Large Loss On Nonfarm Payroll Day

Assigning a reason to why a market is up or down on any particular day is typically a fool's errand. That's especially the case with stocks when so many inputs are coming together in a highly liquid market.

An initial knee-jerk reaction to an economic report or news event can often be pointed to as a catalyst, but the longer a day wears on, the more dubious that particular reason becomes.

Stocks are getting hit hard today, but whether that's due to the below-expectations Nonfarm Payroll Report or the heavy selling in some tech names (or some other reason entirely) is anyone's guess.

Let's just pretend it has something to do with the Payroll report (NFP for short). We'e discussed behavior surrounding extreme reactions to this report in the past, and it has generally held up over time.

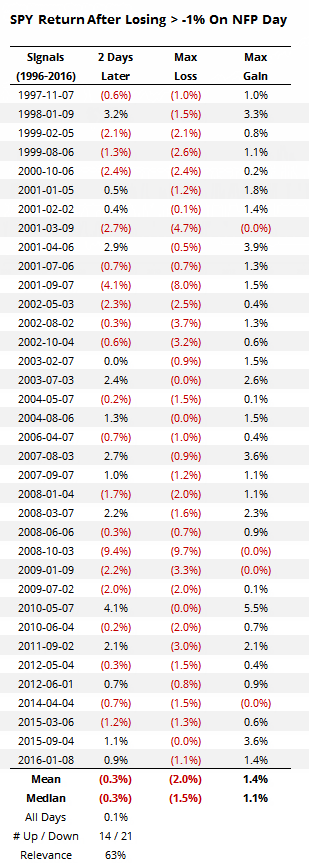

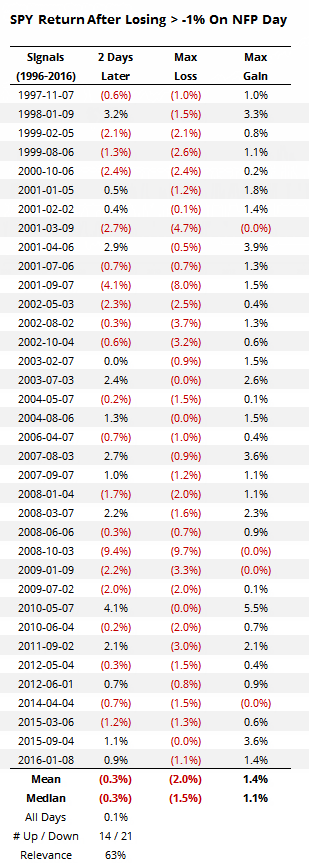

It works better if prices are at or near an extreme level, which isn't really the case this time around. Even so, here is what has happened when the S&P lost at least -1% on NFP day:

These results are only for the next two sessions, which showed by far the most consistency. And it was usually negative, as the selling pressure carried through into early the next week. After that, the results improved more toward random.

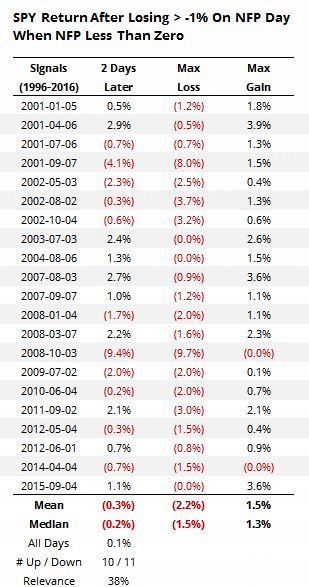

Maybe it's just when NFP misses estimates. To check, here is the same table, but only for those dates when the report was below expectations (the "less than zero" in the table refers to the amount that the payrolls were above/below expectations):

Pretty much the same results, though they actually improved a bit.

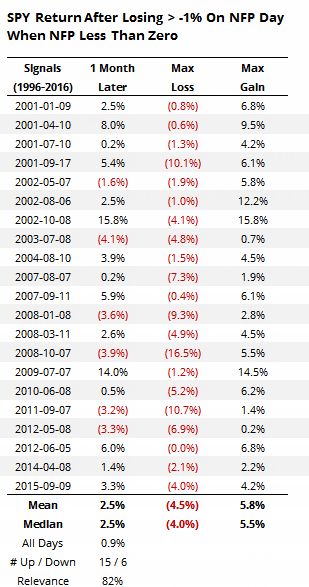

Most of them occurred during the bear markets of 2001-2002 and 2007-2008, but even so, results over the next month weren't that bad. This is assuming we buy on the close two days later (so next Tuesday):

The S&P was higher 71% of the time, with a decent average return. We prefer to see the max gain be at least twice as large as the max loss, which isn't the case here. And there were some large losses sprinkled in there.

Curiously, bonds are also down on the day, using the TLT fund as a proxy. This is highly unusual. With a weak jobs number, bonds would usually be higher, especially if stocks are selling off, because bonds act as a type of safe haven.

There was only one other time that the jobs report was below expectations, the S&P was down at least -1% and bonds also were down on the day, which was July 3, 2003. For what it's worth, stocks rallied in the short-term after that, then fell back again before staging a longer-term rally.

Investors and traders like to obsess over the jobs number, mainly as a potential leading indicator for recession, so reactions to the number can be telling. Based on previous behavior, there tended to be some short-term follow-through to the selling pressure after days like this, but no more than over the next couple of sessions.