It's time to keep an eye on unleaded gas

Key points

- Unleaded Gas has rallied sharply of late

- However, unleaded also has a long history of experiencing significant price weakness during the second half of the year

- Traders might start making plans now regarding how to play the short side of the gasoline market if price action reverses

Unleaded Gas has rallied in 2023

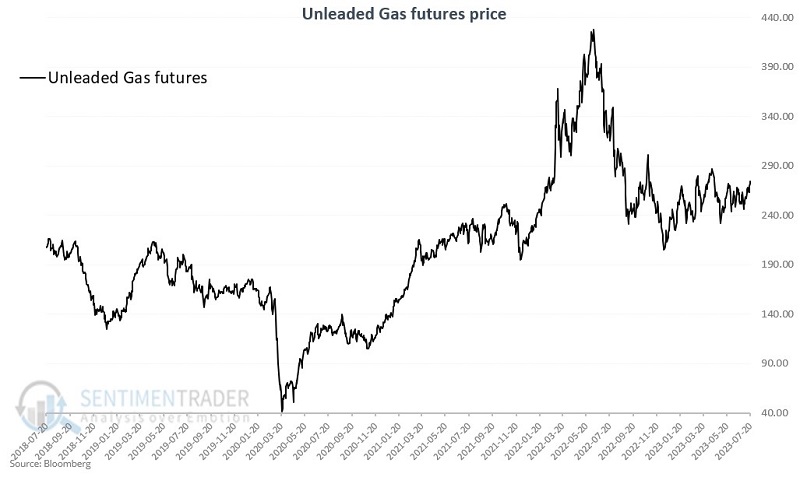

The chart below displays price action for unleaded gas futures over the last five years.

This market put in an intermediate-term low in December 2022 before chopping higher. Since its low in early May 2023, unleaded has rallied almost $0.55 a gallon. Based on a futures contract size of 42,000 gallons, this equates to an increase in contract value of over $23,000. The factors that influence gasoline prices are myriad, often conflicting, and hard to interpret. Trying to predict the exact moment when this market (or any market) might top out is essentially impossible. However, one thing is constant - the changing of seasons.

Unleaded Gas is now entering a significant period of seasonal weakness

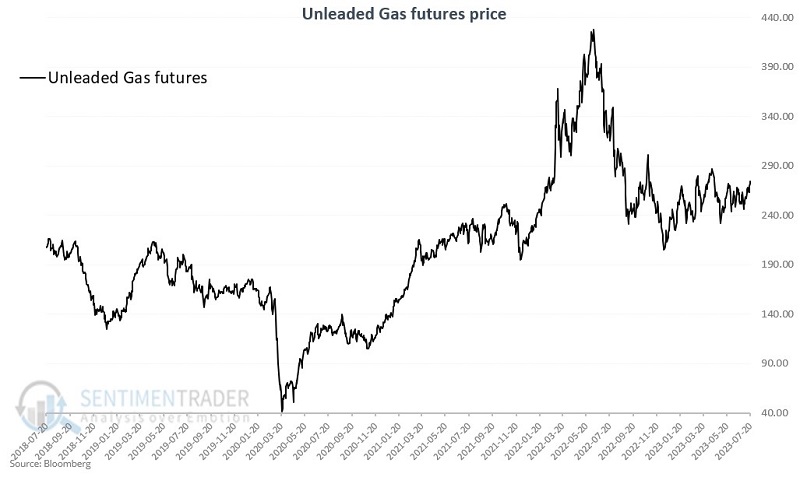

The chart below displays the annual seasonal trend for unleaded gas futures.

Identifying the weakest time of year is not difficult. The red box highlights the period that extends from the close on Trading Day of Year #145 through TDY #236. For 2023 this period extends from the close on 2023-07-25 through the close on 2023-11-27.

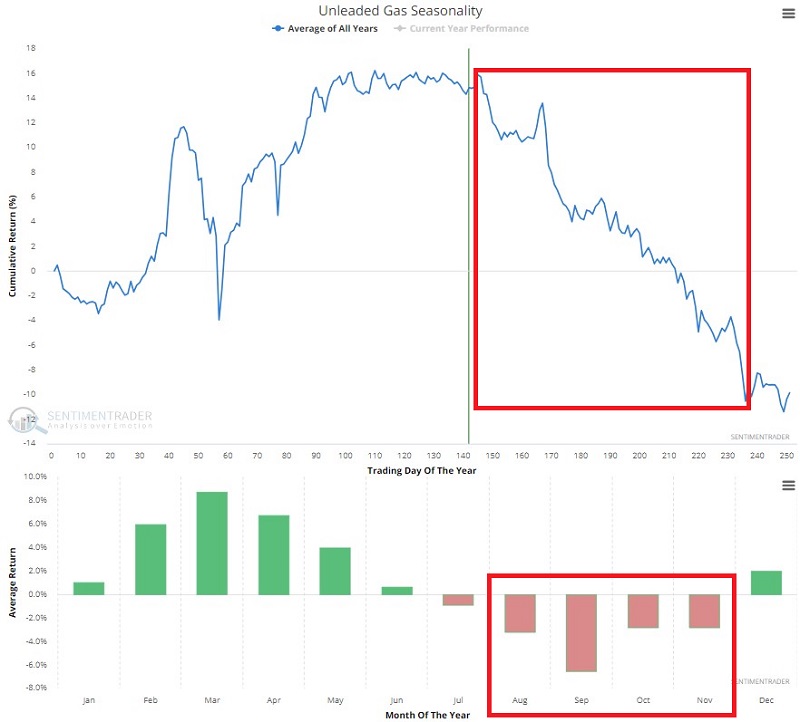

The chart below displays the hypothetical cumulative $ +(-) from holding a long position in unleaded gas futures only during this unfavorable period every year since 2005.

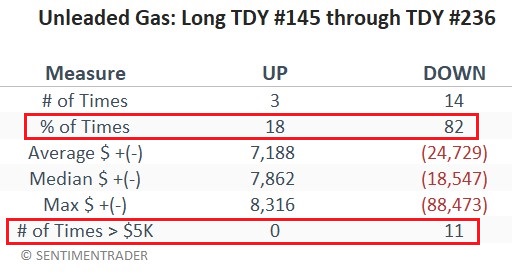

The table below summarizes unleaded gas futures performance during this unfavorable period.

Clearly, the probabilities favor the downside during this period. 82% of the past 17 years have witnessed lower gas prices during this period. Also, note that the largest up year during this period was a gain of +$8,316 in 2010. On the other hand, the largest loss was over -$88,000 (during the 2008 commodities plunge), and unleaded gas futures have lost more than -$10,000 eleven times. However, none of this guarantees that unleaded is doomed to fall in the months ahead - particularly with unleaded exhibiting strength at the moment. Still, history suggests that traders who are so inclined should be watching closely for any signs of weakness and an opportunity to play the short side.

What the research tells us…

The question is not whether historical probability favors an advance or a decline for unleaded Gas in the months ahead. The history is clear. The real questions are, "Is trading the short side of unleaded gas something I should even be doing" "How much can I reasonably afford to risk" and "What price or indicator action should I look for to confirm a reversal to the downside before entering."