King Dollar

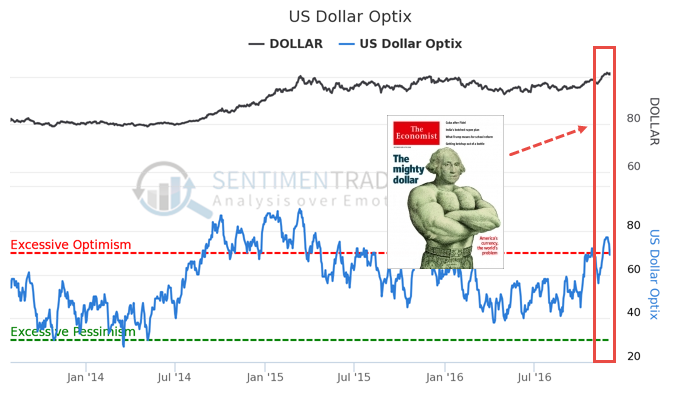

The Optimism Index for the U.S. dollar has been at an extreme since mid-November and the it has started to struggle as it often does in December.

The strong trend hasn't gone unnoticed by mainstream media. The latest cover the The Economist shows a triumphant Schwarzenegger-esque buck with the title "America's currency, the world's problem." Just when optimism has started to ebb from extreme optimism.

The Economist is read by most world leaders, or at least they say they read it, so this week's issue won't go unnoticed.

The timing is interesting - no Economist covers mentioned the dollar in this respect at any point during the past two years. There was a feature in early October 2015 but that was more geared toward America's role as a power as opposed to the currency's trend.

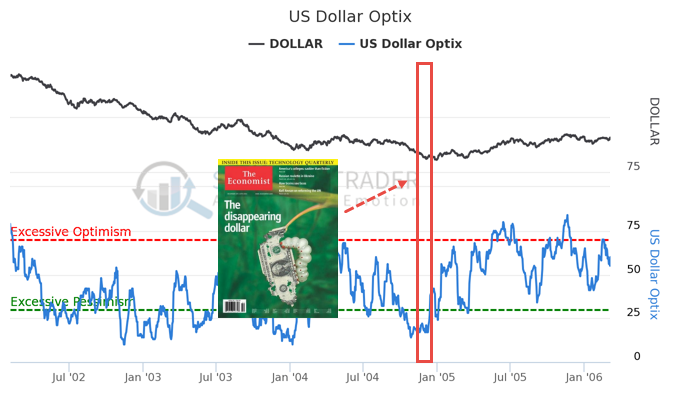

This week's cover is in direct contrast to a little over a decade ago, when sentiment was about as low as it gets and the publication highlighted "The Disappearing Dollar".

It's always tempting to take magazine covers as knee-jerk contrarian indicators, and proponents will trot out cherry-picked examples showing the success of doing so. We've done more objective work with other publications, such as Barron's, and it had a mixed record.

According to an academic study bravely noted by the Economist itself, their covers do tend to act as a contrary indicator over a longer time period:

Interestingly, their analysis finds that after 180 days only about 53.3% of Economist covers are contrarian; little better than tossing a coin. After 360 days, the signal is a lot more reliable—68.2% are contrarian. Buying the asset if the cover is very bearish results in an 18% return over the following year; shorting the asset when the cover is bullish generates a return of 7.5%.

The dollar tends to show its strongest performance during the first few months of the year, but until then a combination of objective and subjective indicators suggests an overheated market.