Is sentiment reversing?

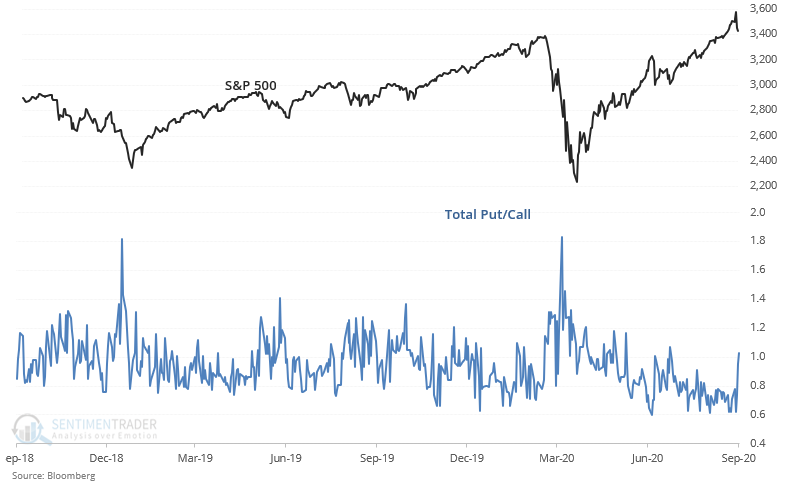

The stock market's pullback over the past 2 days has caused some extreme sentiment indicators to slightly reverse. For example, the Total Put/Call ratio is above its 200 day moving average for the first time in over a month:

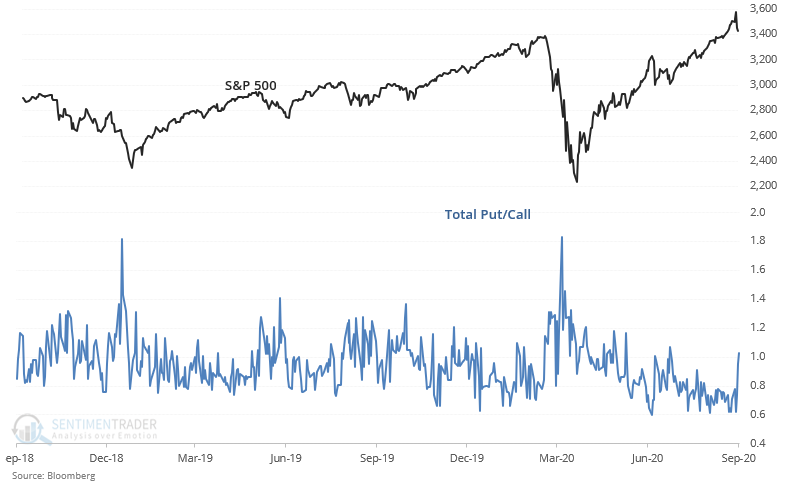

When this happened in the past, it wasn't a clear sign that the market's pullback would continue. Future returns for the S&P were pretty mixed:

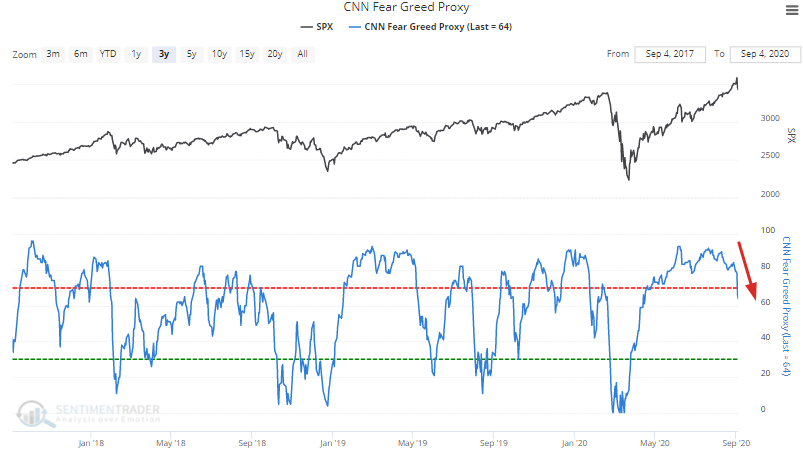

Similarly, our proxy for the CNN Fear & Greed indicator has dipped below 70 for the first time in more than 4 months:

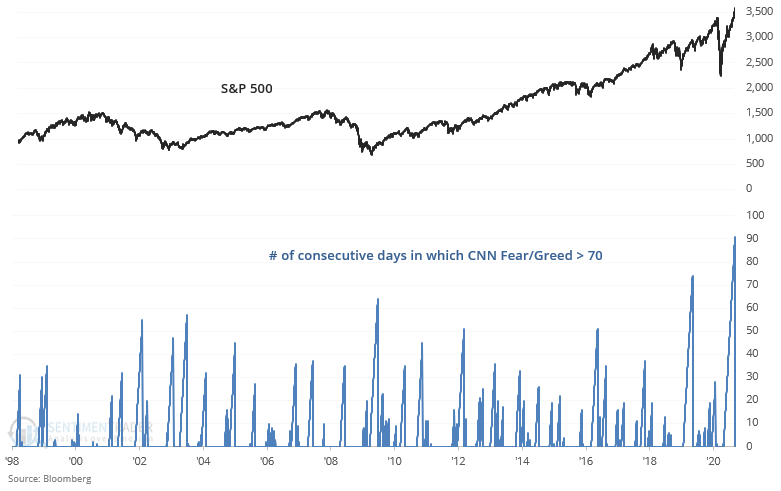

Ending the longest historical streak of extreme optimism:

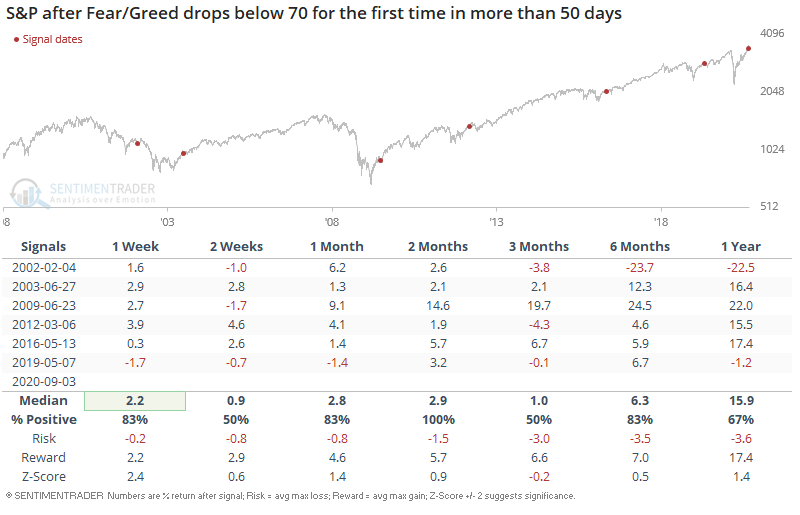

When this happened in the past, the S&P 500's forward returns were no longer consistently bearish:

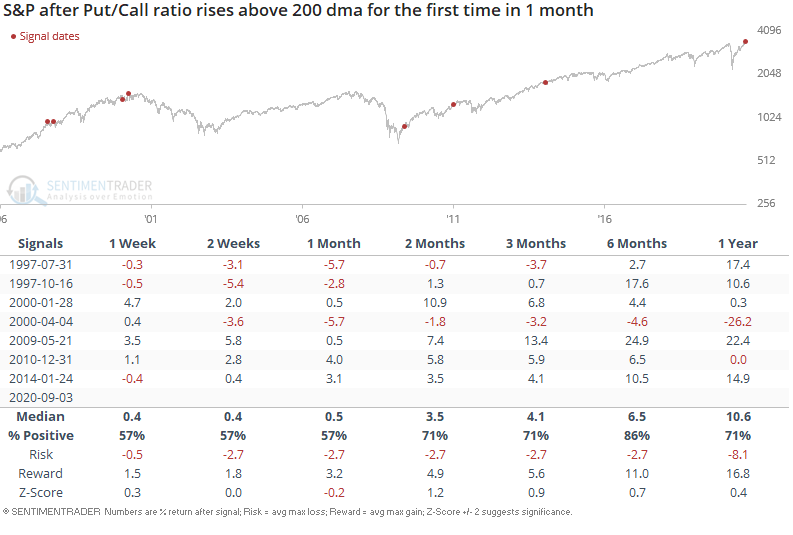

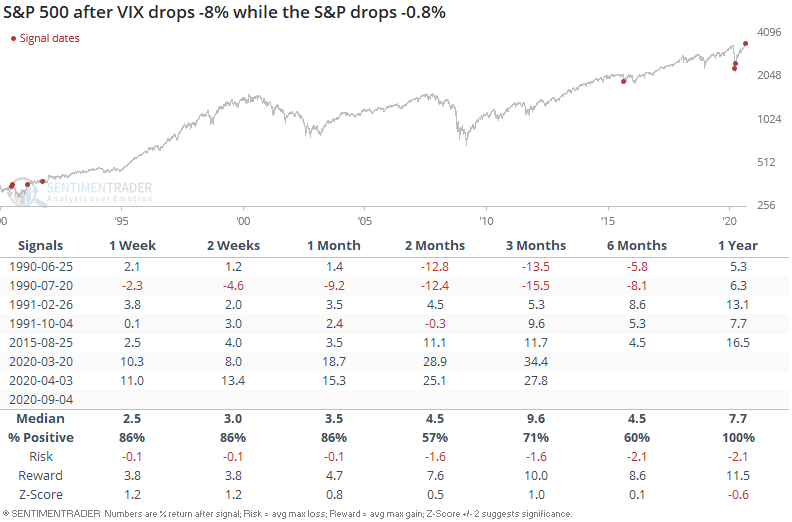

Yesterday saw the S&P drop -0.8% while VIX fell -8%. This is highly unusual given that the S&P and VIX usually move in opposite directions. Over the past few years this has been quite common near market bottoms, when a falling S&P no longer pushes VIX even higher:

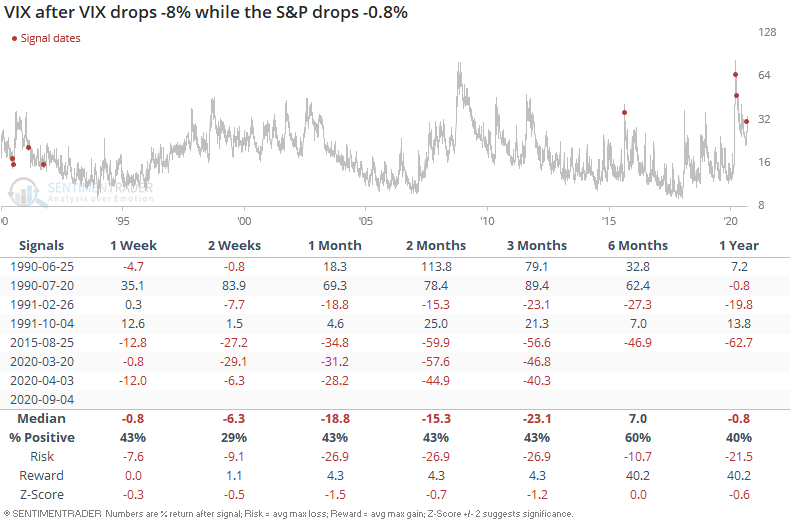

Here's what VIX did next: