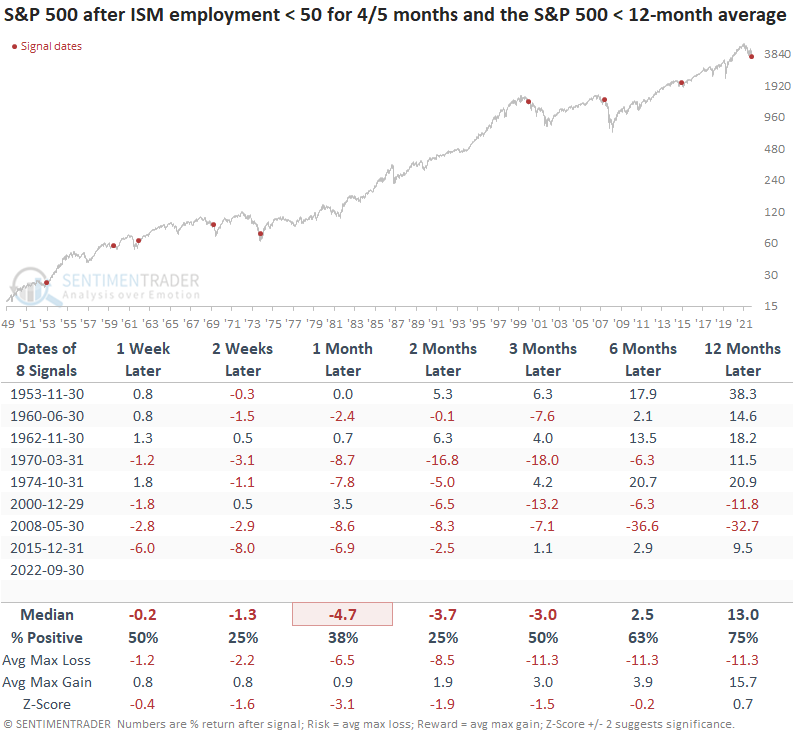

- After similar conditions, the S&P 500 struggled up to 6 months later

The contraction in two key ISM manufacturing sub-components suggests caution

The latest survey from manufacturing executives does not bode well for a potential turn in the business cycle.

The Institute for Supply Management released the latest manufacturing data this week. While the overall survey remains slightly above 50 - suggesting expansion - two key sub-components have continued to hover below the critical level.

For the first time since March 2008, the new orders index closed in contraction territory in 3 of 4 months, with the S&P 500 trading below its 12-month average.

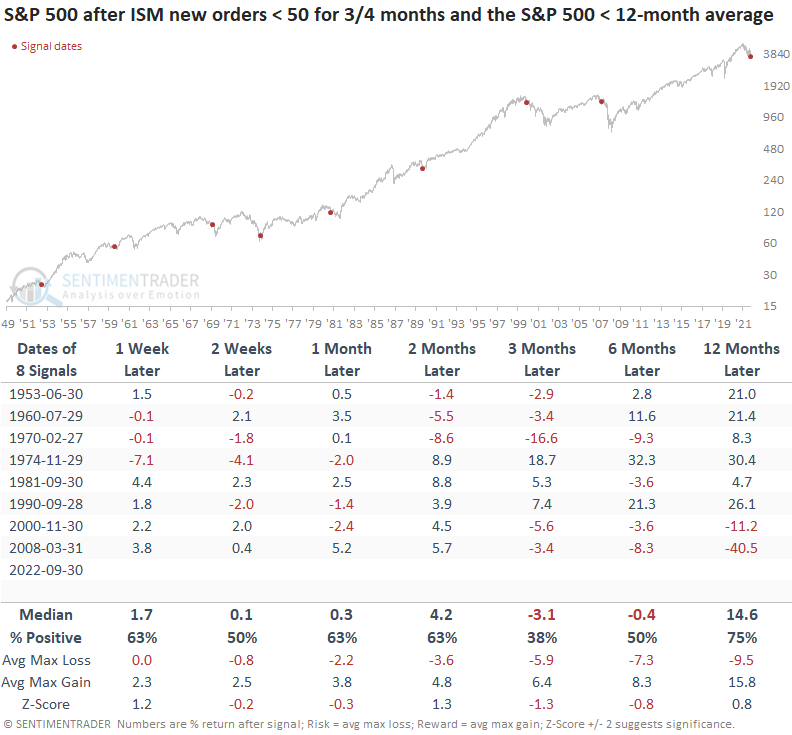

A persistent contraction in the new orders survey preceded negative returns for stocks

When the new orders index is in contraction mode and the S&P 500 is below its 12-month average, stocks tend to struggle up to 6 months later. The signal shows a negative return at some point in every case in the first six months. A year later, the results look solid except for 2000 and 2008.

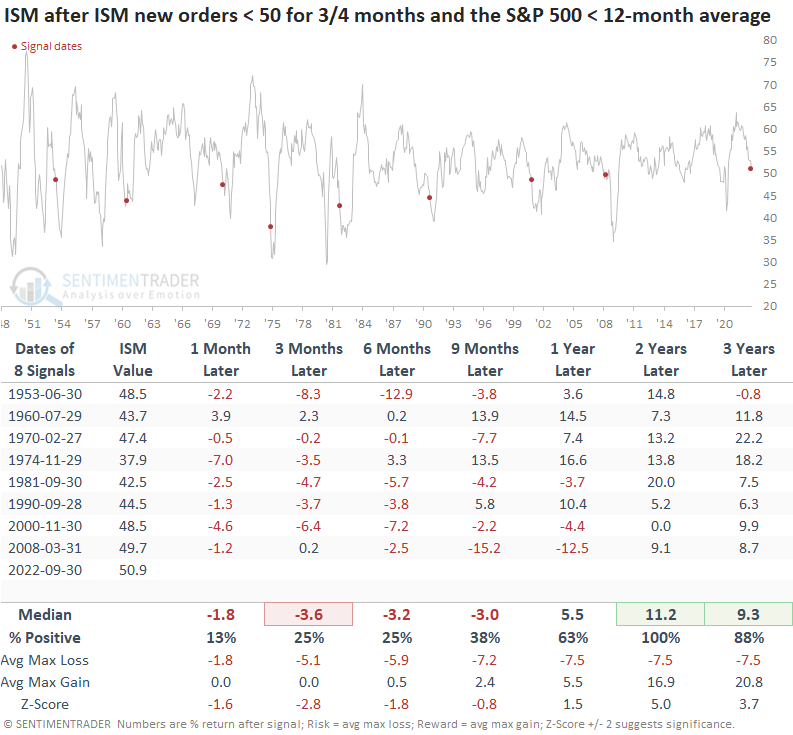

While the overall ISM survey remains in expansion territory, the new orders signal suggests it will likely fall below 50. Most of the ISM values were well below the contraction level at the time of an alert, with March 2008 being the most similar.

The employment picture doesn't provide much comfort either

The ISM employment index looks slightly worse than the new orders index, with a contraction in 4 of 5 months.

After a persistent contraction in the employment index, stocks struggled, especially up to 3 months later. Once again, a year later looks constructive except for the dot-com bust and the global financial crisis.

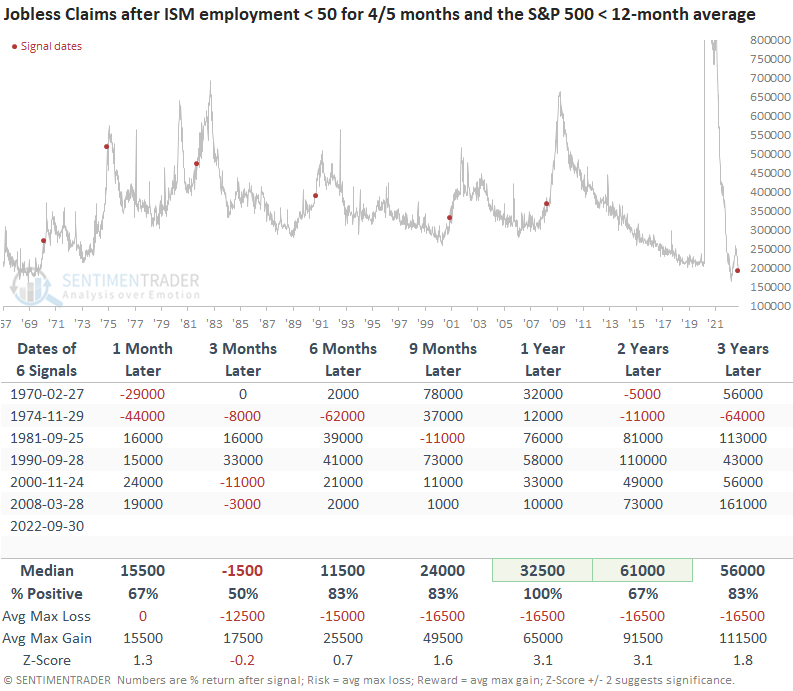

One of the arguments against an imminent recession in the U.S. has been the healthy employment backdrop. Applying the ISM employment signals to jobless claims suggests people filing to receive unemployment insurance benefits could rise in the next year.

However, I would note that claims are not currently in an uptrend, which was the case in previous instances. So, maybe this time is different.

What the research tells us...

With economic data across various pockets of the economy continuing to soften within the context of a stock market downtrend, one must monitor new data closely for clues of a potential trough in the business cycle. While the most recent update from the Institute for Supply Management doesn't bode well for stocks on a medium-term basis, eventually, the cycle will turn, and the market will pivot accordingly.