Keeping an eye on Copper

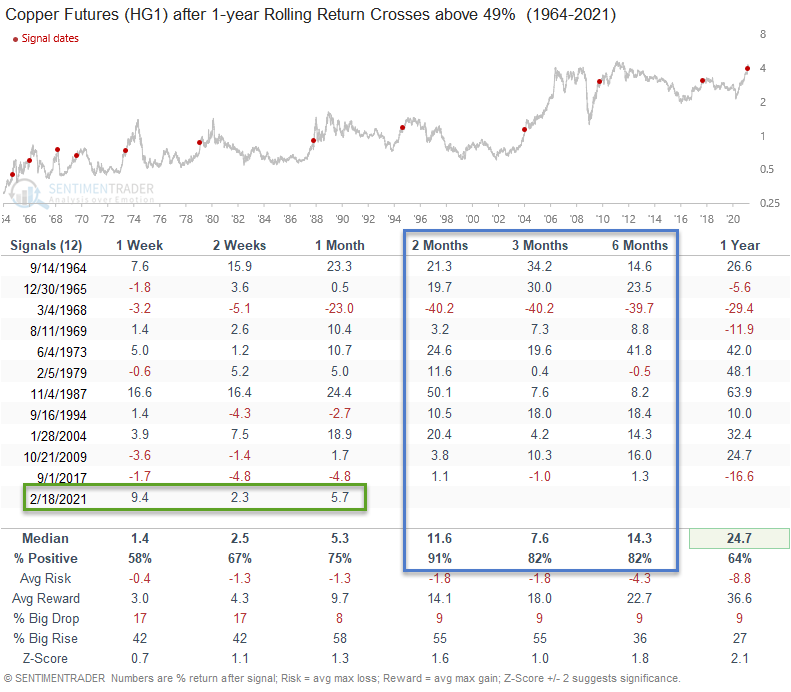

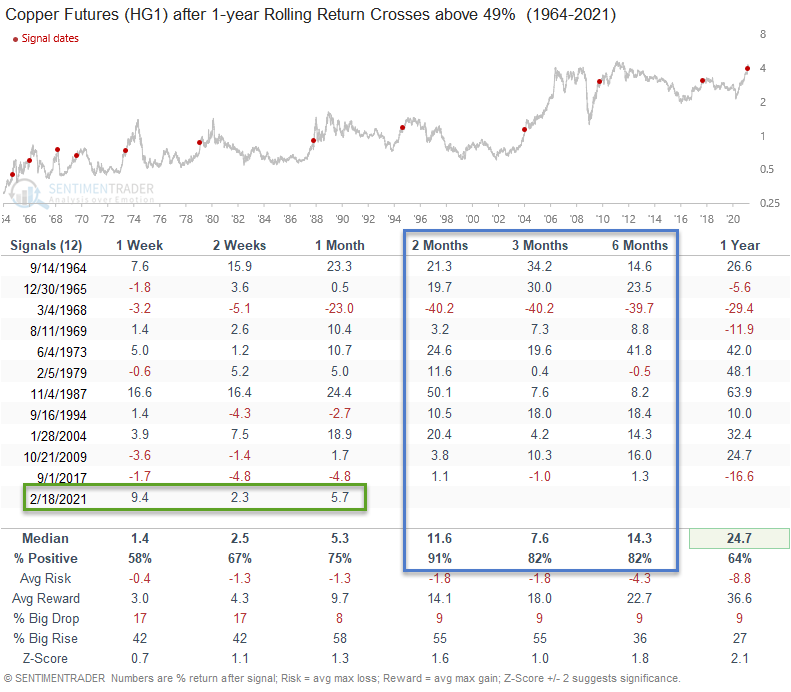

In a note on 2/19/21, I shared the potential outlook for several assets after a 49% surge in the 1-year rolling return for copper. Interestingly, copper had one of the best forward return profiles in the 2-6 month timeframe, even after a significant price surge.

As I write this note, copper futures are up 3.75% on the day. Let's review copper's performance since the signal on 2/18/21.

Copper Performance Since 2/18/21

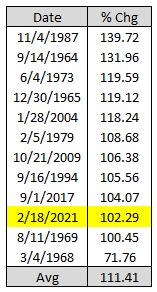

The current copper signal got off to a fast start with the second-best performance in the 1-week timeframe relative to other historical instances. However, the one-week timeframe also marked the top in copper as the commodity peaked on 2/25 and has subsequently entered into a consolidation/correction phase.

Copper after 30 Days (Indexed to 100)

Suppose we focus on performance from the 2/18/21 signal date to the most recent close on 4/1/21. In that case, one can see that the consolidation/correction in copper has pushed performance results down to one of the weaker instances over 30 days.

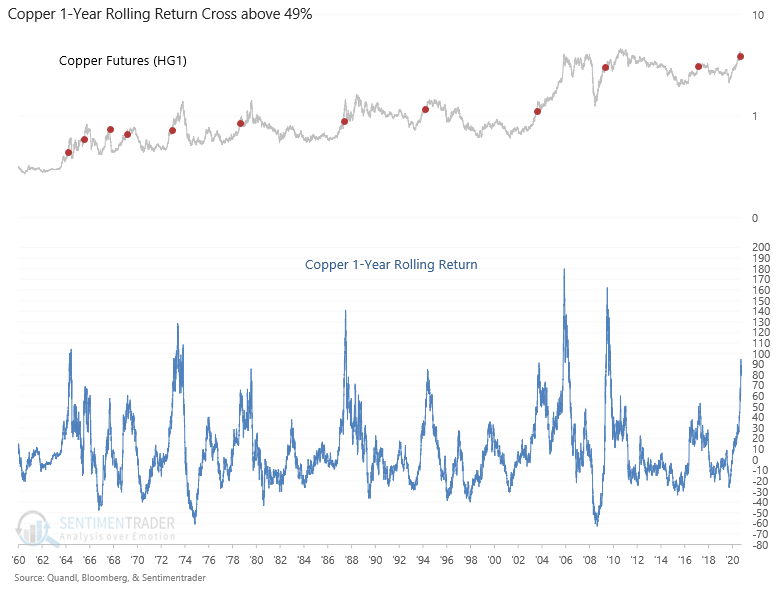

Copper Rolling Return Chart

The rolling return chart has moved higher from the signal date but has subsequently moved down with the 30-day consolidation/correction. While the rolling return is up a significant amount, I would note that copper has not reached a level on par with other major price peaks.

Current Day Chart

The price spike in February pushed the RSI for copper up to a very overbought level of 88. One should not have been surprised by the current consolidation/correction phase. More importantly, I would note that the RSI has failed to reach an oversold level with the pullback in price, which is a sign of a strong uptrend. It is now turning up with today's price strength. The chart looks constructive.

Conclusion: The copper consolidation/correction within an ongoing uptrend looks constructive. A significant break in price, whereby the RSI falls below 30, would lead me to reassess the current copper bull market.

Conclusion: The copper consolidation/correction within an ongoing uptrend looks constructive. A significant break in price, whereby the RSI falls below 30, would lead me to reassess the current copper bull market.

For a more detailed trading plan on the same signal, please see Jay's note from 2/24/21.