It's not too late for health care

Key Points

- When the health care sector reaches a certain level of oversold, it typically sets up a decent buying opportunity, often followed by an extended advance.

- Following a simple rule may be enough to alert investors to this type of opportunity

XLV Breadth Signal

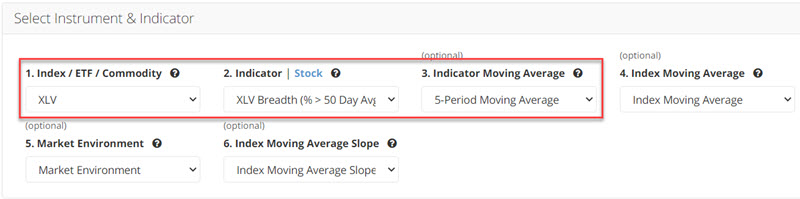

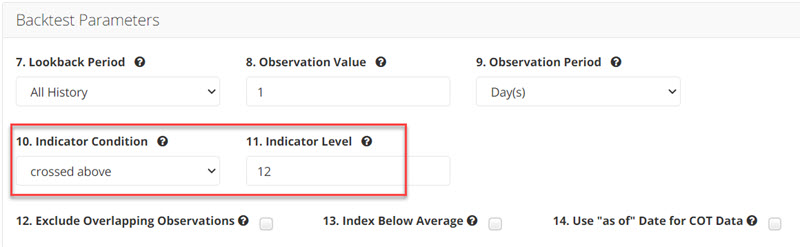

Let's consider the potential for using a simple breadth-based indicator to play the long side using shares of ETF XLV (Health Care Select Sector SPDR Fund). The rule we will use is:

- The 5-day average for SPY Breadth (% > 50 Day Avg) crosses above 12%

The input screens appear in the screenshots below. You can run this test in the Backtest Engine.

The Signals

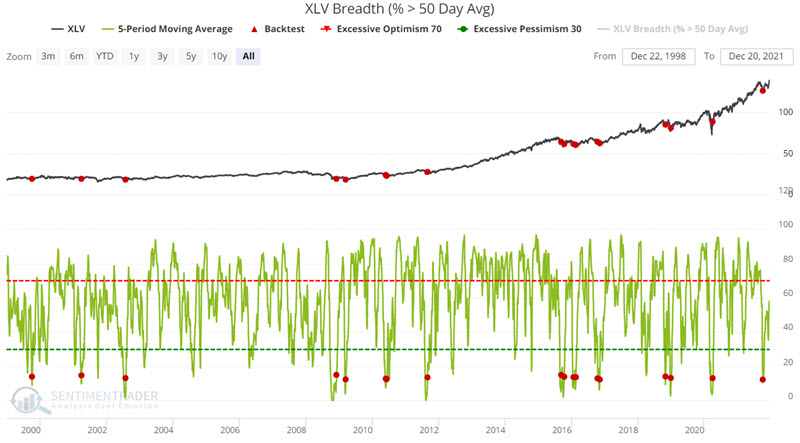

The signals generated by the rule above appear in the chart below.

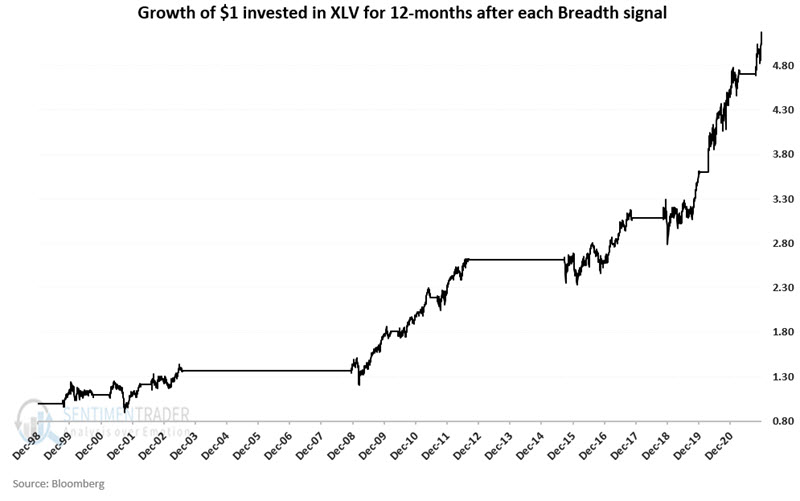

The chart below displays the growth of $1 invested in XLV for twelve months after each signal (including overlaps; i.e., if a new signal occurs within 12-months of a previous signal, the holding period is extended another 12 months).

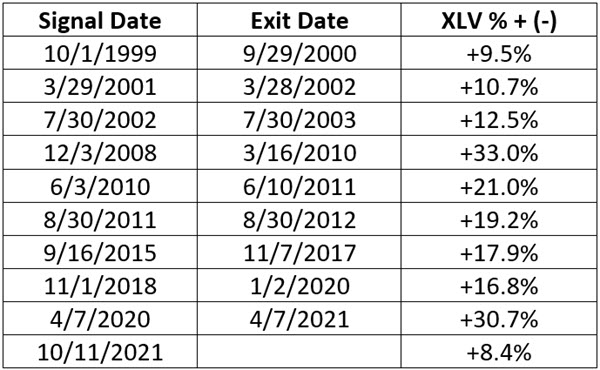

The table below displays the cumulative % return for XLV during each "invested" period (including overlaps).

The average % gain has been +19.0%, and the median gain +17.9%

Now what?

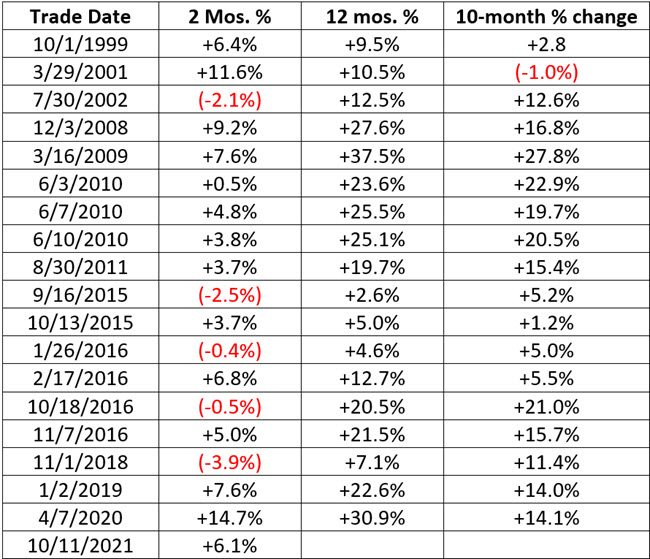

The most recent signal occurred on 10/11/2021. Since that time, XLV has gained over +8%. Is it too late to get in? History suggests that the answer is "no." The table below displays the % return for XLV:

- Two months after each previous signal

- 12 months after each previous signal

- And the % gain or loss if an investor had entered two months after each signal and held for ten months

The period between 2 months and 12 months showed a gain 16 out of 17 times (94%), with a median 10-month gain of +14.0%.

What the research tells us:

Rallies in the health care sector tend to play out over time and reward patient investors. One key advantage to this tendency is that investors who are "late to the game" can often still enjoy the benefits of these extended rallies. The October signal from our Optix indicator does not mean that it is smooth sailing for health care sector investors this time around. But history suggests that the odds are favorable.